User Reviews

More

User comment

39

CommentsWrite a review

2025-04-25 12:40

2025-04-25 12:40

2025-04-22 18:25

2025-04-22 18:25

Score

1-2 years

1-2 yearsRegulated in Indonesia

Retail Forex License

MT4 Full License

Global Business

Medium potential risk

Influence

Add brokers

Comparison

Quantity 7

Exposure

Score

Regulatory Index6.02

Business Index4.97

Risk Management Index8.90

Software Index9.14

License Index6.02

Single Core

1G

40G

More

Company Name

KVB Europe Ltd

Company Abbreviation

KVB

Platform registered country and region

United Kingdom

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| KVBReview Summary | |

| Founded | 2023 |

| Registered Country/Region | Comoros |

| Regulation | AOFA (Offshore), FCA |

| Market Instruments | Forex, Indices, Commodities, Shares, Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | Floating from 1.2 pips (Classic account) |

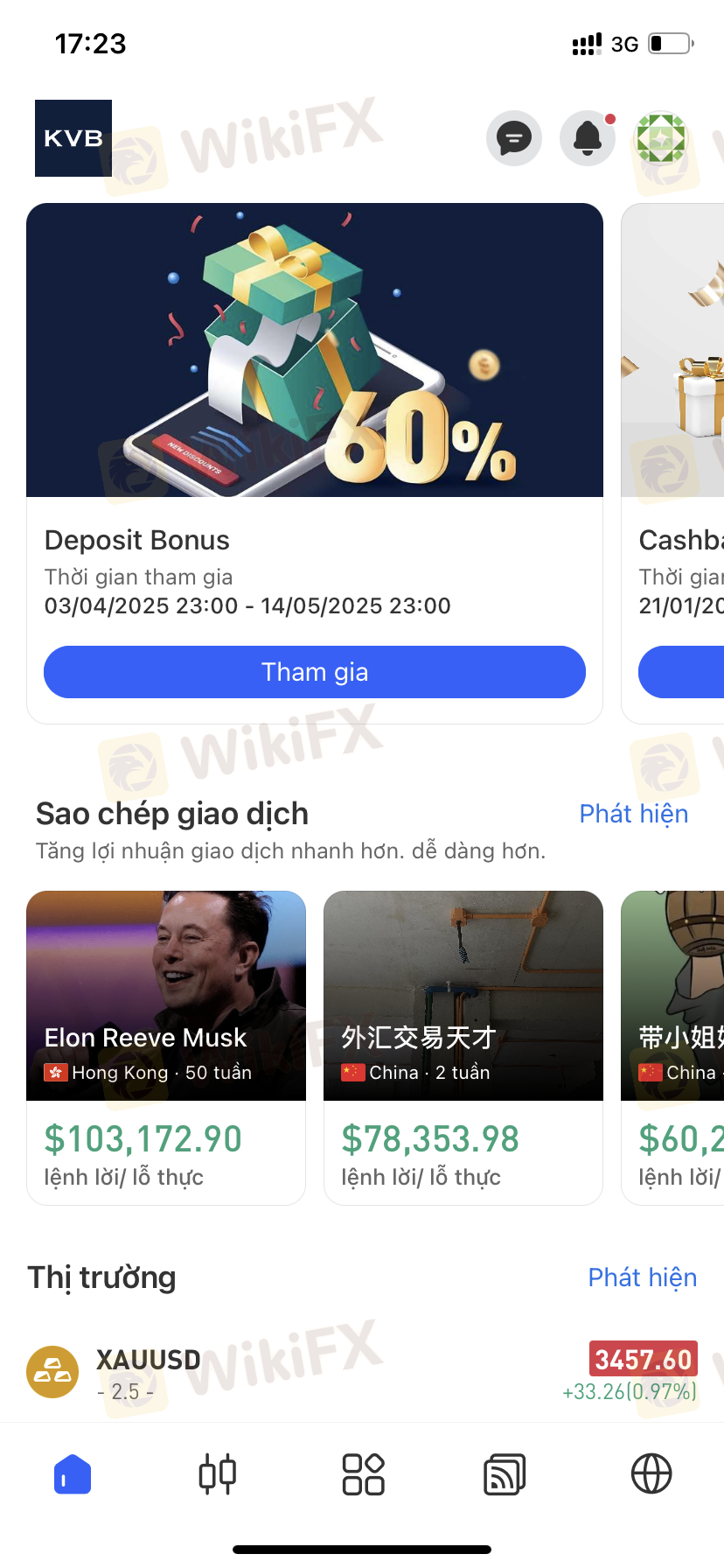

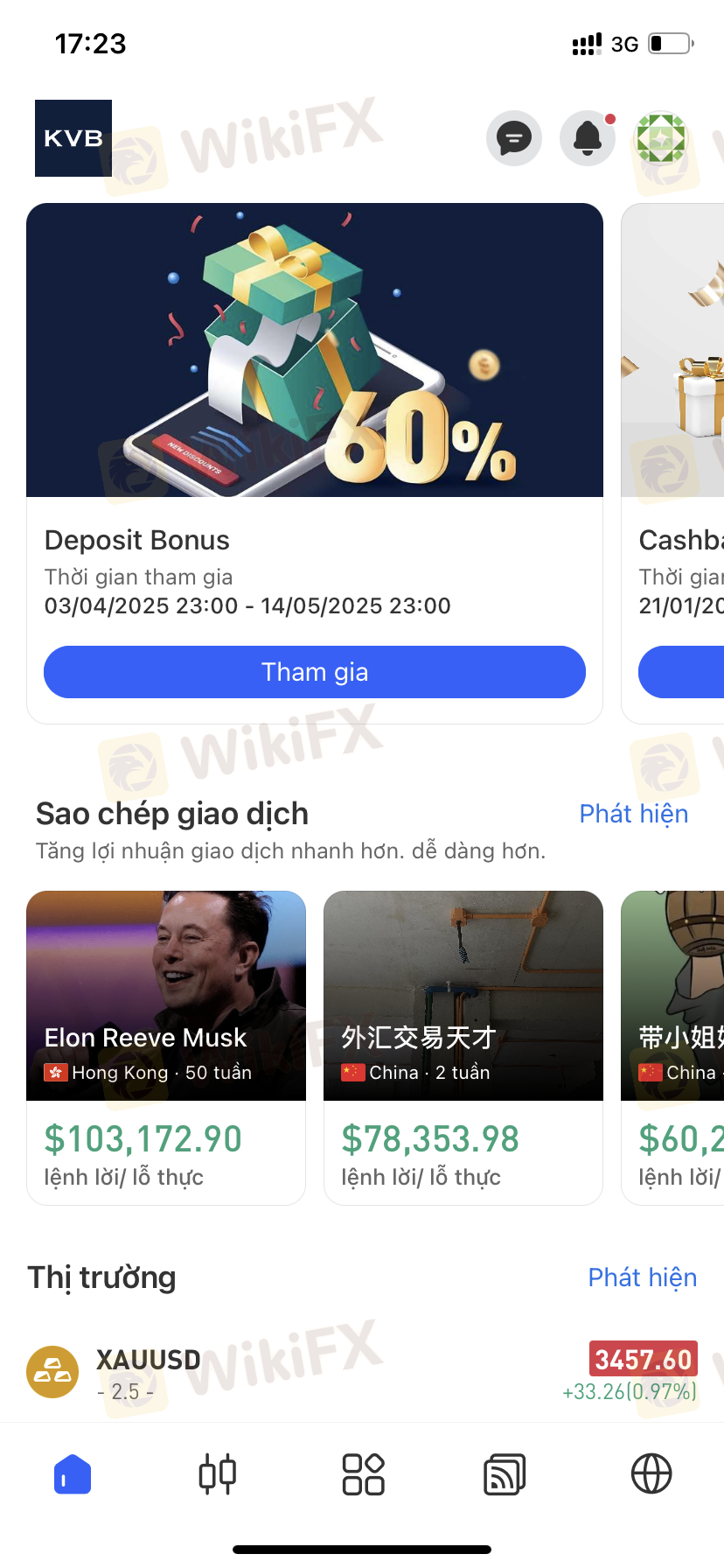

| Trading Platform | KVB App, ActsTrade, MetaTrader 4 |

| Min Deposit | $30 |

| Customer Support | Email: support@kvbplus.com |

| Social Media: Facebook, Instagram, Linkedin, Twitter | |

| Company Address: Hamchako, Mutsamudu, The Autonomous Island of Anjouan, Union of Comoros | |

KVB is an online trading platform based in Comoros. KVB asserts that it provides market instruments such as cryptocurrency, shares, commodities, forex, and indices with leverage of up to 1:1000 via KVB App, ActsTrade, and MetaTrader 4 as trading platforms.

| Pros | Cons |

| Multiple market instruments | Offshore regulation |

| Copy trading available | Limited payment options |

| Various trading plaforms |

Yes. KVB is currently regulated by Anjouan Offshore Finance Authority (AOFA) and Financial Conduct Authority (FCA). It also offers negative balance protection for all account types.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Regulatory Status |

| Anjouan Offshore Finance Authority (AOFA) | KVB Prime Limited | L 15626 / KVB | Retail Forex License | Offshore Regulated |

| Financial Conduct Authority (FCA) | KVB Europe Ltd | Appointed Representative (AR) | 1017430 | Regulated |

| Trading Asset | Available |

| forex | ✔ |

| commodities | ✔ |

| indices | ✔ |

| shares | ✔ |

| cryptocurrencies | ✔ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

| Features | Classic Account | Plus Account |

| Min Deposit | $30 | $10000 |

| Min Volume Per Trade | 0.01 lot | |

| Max Volume Per Trade | 20 lots | |

| Max Leverage | 1:1000 | |

| Spread | Floating from 1.2 pips | Floating from 0 pips |

| Trading Platform | Supported | Available Devices | Suitable for |

| ActsTrade | ✔ | Desktop | / |

| KVB App | ✔ | Mobile | / |

| MT5 | ❌ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

Deposit Options

| Deposit Option | Fee | Processing Time |

| Local Bank Transfer | ❌ | Instant |

| Cryptocurrency | ❌ | Instant |

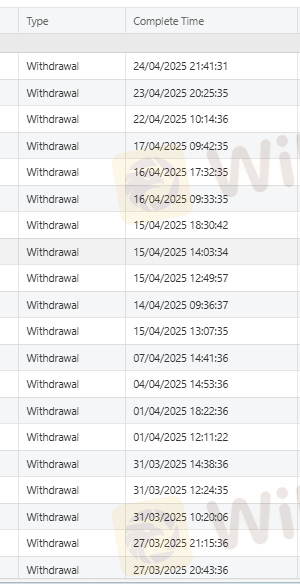

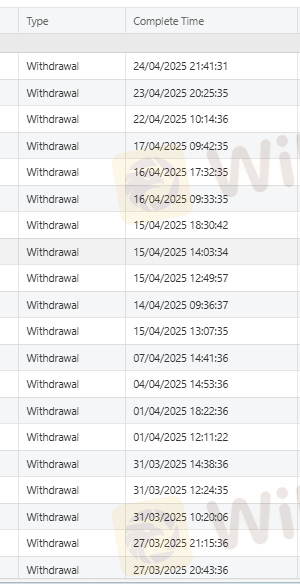

Withdrawal Options

| Withdrawal Option | Fee | Processing Time |

| Bank Transfer | / | Within 2 hours |

| Cryptocurrency | / | Within 2 hours |

Product: EUR/USDPrediction: DecreaseFundamental Analysis: The EUR/USD pair is under selling pressure, dropping to around 1.0530 due to a stronger U.S. Dollar in early Asian trading. Investors are awai

WikiFX

WikiFX

Product: XAU/USDPrediction: IncreaseFundamental Analysis: On Friday morning (November 29), spot gold prices quickly rebounded from a daily low of $2,633.85 per ounce, reaching a high of $2,645.52. Gol

WikiFX

WikiFX

Product: XAU/USDPrediction: DecreaseFundamental Analysis: Gold prices fell from their daily high as sellers took control, raising the risk of further decline. The main reason for the drop is rising pe

WikiFX

WikiFX

Product: XAU/USDPrediction: DecreaseFundamental Analysis:Spot gold rebounded sharply after hitting a one-week low near $2,605 per ounce, closing above $2,630. Analysts note that while Israels agreemen

WikiFX

WikiFX

Product: XAU/USDPrediction: DecreaseFundamental Analysis:Reports of an upcoming ceasefire agreement between Israel and Hezbollah, along with Trump nominating Scott Bessent as the U.S. Treasury Secreta

WikiFX

WikiFX

Product: EUR/USDPrediction: IncreaseFundamental Analysis:During midweek, EUR/USD bulls struggled, losing nearly half a percent and keeping prices just above the 1.0500 mark.Thursday is quiet for both

WikiFX

WikiFX

Product: EUR/USDPrediction: IncreaseFundamental Analysis:EUR/USD fluctuated between 1.0550 and 1.0600 on Tuesday, briefly testing lower levels before recovering to gain 0.14% for the day.The final pan

WikiFX

WikiFX

Product: EUR/USDPrediction: DecreaseFundamental Analysis:The EUR/USD pair is trading around 1.0550 during Mondays Asian session, close to its yearly low of 1.0496 reached on November 14. Downside risk

WikiFX

WikiFX

More

User comment

39

CommentsWrite a review

2025-04-25 12:40

2025-04-25 12:40

2025-04-22 18:25

2025-04-22 18:25