GIBXChange-Overview of Minimum Deposit, Spreads & Leverage

Abstract:GIBXChange, an international brokerage headquartered in United States, provides a diverse range of financial instruments, encompassing Forex currency pairs, cryptocurrency, precious metals, stock CFDs, global index. However, the broker currently operates with no valid regulation from any recognized regulatory bodies. Furthermore, the non-functional status of the broker's website adds to the concerns, significantly increasing the associated investment risks within the platform.

Note: GIBXChanges official site - https://gibx.io/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

| GIBXChange Review Summary in 10 Points | |

| Founded | 2-5 years |

| Registered Country/Region | United States |

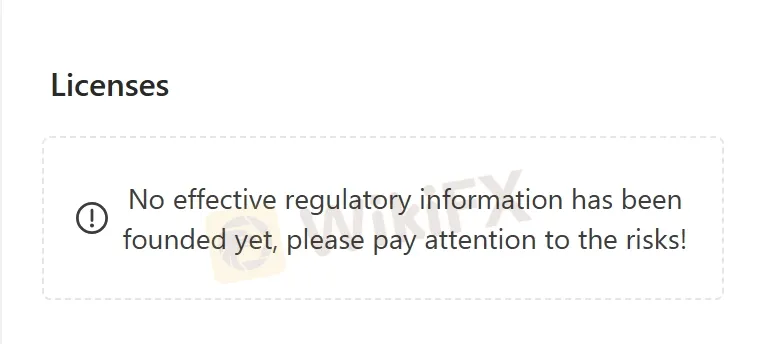

| Regulation | Unregulated |

| Market Instruments | Forex currency pairs, cryptocurrency, precious metals, stock CFDs, global index |

| Demo Account | Not Available |

| Leverage | Up to 1:100 |

| EUR/USD Spread | From 0.3 to 2 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | $100 |

| Customer Support | Email, Social media |

What is GIBXChange?

GIBXChange, an international brokerage headquartered in United States, provides a diverse range of financial instruments, encompassing Forex currency pairs, cryptocurrency, precious metals, stock CFDs, global index. However, the broker currently operates with no valid regulation from any recognized regulatory bodies. Furthermore, the non-functional status of the broker's website adds to the concerns, significantly increasing the associated investment risks within the platform.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Diversified instruments | • Unregulated |

| • MT5 trading platform | • Website unavailable |

| • Acceptable minimum deposit amount | • Lack of transparency |

GIBXChange, as a trading platform, offers a set of advantages and drawbacks.

On the positive side, it provides diversified trading instruments, giving traders extensive options to choose from. It also utilizes the MT5 trading platform which is well recognized in terms of its comprehensive features and user-friendly interface. Moreover, it offers an acceptable minimum deposit amount at $100, making it accessible for a wider audience.

However, it's important to note the cons. GIBXChange operates unregulated, potentially exposing traders to undue risk. The unavailability of its website further accentuates this problem, obstructing access to necessary information about its operations. This lack of transparency on commissions/payment methods etc is also a significant concern, highlighting the need for potential traders to approach this platform with due caution.

Is GIBXChange Safe or Scam?

Regulatory sight: Operating without valid regulations, GIBXChange raises significant concerns about its legitimacy and accountability. Additionally, its non-functional website further amplifies these concerns, creating doubts about its reliability and user-friendliness.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedbacks from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: So far we cannot find any security measures info on Internet for this broker.

In the end, choosing whether or not to engage in trading with GIBXChange is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

GIBXChange provides an extensive array of financial instruments to investors.

Their offering starts with Forex currency pairs, a cornerstone of any substantial trading platform.

For the tech-inclined investors, they also facilitate trade of major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC), with almost 300 distinct trading pairs in more than 290 currencies.

For those who prefer tangible assets, precious metals are available for trading. Their inventory is further expanded by the inclusion of Contracts for Difference (CFDs) on stocks, potentially allowing investors to benefit from market volatility without owning the underlying asset.

Additionally, they provide a global index for investors keen on tracking market movements on an aggregate level.

Accounts

GIBXChange provides its clients with a standard account type, an option that allows for a reasonable level of entry into the trading world. The minimum deposit required to open this standard account is set at $100. This relatively low threshold attracts a broad range of potential investors, from novices who are just starting to navigate the financial markets to more experienced traders looking for a new platform.

The standard account presents an accessible and feasible way for investors to engage with the wide array of financial instruments that GIBXChange offers.

Leverage

GIBXChange offers a substantial leverage of up to 1:100. This means that traders can potentially amplify their investment up to 100 times, thereby significantly increasing their market exposure and potential gains.

However, it's crucial to understand that while leverage can indeed magnify profits, it can equally amplify losses. Thus, the use of such high leverage carries considerable risk - especially for inexperienced traders who may not fully comprehend its implications.

Consequently, we advise all traders, particularly those new to the markets, to exercise extreme caution when employing leverage in their trading strategy. It's essential to harness leverage sensibly and in line with one's risk tolerance, financial goals and understanding of the markets.

Spreads & Commissions

GIBXChange operates with floating spreads that vary between 0.3 pips and 2 pips. The variability of spreads can provide traders with a competitive trading environment during periods of high liquidity.

However, specific details regarding commission structure are not available, an aspect that somewhat obfuscates the overall trading cost on this platform. Without clear information on commission, it's challenging for traders to calculate the full cost of transactions accurately.

Therefore, it's recommended that potential traders to contact with broker directly to seek this necessary detail for a comprehensive understanding of the cost structure before choosing to trade with GIBXChange.

Trading Platform

GIBXChange provides customers with access to a world of financial opportunities through the robust MetaTrader 5 (MT5) platform.

Renowned for its advanced features, the MT5 platform allows traders to execute a variety of trading strategies and manage multiple assets with ease. It also provides numerous charting tools, indicators, and other technical analysis resources that empower traders with insights to make informed decisions.

Customer Service

While GIBXChange provides its email and social media such as Twitter, Facebook and Instagram as customer support channels, whilst the absence live chat and phone support might limit the accessibility and responsiveness of their customer service.

Email: info@gibx.io; admin@gibx.io; finance@gibx.io; IT@gibx.io; marketing@gibx.io; support@gibx.io.

Traders should consider this potential limitation when evaluating the broker's overall support framework and their own communication preferences.

Conclusion

In conclusion, GIBXChange presents itself as a globally accessible online brokerage operating from United States, offering a diverse range of trading instruments such as Forex currency pairs, cryptocurrency, precious metals, stock CFDs, global index. However, potential investors should approach with caution due to alarming unregulated status of the broker. Such concerns cast doubt on the broker's commitment to regulatory compliance and client security. Furthermore, ongoing issues with the accessibility of their website pose serious doubts on their professionalism and dependability.

Given these considerations, individuals are encouraged to explore alternative brokers that prioritize transparency, regulatory adherence, and professionalism.

Frequently Asked Questions (FAQs)

| Q 1: | Is GIBXChange regulated? |

| A 1: | No. The broker is currently under no valid regulations. |

| Q 2: | Is GIBXChange a good broker for beginners? |

| A 2: | No. It is not a good choice for beginners. Not only because of its unregulated status, but also because of its unavailable website and lack of transparency. |

| Q 3: | Whats the minimum deposit does GIBXChange require? |

| A 3: | GIBXChange requested minimum deposit of $100. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Read more

‘Metherworld is the future’ Under Questions from Traders: Is it a Safe Bet?

Mether World, an unregulated broker claiming to be the future of trading and Web3 education, has come under scrutiny due to its lack of reliability and concerns from traders. Others are advised to choose other regulated alternatives over such platforms.

Gold Prices Rise After U.S.-China Tariff Deal and Lower Inflation

Gold prices climb to $3,246.95 after U.S.-China tariff truce and soft CPI data. Traders eye Fed rate cuts and trade talks for gold's next move. Insights for daily trading.

WikiFX Broker Assessment Series | WCG Markets: Is It Trustworthy?

In this article, we will conduct a comprehensive examination of WCG Markets, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

RM80 Million in Losses After ‘Islamic’ Scheme Falls Apart

A group of 232 investors is urging Malaysian authorities to launch a comprehensive investigation into an Islamic investment scheme that reportedly incurred losses exceeding RM80 million. The scheme, marketed under the guise of Islamic Redeemable Preference Shares (IRPS), is now under scrutiny for alleged misrepresentation and regulatory breaches.

WikiFX Broker

Latest News

Short-Term Pressure Mounts on Gold as Risk Sentiment Improves

How Will the U.S.-China Trade Deal Affect the Dollar and Global Markets?

Radiant DAO Proposes Compensation Plan for Wallet Losses

BitGo Secures MiCA License, Expands Crypto Services Across the EU

Big Changes at Saxo Bank: What Traders and Partners Need to Know

Traders Warned to Stay Alert Amid Growing Exposures for INGOT Brokers

WELTRADE's transformation from Reliable to a Problematic Broker

How UK-China Financial Cooperation Is Shaping Global Resilience

Deriv Review 2025: A Growing Force in Online Trading

WikiFX Broker Assessment Series | WCG Markets: Is It Trustworthy?

Rate Calc