补

2025-04-01 12:59中国

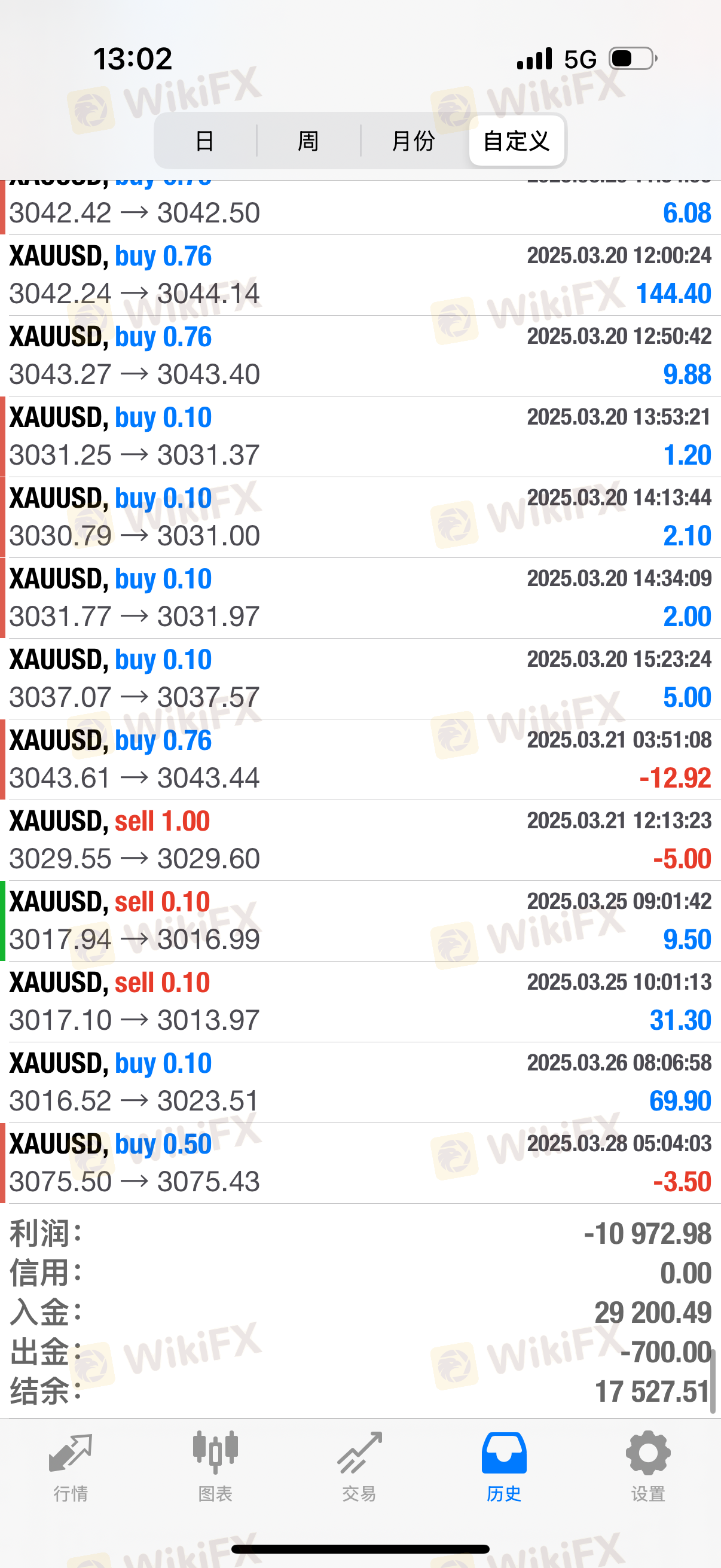

无法出金

出金

$29,200(USD)

31天0小时

补已解决

2025-05-02 14:01

该内容涉及敏感信息,天眼已进行隐藏

天眼海外客服联系交易商

2025-04-01 16:06

联系交易商

天眼调解中心审核通过

2025-04-01 13:48

审核通过

补发起调解

2025-04-01 12:59

发起调解

IC Markets foreign exchange platform manipulates trading data through domestic servers (servers in China and Hong Kong), frequently causing abnormal slippage (such as a gold spread of up to $70) to profit from customer losses. IC Markets foreign exchange platform does not actually enter the real market, but operates on a gambling basis, profiting only when investors lose money. By manipulating trading data in the background, customers are intentionally made to lose money in order to extract more profits. IC claims to be regulated by international regulators such as ASIC in Australia, but the regulatory information is not true. In fact, the servers are located within mainland China and Hong Kong, using regulatory shell games. IC Markets uses a seemingly normal license as a facade, and then conducts transactions through other unregulated or over-limit licensed companies. Once the platform encounters problems, it will not be punished by regulatory agencies and can freely exploit investors. While Seychelles (FSA) Raw Trading Ltd is indeed regulated, IC Markets, the only company promoted and regulated on its official website, does not conduct transactions on MT4/5, while other licensed companies with numerous issues are allowed to trade on MT4/5. IC Markets foreign exchange platform falsifies regulatory qualifications and manipulates trading data in the background to profit from customer losses. If the principal is not refunded, it will continue to be exposed!

声明:

2、未经授权,本平台案例禁止任何转载,违者将被追究法律责任