BSE Spreads, leverage, minimum deposit Revealed

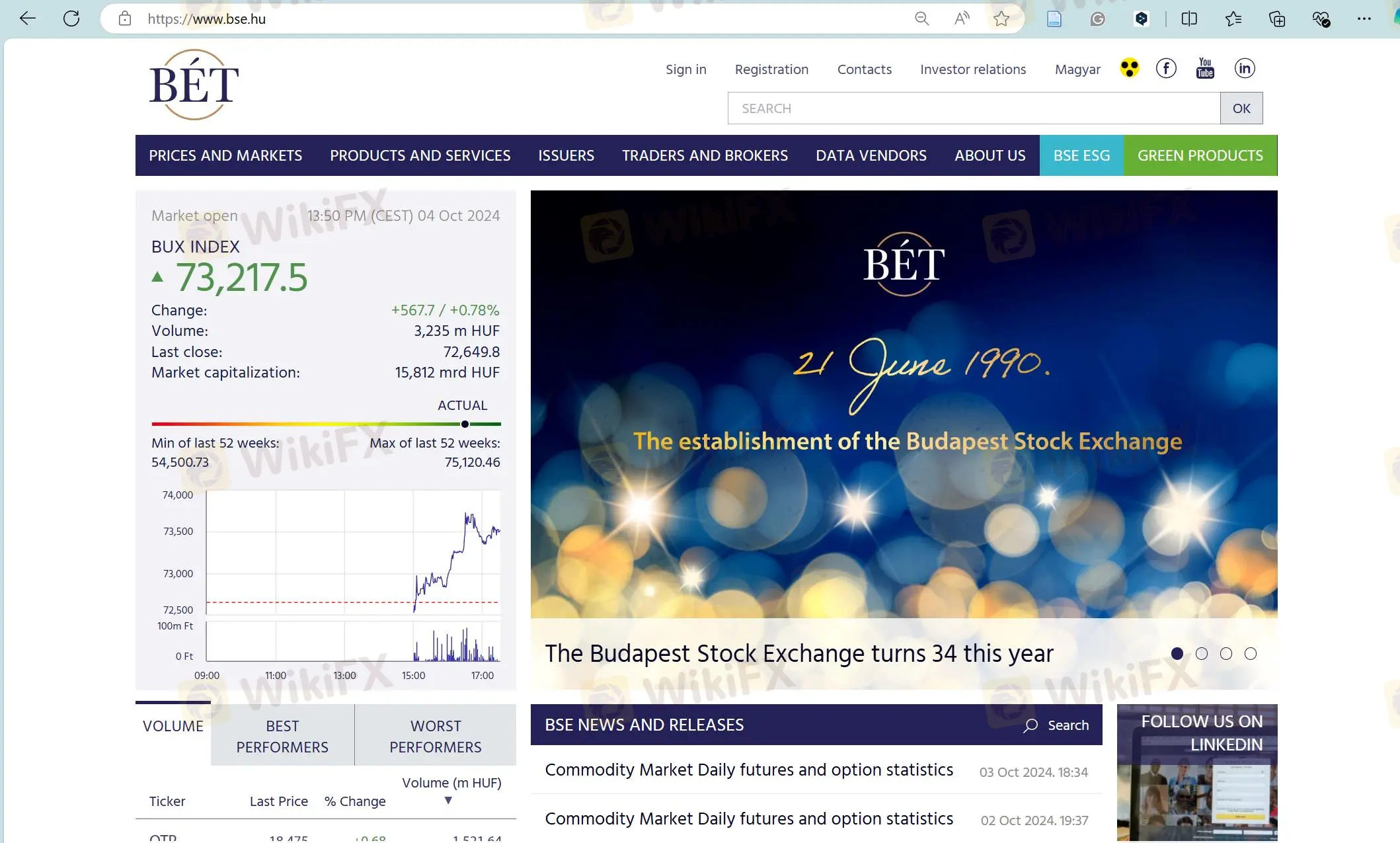

Abstract:The Budapest Stock Exchange (BSE) was established in 2015 as Hungary's primary financial market and offers a variety of trading products across its four main sections. These sections cover various class assets. However, it is not regulated and charges complex fee items.

| BSE Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Hungary |

| Regulation | Unregulated |

| Market Instruments | Equities, shares ETFs, certificates, debt securities, futures, options, spot and derivative commodity and so on |

| Demo Account | ❌ |

| Leverage | / |

| EUR/ USD Spread | / |

| Trading Platforms | / |

| Minimum Deposit | / |

| Customer Support | Email and social media |

The Budapest Stock Exchange (BSE) was established in 2015 as Hungary's primary financial market and offers a variety of trading products across its four main sections. These sections cover various class assets. However, it is not regulated and charges complex fee items.

Pros and Cons

| Pros | Cons |

| Various trading instruments | Unregulated |

| Social media presence | Complex fee schedule |

| No information related to accounts and funding methods |

Is BSE Legit?

The domain budapeststockexchange.com was registered on November 25, 2015. Currently, it is in the status of clientDeleteProhibited, clientRenewProhibited, clientTransferProhibited, and clientUpdateProhibited, which means that certain actions regarding the domain, such as deletion, renewal, transfer, and updates, are restricted. Besides, BSE is under unregulated status.

What Can I Trade on BSE?

On the Budapest Stock Exchange (BSE), you can trade a variety of financial instruments across its four sections, each with its own trading rules. These sections include:

- The Equities Section for securities representing ownership rights (equities, investment fund shares), structured products (ETFs, certificates), and special securities like compensation notes.

- The Debt Securities Section for government debt securities (treasury bills, government bonds), corporate bonds, and mortgage bonds.

- The Derivatives Section which offers futures and options contracts based on single stocks, equity indices, FX, and interest rates.

- The Commodities Section where both spot and derivative commodity instruments, primarily grain products, are traded.

Additionally, the BETa Market, an alternative market launched in 2011, allows trading of large, liquid equities from European companies under the trading conditions of the BSEs Equities Section, with transactions cleared and guaranteed by KELER Ltd. and KELER CCP Ltd.

BSE Fees

BSE charges membership and transaction fees paid by trading members, listing and maintenance and website disclosure fees for issuers. Besides, the fees are also paid according to different product sectors. For example, for trading in the Derivatives Section, both investment firms and individual traders are required to pay a minimum annual fee of HUF 1.5 million per year. Similarly, for the Commodities Section, they must pay a minimum annual fee of HUF 200,000. You can learn more about details through the link and download the fee schedule: https://www.bse.hu/Products-and-Services/Schedule-of-fees.

Customer Service

You can contact BSE via email, Facebook, YouTube and Linkedin.

| Contact Options | Details |

| Phone | ❌ |

| nfo@bse.hu | |

| Contact Form | ❌ |

| Online Chat | ❌ |

| Social Media | Facebook, YouTube and Linkedin |

| Supported Language | English |

| Website Language | English and Hungarian |

The Bottom Line

In conclusion, BSE offers a diverse array of trading options for both institutional and individual investors. With its structured trading sections, BSE accommodates various financial instruments. However, there are concern of uncertain regulation and fees associated with trading.

FAQs

Is BSE safe?

No. It has no regulation.

Is BSE a good for beginners?

No. The products are rather complex and they do not offer demo accounts for novices to get familiar with their trading conditions.

At BSE, are there any regional restrictions for traders?

No.

Latest News

XM Marks 15 Years in Trading with New Product Launches and Events

Warren Buffett’s 5 Golden Rules that Every Trader Must Know

Mastering Trading Psychology: Four Pillars of Mental Strength for Market Participants

Futu Securities Launches Crypto Deposit Service for Investors

EUR/USD at a Critical Juncture: Can the 1.13 Level Hold?

Meta Cracks Down on Scam Networks Targeting Brazil and India

Clicking on a Facebook Ad Cost Him His Life Savings of RM186,800

Are You Trading or Are You Gambling?

Essential Features to Look for in a Trading Platform

Why Digital Assets Are Surging Today?

Rate Calc