GAINFUL MARKETS Spreads, leverage, minimum deposit Revealed

Abstract:Gainful Markets is an unregulated broker based in Singapore, with a recently established presence and an undeveloped website as of September 2023. The company lacks regulatory oversight, which raises concerns about investor protection. It offers varying minimum deposits and high leverage of 1:400, potentially exposing traders to significant risks. Spreads differ across its seven account types, making it essential for traders to carefully consider their options. While it provides a proprietary trading platform and access to Forex, Stocks, Cryptocurrency, and ETFs, the absence of a demo account and educational resources may leave traders with limited support and guidance. Additionally, the company's formal website is currently down, adding uncertainty to its credibility. Traders should exercise caution and conduct thorough research before considering this unregulated broker.

| Aspect | Information |

| Registered Country/Area | Singapore |

| Company Name | Gainful Markets |

| Regulation | Unregulated |

| Minimum Deposit | Varies by account type |

| Maximum Leverage | 1:400 |

| Spreads | Vary by account type |

| Trading Platforms | Proprietary |

| Tradable Assets | Forex, Stocks, Cryptocurrency, ETFs |

| Account Types | Standard, Bronze, Silver, Gold, Platinum, Pro, VIP |

| Demo Account | Unavailable |

| Customer Support | Phone, Email, Physical Address |

| Payment Methods | Credit/Debit/Prepaid Cards, Bank Transfer |

| Educational Tools | Not available |

Overview

Be aware : Gainful Markets, a recently established company, is still in the process of developing its official website as of September 2023. The domain has been moved to gainful-markets.com, registered in July 2023.

Gainful Markets is an unregulated broker based in Singapore, with a recently established presence and an undeveloped website as of September 2023. The company lacks regulatory oversight, which raises concerns about investor protection. It offers varying minimum deposits and high leverage of 1:400, potentially exposing traders to significant risks. Spreads differ across its seven account types, making it essential for traders to carefully consider their options. While it provides a proprietary trading platform and access to Forex, Stocks, Cryptocurrency, and ETFs, the absence of a demo account and educational resources may leave traders with limited support and guidance. Additionally, the company's formal website is currently down, adding uncertainty to its credibility. Traders should exercise caution and conduct thorough research before considering this unregulated broker.

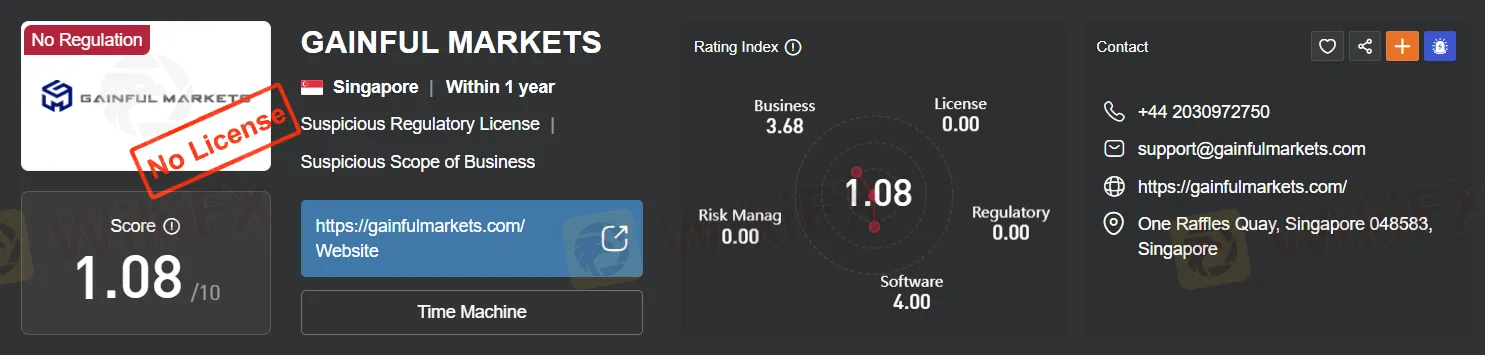

Regulation

GAINFUL MARKETS is an unregulated broker, which means it operates without oversight or supervision from financial regulatory authorities. While unregulated brokers may offer certain advantages such as lower fees and less stringent requirements for account opening, they also pose significant risks to investors. The absence of regulation can result in a lack of investor protection, making it difficult to seek recourse in case of disputes or fraudulent activities. It is essential for potential investors to exercise caution and conduct thorough research before engaging with unregulated brokers to mitigate the potential risks associated with such investments. Choosing a regulated broker with a proven track record of compliance can provide a higher level of security and confidence for investors in the financial markets.

Pros and Cons

Gainful Markets offers a diverse range of tradable assets, including Forex, Stocks, Cryptocurrency, and ETFs, along with multiple account types to cater to traders with varying preferences. The availability of high leverage up to 1:400 and a user-friendly proprietary trading platform enhances trading opportunities. However, the broker's lack of regulation raises concerns about investor protection and dispute resolution. Additionally, the absence of educational resources may hinder traders' skill development. Furthermore, as of September 2023, Gainful Markets' undeveloped website and online presence warrant caution regarding its credibility.

| Pros | Cons |

| Diverse Tradable Assets | Unregulated |

| Various Account Types | Limited Educational Resources |

| High Leverage | Undeveloped Website |

| User-Friendly Platform | |

| Multiple Contact Channels |

Market Instruments

Forex (Foreign Exchange): Traders can access the forex market, one of the largest and most liquid markets globally, through this broker. Forex trading involves the exchange of currencies, allowing traders to speculate on the price movements of currency pairs such as EUR/USD, GBP/JPY, and USD/JPY. It's a market known for its high liquidity and the opportunity to profit from both rising and falling currency values.

Stocks: The broker provides access to the stock market, enabling traders to invest in shares of publicly traded companies. Stock trading allows individuals to buy and sell ownership in companies, potentially benefitting from capital appreciation and dividends. Traders can diversify their portfolios by trading stocks from various industries and regions.

Crypto (Cryptocurrencies): With the cryptocurrency market gaining popularity, the broker offers the opportunity to trade various cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others. Cryptocurrency trading involves speculating on the price movements of digital currencies, which can be highly volatile. It allows traders to potentially profit from both upward and downward price swings in the crypto market.

ETFs (Exchange-Traded Funds): Exchange-Traded Funds (ETFs) are financial instruments that represent a diversified portfolio of assets, such as stocks, bonds, or commodities. The broker provides access to ETF trading, allowing traders to invest in a broad range of assets through a single instrument. ETFs offer diversification and liquidity benefits, making them a popular choice among investors looking to spread risk.

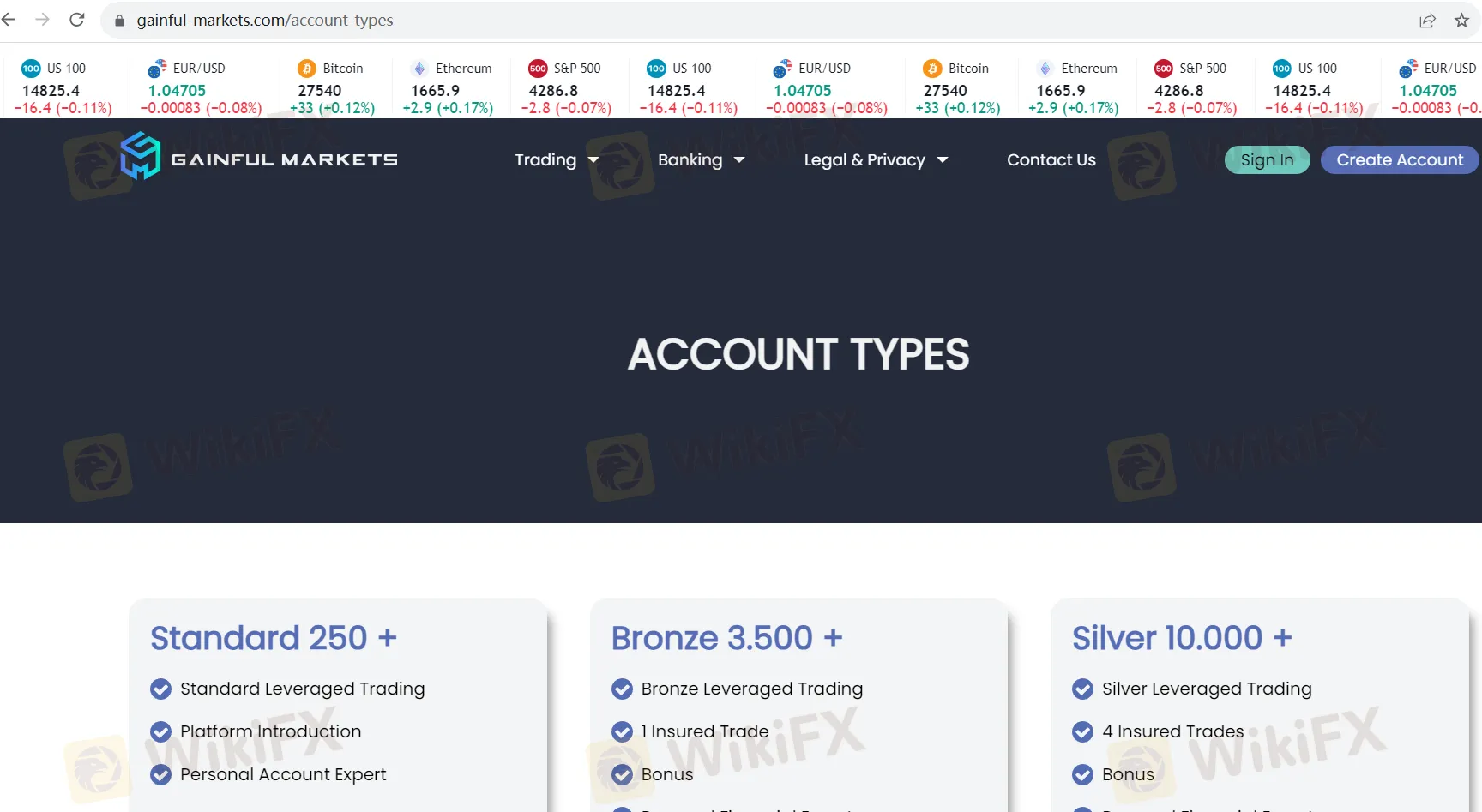

Account Types

Standard Account (250+): The Standard Account is an entry-level option for traders with a minimum deposit of 250 or more. It offers Standard Leveraged Trading, introducing users to the trading platform and providing access to a Personal Account Expert. This account is suitable for those looking to start their trading journey with a basic set of features and expert guidance.

Bronze Account (3,500+): The Bronze Account is designed for traders who want to take their trading experience a step further. With a minimum deposit of 3,500 or more, users gain access to Bronze Leveraged Trading, one Insured Trade, and additional bonuses. They also receive guidance from a Personal Financial Expert and benefit from an educational course tailored for beginners.

Silver Account (10,000+): The Silver Account caters to traders seeking more comprehensive features. It requires a minimum deposit of 10,000 or more and offers Silver Leveraged Trading, four Insured Trades, and bonuses. Users receive support from a Personal Financial Expert and gain access to a standard educational course. Additionally, they can develop a Personal Financial Plan and Investment Strategy, along with options for company financing.

Gold Account (25,000+): With a minimum deposit of 25,000 or more, the Gold Account is for traders who desire advanced capabilities. It includes Gold Leveraged Trading, eight Insured Trades, and bonus opportunities. Users benefit from the expertise of a Senior Financial Expert and access an advanced educational course. They can also create a Personal Financial Plan and Investment Strategy, as well as explore options for company financing.

Platinum Account (50,000+): The Platinum Account is tailored for experienced traders with a minimum deposit of 50,000 or more. It offers Platinum Leveraged Trading, a substantial 16 Insured Trades, and access to a Senior Financial Expert. Traders can develop a Personal Financial Plan with an Advanced Investment Strategy, enjoy advanced company financing options, and receive valuable features like Trading Signals, Order Notifications, and access to Mutual Investment Plans. Additionally, they stay updated with current trends and economic events.

Pro Account (100,000+): Pro traders will find the Pro Account suitable, with a minimum deposit of 100,000 or more. It provides Pro Leveraged Trading, a Personal Financial Plan with a Premium Investment Strategy, and premium bonuses. Users also benefit from Premium Company Financing, daily Trading Signals Updates, Personal Order Notifications, access to exclusive contracts, Mutual Investment Plans, and comprehensive insights into current trends and economic events. Premium Customer Support is also available.

VIP Account (250,000+): The VIP Account is an exclusive offering for elite clients, requiring a minimum deposit of 250,000 or more. It comes with a Modified and Improved Program, ensuring VIP clients have a Personal Expert available around the clock to address their specific trading needs and provide tailored support. This account is designed for traders seeking the highest level of personalized service and attention.

Leverage

This broker offers a maximum trading leverage of 1:400. Leverage in trading allows traders to control a larger position size with a relatively smaller amount of capital. With a leverage ratio of 1:400, traders can potentially magnify their trading positions up to 400 times the amount of their initial investment. While higher leverage can amplify potential profits, it also increases the level of risk significantly. Traders should exercise caution and have a thorough understanding of leverage before using it, as it can lead to substantial gains or losses depending on market movements. It's essential to manage leverage responsibly and consider risk management strategies to protect one's capital when trading with such high leverage ratios.

Spreads and Commissions

Spreads and commissions with Gainful Markets vary depending on the chosen trading account. Each account type offers a unique spread structure and commission considerations. For example, the Standard Account, with a $250 minimum deposit, provides floating spreads from 0.0 pips. However, spreads and commissions may differ across account tiers like Bronze, Silver, Gold, Platinum, Pro, and VIP. These accounts cater to diverse budgets and trading objectives, offering traders the flexibility to choose based on their preferences and strategies. It's essential to review each account's details to select the one that aligns best with your trading goals and risk tolerance.

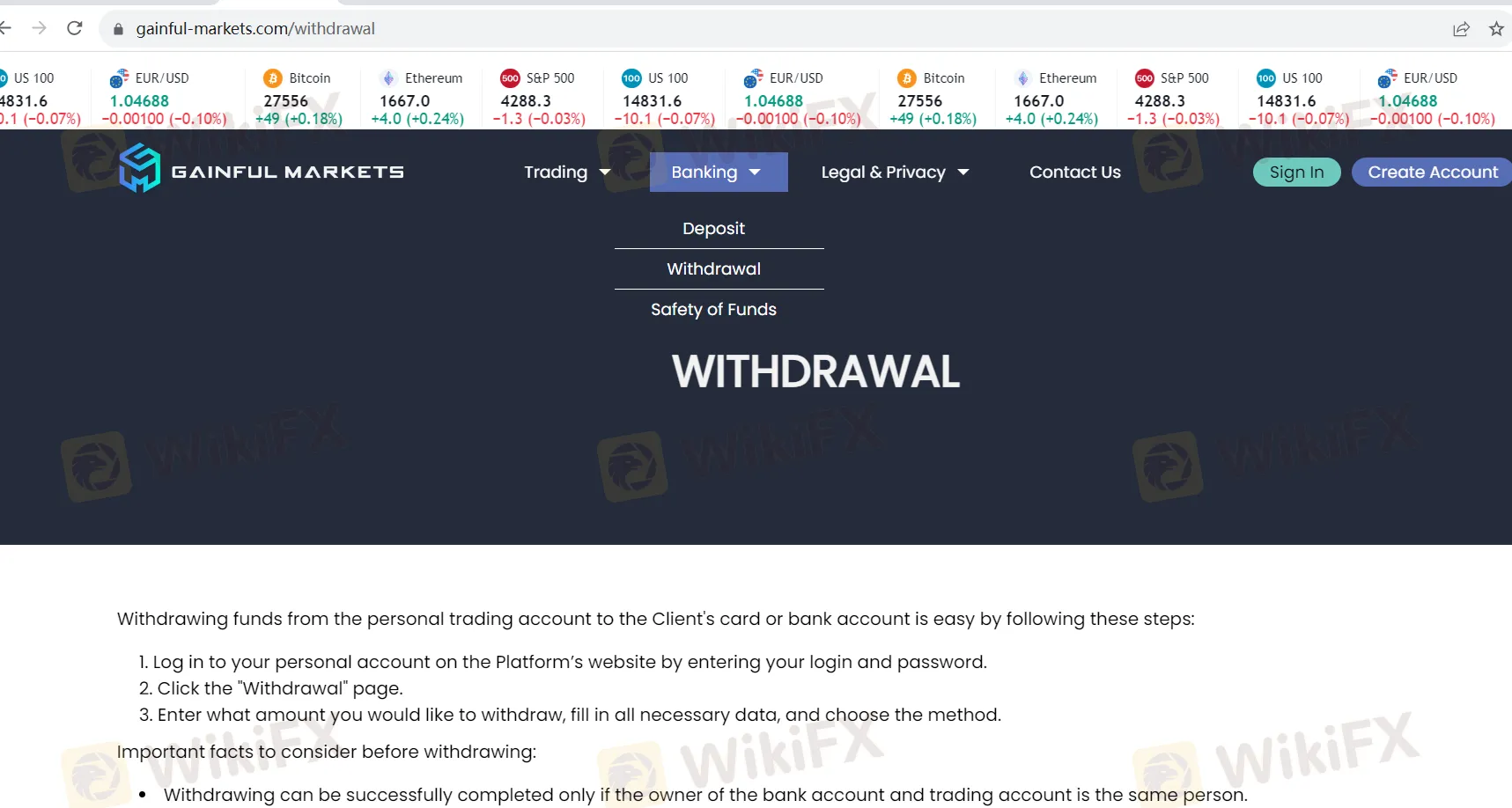

Deposit & Withdrawal

Gainful Markets offers a variety of deposit and withdrawal methods for the convenience of its clients:

Deposit Methods:

Credit/Debit/Prepaid Cards: Clients can fund their trading accounts using credit, debit, or prepaid cards. This method provides a fast and straightforward way to transfer funds from a client's card to their trading account.

Bank Transfer: Gainful Markets allows clients to transfer funds from their bank accounts to the broker's bank account. However, clients are advised to contact customer support to obtain necessary information for such transfers.

Withdrawal Methods:

Bank Transfer: Clients can withdraw funds from their trading accounts to their bank accounts. It's essential to ensure that the owner of both the bank account and trading account is the same person.

Please note that while the broker offers these methods for deposits and withdrawals, specific details regarding fees, processing times, and availability may vary. Clients should refer to the broker's official website or contact customer support for the most up-to-date and detailed information on deposit and withdrawal methods.

Trading Platforms

Gainful Markets provides a user-friendly proprietary trading platform accessible on both desktop and mobile devices. This platform offers an intuitive interface, making it suitable for traders of all levels. It eliminates the need for software downloads by allowing direct web-based trading from browsers, emphasizing convenience and accessibility.

Customer Support

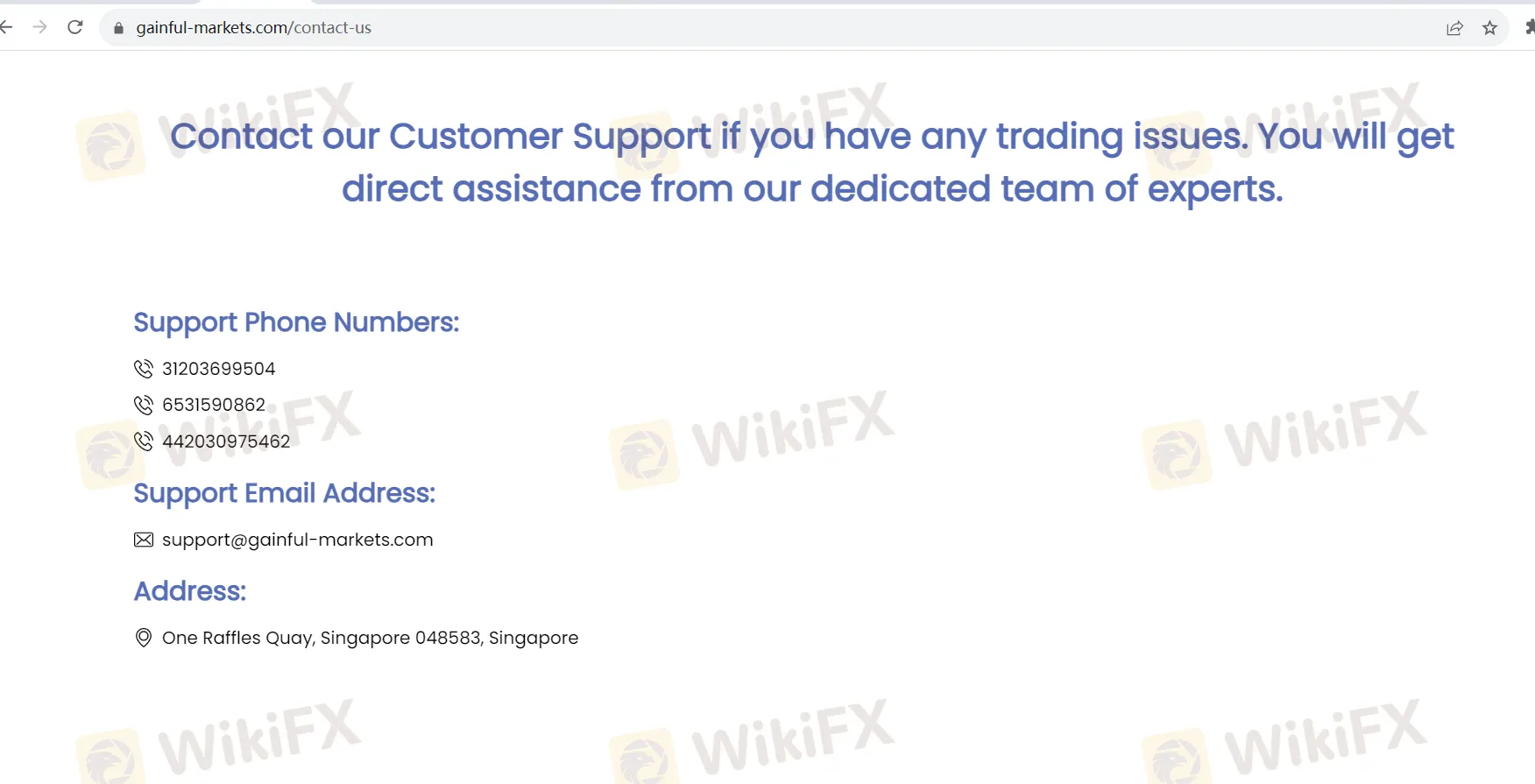

Gainful Markets offers robust customer support to assist traders with their inquiries and concerns. Traders can reach the support team through the following contact options:

Support Phone Numbers:

31203699504

6531590862

442030975462

Support Email Address:

Email: support@gainful-markets.com

Physical Address:

Address: One Raffles Quay, Singapore 048583, Singapore

These contact channels ensure that traders can access assistance promptly and efficiently, whether they prefer phone, email, or physical correspondence.

Educational Resources

Gainful Markets does not offer educational resources, such as training materials or courses, to assist traders in improving their knowledge and skills in the world of trading. Traders seeking educational support and resources may need to explore alternative sources or platforms to enhance their trading expertise.

Summary

Gainful Markets, an unregulated broker based in Singapore, is a newly established company with an undeveloped website as of September 2023. Its lack of regulatory oversight raises significant concerns regarding investor protection and dispute resolution. While it provides access to various tradable assets and offers high leverage of up to 1:400, the absence of a demo account and educational resources limits its support for traders. Moreover, the unavailability of its formal website adds uncertainty to its credibility, urging caution and thorough research before considering this broker as a trading partner.

FAQs

Q1: Is Gainful Markets a regulated broker?

A1: No, Gainful Markets is an unregulated broker, which means it operates without oversight from financial regulatory authorities.

Q2: What is the maximum leverage offered by Gainful Markets?

A2: Gainful Markets offers a maximum trading leverage of 1:400, allowing traders to control larger positions with a relatively smaller amount of capital.

Q3: Does Gainful Markets provide educational resources for traders?

A3: No, Gainful Markets does not offer educational resources such as training materials or courses to assist traders in improving their knowledge and skills.

Q4: Can I access Gainful Markets' trading platform on mobile devices?

A4: Yes, Gainful Markets provides a user-friendly proprietary trading platform that is accessible on both desktop and mobile devices.

Q5: What is the minimum deposit required to open an account with Gainful Markets?

A5: The minimum deposit varies depending on the account type, with the Standard Account requiring a minimum deposit of $250 or more.

Latest News

Unlocking Forex Profits: Your Guide to Smart Currency Trading

FBI Calls on AML Bitcoin Scam Victims to File Claims by June 5

Donald Trump prizes more Gulf investment in the US

US Dollar Index Makes a Strong Comeback, Climbs Back to 101.60 Level

Short-Term Pressure Mounts on Gold as Risk Sentiment Improves

Radiant DAO Proposes Compensation Plan for Wallet Losses

How Will the U.S.-China Trade Deal Affect the Dollar and Global Markets?

BitGo Secures MiCA License, Expands Crypto Services Across the EU

CMC Markets Partners with FYNXT to Enhance Client and Partner Portals

CySEC Withdraws CIF License of Viverno Markets Ltd

Rate Calc