FXB Capital

Abstract:FXB Capital, a trading name of FXB Capital Ltd, is allegedly a forex broker registered in the United States that claims to provide its clients with various tradable financial instruments on the web-based trading platform via five different live account types.

Note: FXB Capital is to operate via the website - https://fxbcapital.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | forex, binary options, cryptocurrencies |

| Account Type | Bronze, Silver, Gold, Diamond and Mining |

| Demo Account | N/A |

| Maximum Leverage | N/A |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | web |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | bank wire and credit /debit cards (Visa, Maestro and MasterCard), Skrill, Neteller, Perfect Money, Qiwi, Yandex Money, and WebMoney |

FXB Capital, a trading name of FXB Capital Ltd, is allegedly a forex broker registered in the United States that claims to provide its clients with various tradable financial instruments on the web-based trading platform via five different live account types.

As this brokerage's website cannot be accessed, we were unable to obtain further details about its leverage, spreads, etc.

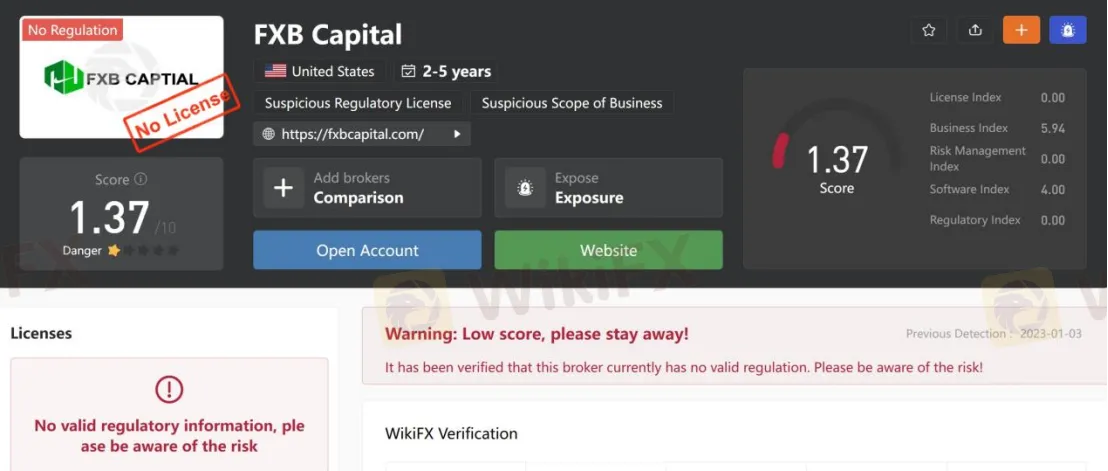

As for regulation, it has been verified that FXB Capital currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.37/10. Please be aware of the risk.

Market Instruments

FXB Capital advertises that it offers access to a wide range of trading instruments in financial markets, including forex, binary options, cryptocurrencies.

Account Types

FXB Capital claims to offer five types of trading accounts, namely Bronze, Silver, Gold, Diamond and Mining, with minimum initial deposit requirements of $100, $1,000, $1,500, $2,000 and $150 respectively.

Trading Platform Available

Instead of the world's most advanced and popularly-used MT4 and MT5 platforms, FXB Capital gives traders a web-based trading platform. Anyway, you had better choose brokers who offer the leading MT4 and MT5, which are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

FXB Capital says to accept deposits via bank wire and credit /debit cards like Visa, Maestro and MasterCard, Skrill, Neteller, Perfect Money, Qiwi, Yandex Money, and WebMoney. The minimum initial deposit requirement is $100.

Customer Support

FXB Capitals customer support can be reached by telephone: +1 (551) 230-6782, email: support@fxbcapital.com. Company address: 5895 W. Olympic Blvd. Los Angeles, CA 90036.

Pros & Cons

| Pros | Cons |

| • Multiple account types and payment options | • No regulation |

| • Website inaccessible |

Frequently Asked Questions (FAQs)

| Q 1: | Is FXB Capital regulated? |

| A 1: | No. It has been verified that FXB Capital currently has no valid regulation. |

| Q 2: | Does FXB Capital offer the industry-standard MT4 & MT5? |

| A 2: | No. Instead, FXB Capital offers a web-based trading platform. |

| Q 3: | What is the minimum deposit for FXB Capital? |

| A 3: | The minimum initial deposit at FXB Capital to open the most basic account is $100. |

| Q 4: | Is FXB Capital a good broker for beginners? |

| A 4: | No. FXB Capital is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Read more

ASIC Launches Streamlined Digital Platform for AFS Licensing

ASIC launches a new digital AFS licensing platform on May 5, 2025, streamlining applications with a user-friendly interface and enhanced features.

Global Traders Sound Alarm Over Dollars Markets' Shady Practices

This article exposes the alarming experiences of global traders with Dollars Markets, a low-rated and blacklisted broker, highlighting serious issues such as withdrawal delays, suspicious payment methods, and possible links to illegal online gambling.

Capital.com Faces Fraud Allegations Rising From Systemic Issues

It has been found that even the regulated and licensed brokers have been opting for scammy tactics, withholding traders’ funds and causing serious losses for them, as is the case for Capital.com. There is not one but a trail of user complaints seeking exposure on WikiFX about their troubling experience with the broker.

Why Digital Assets Are Surging Today?

Explore the driving forces behind the 2025 surge in digital assets, from institutional investments to regulatory clarity and technological advances, shaping the market’s future.

WikiFX Broker

Latest News

Meta Cracks Down on Scam Networks Targeting Brazil and India

Clicking on a Facebook Ad Cost Him His Life Savings of RM186,800

Are You Trading or Are You Gambling?

EUR/USD at a Critical Juncture: Can the 1.13 Level Hold?

Warren Buffett’s 5 Golden Rules that Every Trader Must Know

XM Marks 15 Years in Trading with New Product Launches and Events

Mastering Trading Psychology: Four Pillars of Mental Strength for Market Participants

Futu Securities Launches Crypto Deposit Service for Investors

Essential Features to Look for in a Trading Platform

Why Digital Assets Are Surging Today?

Rate Calc