FX Nice-Some Important Details of This Broker

Abstract:FX-Nice is an unregulated brokerage firm that offers a variety of trading accounts with different deposit requirements and trading conditions. The accounts differ in terms of spreads, commissions, and available instruments such as Forex, Energy, Metals, and Crypto via the MetaTrader 5 (MT5) platform.

Note: FX-Nices official site - https://fx-nice.net/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| FX-Nice Review Summary | |

| Registered Country/Region | United Kingdom |

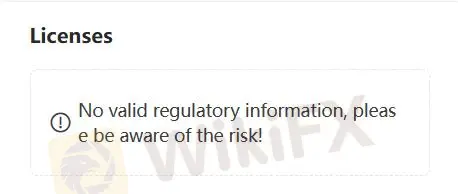

| Regulation | No Regulation |

| Market Instruments | Forex, Energy, Metals, Crypto |

| Demo Account | Available |

| Leverage | 1:100 |

| Spread | Mini Account: 3 pips |

| Standard Account: 2 pips | |

| Premium Account: 1 pip | |

| Trading Platform | MT5 |

| Minimum Deposit | $100 |

| Company address | 71-75 Shelton Street, Covent Garden, London WC 2H9 JQ |

| Customer Support | Tel: +44 702 401 0699; Email: info@example.com; Facebook |

FX-Nice Information

FX-Nice is an unregulated brokerage firm that offers a variety of trading accounts with different deposit requirements and trading conditions. The accounts differ in terms of spreads, commissions, and available instruments such as Forex, Energy, Metals, and Crypto via theMetaTrader 5 (MT5) platform.

Pros & Cons

| Pros | Cons |

| High Leverage | No Regulation |

| Demo Accounts Available | Commission Charged |

| Multiple Account Types | Official Website Unavailable |

Pros

High Leverage: FX-Nice offers a high leverage ratio of up to 1:500, allowing traders to enter trades of significantly larger value than the capital they possess. Although this can lead to increased profits, it can also amplify potential losses.

Demo accounts available: FX-Nice offers demo accounts, allowing users to practice trading without risking real money. This can be beneficial for beginners or those who want to test the platform.

Multiple account types: FX-Nice offers three live account types, providing users with the flexibility to choose an account that suits their trading needs.

Cons

No Regulation: FX-Nice is not regulated, which increases risks for clients as the company doesn't have to adhere to any established financial standards nor offer protections typically required by financial regulators.

Commission Charged: Unlike some brokers that offer commission-free trading, FX-Nice charges a a commission of $6 per lot traded in mini account, which renders its services less competitive in comparison.

Official Website Unavailable: Fx-Nice's official website is currently unavailable which is unable to provide any further information.

Is FX-Nice Legit?

- Regulatory Sight: Fx-Nice is currently not regulated by any recognized financial authority. Traders should exercise caution and conduct thorough research before engaging with Fx-Nice.

- User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

- Security Measures: So far we haven't found any information about the security measures for this broker.

Market Instruments

FX-Nice provides a range of market instruments for trading, including Forex, Energy, Metals, and Cryptocurrencies.

The Forex market allows traders to speculate on the exchange rates of various currency pairs.

Energy trading involves commodities such as oil and natural gas, allowing investors to participate in the price movements of these crucial energy resources.

Metals trading involves precious metals like gold and silver, which are often sought after as safe-haven assets or for industrial purposes.

Additionally, FX-Nice offers cryptocurrency trading for investors interested in digital currencies like Bitcoin and Ethereum.

Account Types (Min. Deposit, Leverage, Spreads)

FX-Nice offers a demo account and three types of live trading accounts: Mini, Standard, and Premium.

The Mini Account requires a minimum deposit of $100, has spreads starting from 3 pips, and uses ECN execution with a $6 commission per lot traded. The account offers leverage up to 1:500, trade sizes starting from 0.01 lots, and allows for scalping and hedging.

The Standard Account, with a minimum deposit of $2,000, has spreads starting from 2 pips and no additional commission, while the Premium Account, requiring a deposit of $5,000, has spreads starting from 1 pip.

Both Standard and Premium accounts also use ECN execution, offer leverage up to 1:500, and allow scalping and hedging. All accounts have a margin call level set between 30% and 40% and no specified maximum number of open trades. Swap-free versions are available for all three account types.

| Minimum Deposit | Spread | Leverage | Margin Call Level | Swap-free | |

| Mini | $100 | 3 pips | 1:500 | 30%-40% | Available |

| Standard | $2,000 | 2 pips | |||

| Premium | $5,000 | 1 pip |

Commissions

The Mini account at FX-Nice incurs a commission of $6 per lot traded, which is typical within the industry. It is noteworthy that this account, despite having the highest starting spread, is the only one with an added commission.

On the other hand, the Standard and Premium accounts utilize a spread-based system with no additional commissions.

Furthermore, swap fees, which are interest charges for holding trades overnight, apply to the Standard and Premium accounts, although swap-free versions of these accounts are offered as well.

Trading Platform

FX-Nice provides the MetaTrader 5 (MT5) trading platform for its clients. MT5 is a popular and widely-used platform in the trading industry known for its advanced features and capabilities. It offers a range of tools for technical analysis, charting, and automated trading strategies, making it a versatile option for traders of varying experience levels.

Customer Support

Fx-Nice offers multiple ways to connect to them.

- Tel: +44 702 401 0699

- Email: info@example.com

- Social Media: Facebook

- Company Address: 71-75 Shelton Street, Covent Garden, London WC 2H9 JQ

Conclusion

In conclusion, FX-Nice offers a range of trading accounts and instruments through the MetaTrader 5 platform, providing traders with various options for their trading needs. However, it is important to highlight the lack of regulation of FX-Nice, which raises concerns regarding the safety and security of client funds. Additionally, the unfunctional official website of the firm may hinder traders' ability to access important information and support services. Potential clients should carefully consider these factors before deciding to engage with FX-Nice for their trading activities.

Frequently Asked Questions (FAQs)

Is FX-Nice regulated?

No. FX-Nice is not regulated.

What are the available account types on FX-Nice?

FX-Nice offers Mini, Standard, and Premium trading accounts with varying features and minimum deposit requirements.

Are there any commissions applied to trades on FX-Nice?

The Mini account incurs a commission of $6 per lot traded, while the Standard and Premium accounts operate on a spread-based system.

What trading platform does FX-Nice use?

MetaTrader 5 (MT5).

What financial markets can be accessed through FX-Nice?

Traders on FX-Nice can access the Forex, Energy, Metals, and Cryptocurrency markets.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Read more

CySEC Withdraws CIF License of Viverno Markets Ltd

The Cyprus Securities and Exchange Commission (CySEC) has officially revoked the Cyprus Investment Firm (CIF) authorization of Viverno Markets Ltd, effective May 9, 2025. This decision follows a six-month period during which the firm did not provide investment services or engage in investment activities, beginning from January 1, 2024.

CMC Markets Partners with FYNXT to Enhance Client and Partner Portals

CMC Markets, a global leader in online trading services, has recently integrated FYNXT’s advanced Client Portal and Partner Portal into its technology suite. This strategic collaboration aims to enhance user experience and operational efficiency for CMC Markets' retail, institutional, and introducing broker clients.

Global Traders Sound Alarm Over Dollars Markets' Shady Practices

This article exposes the alarming experiences of global traders with Dollars Markets, a low-rated and blacklisted broker, highlighting serious issues such as withdrawal delays, suspicious payment methods, and possible links to illegal online gambling.

Capital.com Faces Fraud Allegations Rising From Systemic Issues

It has been found that even the regulated and licensed brokers have been opting for scammy tactics, withholding traders’ funds and causing serious losses for them, as is the case for Capital.com. There is not one but a trail of user complaints seeking exposure on WikiFX about their troubling experience with the broker.

WikiFX Broker

Latest News

Unlocking Forex Profits: Your Guide to Smart Currency Trading

FBI Calls on AML Bitcoin Scam Victims to File Claims by June 5

Donald Trump prizes more Gulf investment in the US

US Dollar Index Makes a Strong Comeback, Climbs Back to 101.60 Level

Exposing the Dark Art of Pig Butchering Scams

ASIC Launches Streamlined Digital Platform for AFS Licensing

Global Traders Sound Alarm Over Dollars Markets' Shady Practices

CMC Markets Partners with FYNXT to Enhance Client and Partner Portals

CySEC Withdraws CIF License of Viverno Markets Ltd

CySEC Revokes License of Viverno Markets Following Extended Inactivity

Rate Calc