Citadel Securities

Abstract:Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

| Citadel Securities Review Summary | |

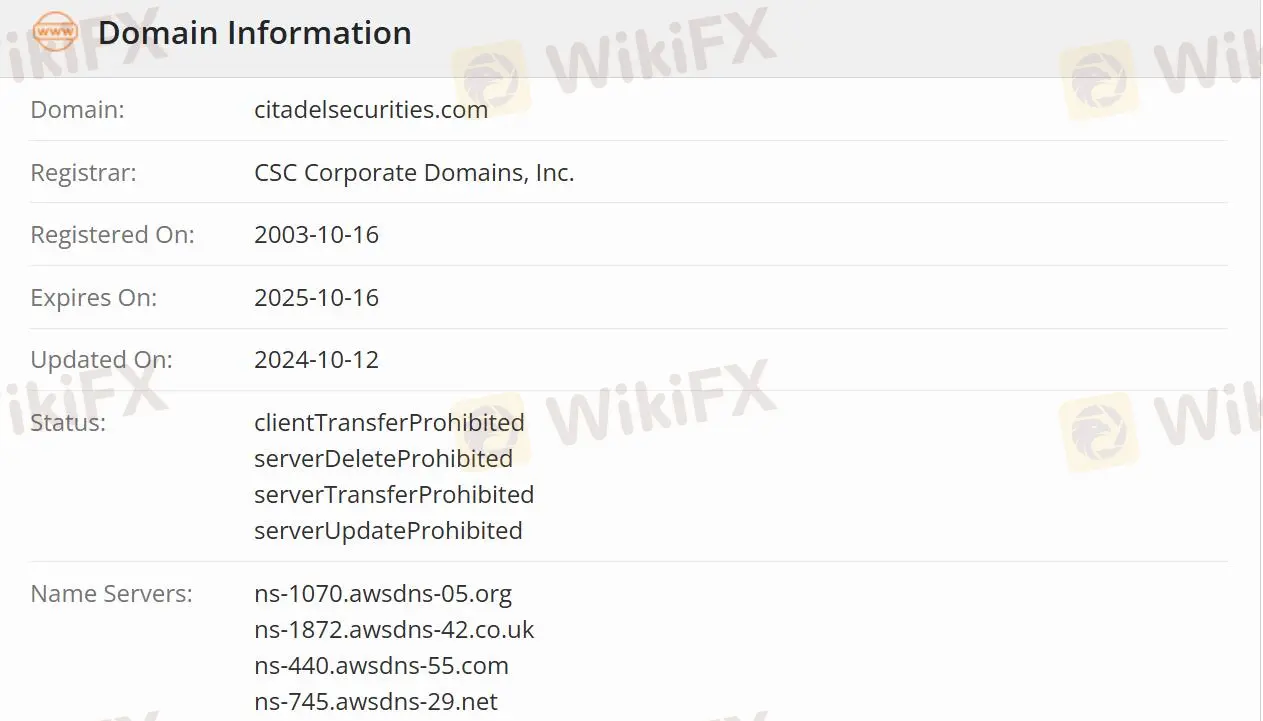

| Founded | 2003-10-16 |

| Registered Country/Region | United States |

| Regulation | Regulated |

| Services | Equities/Options/Fixed Income & FX/Corporate Solutions |

| Customer Support | LinkedIn/Facebook/Instagram/YouTube |

Citadel Securities Information

Registered in the United States, Citadel Securities drives markets through trading, research, and technology. The company's work is driven by the fusion of financial, mathematical, and engineering expertise to provide liquidity to important financial institutions.

Is Citadel Securities Legit?

Citadel Securities is authorized and regulated by the Securities and Futures Commission of Hong Kong(SFC), making it safer than an unregulated company.

What services does Citadel Securities provide?

One of Citadel Securities' functions is market making, which provides liquidity to investors by purchasing securities from sellers and selling them to buyers. Citadel Securities Enterprise Solutions also helps investors make decisions.

Bringing together financial services firms, including major banks, brokers, and even other market makers, to lead the creation of an exchange founded and operated by its members to launch the MEMX fully electronic stock exchange.

Asset-related businesses include equities, options, and fixed income & FX.

Read more

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

Webull and SK Growth complete their business combination, with Webull now trading under the ticker “BULL.” App hits 50 million downloads worldwide.

Global Panic Builds as Forex Shifts into Risk-Off Mode

Global markets plunged into a broad sell-off today, with U.S. equities, crypto assets, and various indexes all sharply lower as risk-off sentiment intensified. The forex market followed suit, shifting into “safe-haven mode” — the Japanese yen and Swiss franc surged, while risk-sensitive currencies like the Australian dollar, New Zealand dollar, and Canadian dollar came under heavy pressure. Tariff concerns acted as the trigger, prompting capital rotation and a clear shift in market structure.

TopFX Launches New Website & Brand Identity for Enhanced Trading

TopFX unveils a redesigned website and brand identity, offering faster trading, advanced technology, and institutional-grade liquidity for serious traders.

Best Binary Options Indicators: Enhance Your Trading Strategy

Binary options trading involves predicting whether an asset's price will rise or fall within a specific timeframe. Unlike traditional investing, more specifically, binary options demand rapid decisions due to fixed expiry times (e.g., 60 seconds to 1 hour). For instance, speculating if EUR/USD will be above 1.0800 in the next five minutes. Success yields a fixed payout, while failure results in the loss of invested capital. Binary indicators distill complex market data—price action, volume, volatility—into actionable signals tailored for short-term trades. Indicators act as a compass, guiding traders to trends, reversals, and optimal entry points, thus enabling traders to detect market shifts for higher-probability decisions.

WikiFX Broker

Latest News

MultiBank, MAG, and Mavryk Partner for $3B RWA Tokenization

Westpac Fined NZ$3.25 Million Over Misleading Fee Practices Affecting 24,000+ Customers

StoneX Brings FOREX.com to Singapore

Italy’s Consob Blocks Four Crypto Platforms for Unauthorized Services

ATFX Reaffirms Commitment to Traders and Community Growth

Regulators Uncover $1.2 Billion Fraud Linked to IM Academy

Beware of Rising Online Scams in the Philippines: A Growing Threat

Promax Trading Exposed with Account Disabling and Scam Allegations

Who Are the Cybercriminals Behind the Darcula Phishing Network?

USD Index Continues to Weaken: Is the Market Losing Confidence?

Rate Calc