Dollar Fuels by Powell Hawkish Statement

摘要:The market's attention has shifted from Middle East tensions to remarks made by Federal Reserve Chair Jerome Powell. Powell's recent speech signals that the U.S. central bank may opt to maintain interest rates at elevated levels for an extended period, given the backdrop of robust economic indicators and surprisingly high inflation readings. This hawkish stance has spurred an uptick in the U.S. long-term treasury yield, which is hovering at its highest level in 2024.

Dollar Fuels by Powell Hawkish Statement

Powell‘s hawkish statement bolsters the dollar’s strength.

Japanese Yen continues to face strong selling pressure as the Japanese authorities have yet to act.

Both UK and EU CPI readings are due today and may fluctuate in both currencies.

Market Summary

The market's attention has shifted from Middle East tensions to remarks made by Federal Reserve Chair Jerome Powell. Powell's recent speech signals that the U.S. central bank may opt to maintain interest rates at elevated levels for an extended period, given the backdrop of robust economic indicators and surprisingly high inflation readings. This hawkish stance has spurred an uptick in the U.S. long-term treasury yield, which is hovering at its highest level in 2024. Similarly, the dollar index is on the verge of surpassing the $106.50 threshold.

Meanwhile, market participants remain vigilant regarding potential retaliation from Israel following Iran's recent attack. This uncertainty has led to commodities prices fluctuating within a narrower range as the situation unfolds. Additionally, both the Pound Sterling and the euro are experiencing significant downward pressure against the resurgent dollar. Traders are eagerly anticipating today's CPI readings from both currencies to assess their respective strengths in light of these developments.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

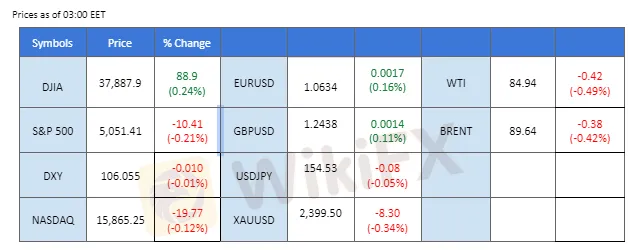

Market Overview

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, a barometer of the greenback's strength against major currencies, rallied to its highest level in five months following remarks from Federal Reserve Chair Jerome Powell suggesting a prolonged period of higher interest rates. Powell's hawkish tone, emphasising the need to combat stubborn inflation, resonated with investors, especially considering recent robust economic data, including stronger-than-expected retail sales figures and a bullish employment report. The upbeat economic indicators have diminished expectations of imminent rate cuts by the Fed, driving further demand for the dollar.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 73, suggesting the index might enter overbought territory.

Resistance level: 106.65, 107.45

Support level: 106.00, 105.40

XAU/USD, H1

Gold prices remained range-bound, struggling to gain momentum amidst conflicting market sentiment and geopolitical uncertainty. While rising tensions in the Middle East bolstered demand for the safe-haven metal, mixed economic signals and a stronger US Dollar limited gold's upside potential. The precious metal found support and resistance levels as investors grappled with divergent market forces. With geopolitical tensions persisting and central bank policies under scrutiny, investors are cautiously monitoring gold's movements for trading cues.

Gold prices are trading flat while currently near the support level. Due to lack of signals from MACD. and RSI remained near 50, it would suggest the overall commodity would continue to consolidate in a range.

Resistance level: 2340.00, 2420.00

Support level: 2385.00, 2360.00

GBP/USD,H4

The GBP/USD pair is trading flat, hovering at its lowest levels for 2024 as it awaits a potential catalyst for a rebound. The U.S. dollar has seen further strengthening following Federal Reserve Chair Jerome Powell's hawkish remarks yesterday, which indicated that the Fed might maintain higher interest rates for a more extended period due to persistent inflation in the U.S. Meanwhile, traders of the Pound Sterling are closely monitoring the upcoming UK CPI data, scheduled for release later today, to assess the potential strength and economic outlook of the Sterling.

GBP/USD is hovering at 2024 lowest levels with strong downside pressure. The RSI flowing closely toward the oversold zone while the MACD hovering at the lower region suggests the bearish momentum is strong with the pair.

Resistance level: 1.2540, 1.2660

Support level: 1.2370, 1.226

EUR/USD,H4

The EUR/USD pair edged lower in the last session as the U.S. dollar continued to strengthen, bolstered by the hawkish statement made by the Federal Reserve Chair. The pair found support near the 1.0614 level and is awaiting today's Euro CPI readings for further direction. However, expectations are that the Euro CPI readings will come in lower than the previous reading, which could potentially exert additional downside pressure on the pair.

EUR/USD continues to trade with its bearish trajectory. The MACD has crossed into the lower region, while the RSI has broken above the oversold zone, suggesting that the bearish momentum is decreasing.

Resistance level: 1.0700, 1.0775

Support level: 1.0560, 1.0500

USD/JPY,H4

The Japanese yen plummeted to multi-decade lows against the US Dollar, reigniting speculation of possible intervention by Japanese monetary authorities. Concerns over the yen's rapid depreciation prompted heightened vigilance among traders, who closely monitored statements from Japanese officials. Finance Minister Shunichi Suzuki's remarks on closely monitoring currency movements and taking necessary measures underscored the government's commitment to addressing excessive exchange-rate volatility. Amidst escalating currency concerns, market participants remain alert for potential interventions that could stabilise the yen's downward spiral.

USD/JPY is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 72, suggesting the pair might enter overbought territory.

Resistance level: 154.75, 156.50

Support level: 153.10, 151.95

NZD/USD, H4

The New Zealand dollar has shown signs of strength, forming a bullish engulfing candlestick pattern during the Asian opening session. Despite the New Zealand CPI reading unveiled earlier coming in at 4%, lower than the previous reading, the Kiwi has found support. This reading, while below the targeted inflation rate, has been met with a hawkish stance from the Reserve Bank of New Zealand. As a result, the Kiwi has experienced a technical rebound from its recent week-long bearish trend.

The NZD/USD pair has formed a bullish engulfing candlestick pattern, suggesting a potential trend reversal signal for the pair. The MACD is about to cross at the bottom while the RSI has broken above from the oversold zone, suggesting the bearish momentum is easing.

Resistance level: 0.5940, 0.6000

Support level: 0.5820, 0.5750

BTC/USD, H4

Bitcoin is presently hovering around its robust liquidity zone, nearing the $62,000 mark, where prices historically find strong support. However, amidst this stability, there are indications of potential selling pressure on BTC as the halving date approaches. The founder of Crypto.com has suggested that this selling pressure might become evident leading up to the event. Nonetheless, post-halving, the price of Bitcoin could see a boost as the supply of BTC becomes scarcer, potentially driving prices higher.

BTC/USD traded within a narrow range in the last session but was supported at its liquidity zone at near the $62000 level, suggesting a potential rebound at such a level. The RSI is on the brink of breaking above the 50 level, while the MACD has crossed at the bottom, suggesting the bearish momentum is easing.

Resistance level: 64820.00, 67080.00

Support level: 61920.00, 59500.00

CL OIL, H4

Crude oil prices experienced a slight decline amid concerns over surging US inventories, despite lingering geopolitical tensions in the Middle East. The American Petroleum Institute's (API) report of a significant increase in US crude oil inventories by 4.09 million barrels, far surpassing market expectations, weighed on oil prices. However, uncertainties surrounding potential retaliatory actions by Israel in response to Iran's recent attack continued to underpin oil market volatility. Investors are closely monitoring developments in the region for any signs of escalation that could disrupt global oil supply chains.

Oil prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 87.50, 90.90

Support level: 84.70, 83.05

天眼交易商

热点资讯

480万令吉 Gigamax 骗局:投资者仍在等待答案

加密货币在英国的隐私时代即将终结?

尼克斯打进东决!当家球星唐斯签约Hola Prime 你真的了解自营交易吗?

天誉国际借口【异常交易不给出金】 报警两次仍旧拖延

富二代自导绑架戏,向母亲诈取290万令吉!

华商72万血本无归背后:起底跨国杀猪盘精密话术与科技陷阱

推动市场波动的力量与如何解读市场

汇率计算