2025-04-11 14:25

업계에서Analisa Market XAUUSD – Update 11 April 2025

Timeframe: H4 & D1

Pair: GOLD (XAU/USD)

Trend: Bullish (Uptrend)

---

1. Arah Market

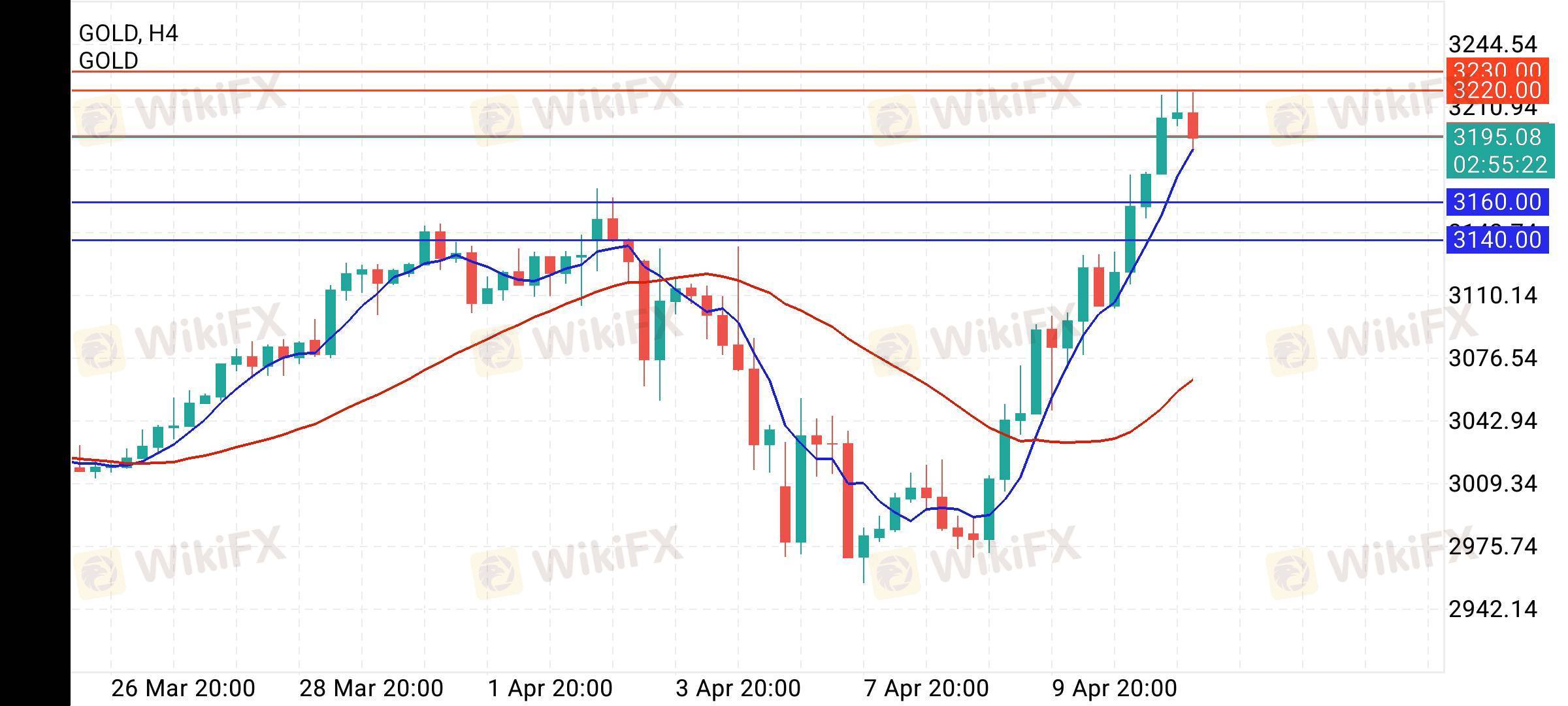

Dari dua timeframe utama (H4 & D1), pergerakan GOLD saat ini masih dominan naik. Di timeframe Daily (D1), harga menembus resistance sebelumnya dan membentuk candle bullish yang kuat—menandakan buyer masih pegang kendali.

Sementara di H4, terlihat ada sedikit rejection di area resistance 3220–3230, namun secara struktur masih higher high & higher low, artinya tren naik tetap valid.

---

2. Support & Resistance

Resistance (Zona Seller):

R1: 3220.00

R2: 3230.00

R3: 3244.54 (all-time high terdekat)

Support (Zona Buyer):

S1: 3195.00 (minor support intraday)

S2: 3160.00 (support kuat sebelumnya)

S3: 3140.00 (area demand utama jika koreksi lebih dalam)

---

3. Strategi Pending Order

Buy Limit (strategi buy on dip):

Buy Limit #1 @ 3160.00

SL: 3135

TP: 3220

Buy Limit #2 @ 3140.00

SL: 3110

TP: 3220

Sell Limit (jika harga gagal breakout dan terbentuk rejection):

Sell Limit @ 3230.00

SL: 3246

TP: 3195

---

4. Kesimpulan

Market masih dominan bullish, namun waspadai potensi koreksi setelah lonjakan tajam. Pending order di area support-resistance bisa jadi strategi aman, terutama untuk scalping intraday atau swing harian. Disarankan tetap pantau candlestick pattern di H4 sebagai konfirmasi entry.

#XAUUSD

#WikiFXMarketForecas

#TradingIA

#TradingPlan

좋아요 0

joyboys77

거래자

인기있는 콘텐츠

시장 분석

투자주체별매매 동향

시장 분석

유로존 경제 쇠퇴 위기 직면

시장 분석

국제 유가는 어디로

시장 분석

미국증시 레버리지(Leverage)·인버스(Inverse)형의 ETF, 최근 사상 최대 신

시장 분석

투기장 된 원유 ETL...첫 투자위험 발령

시장 분석

RBNZ 양적완화 확대

포럼 카테고리

플랫폼

전시회

대리상

신병 모집

EA

업계에서

시장

인덱스

Analisa Market XAUUSD – Update 11 April 2025

싱가포르 | 2025-04-11 14:25

싱가포르 | 2025-04-11 14:25Timeframe: H4 & D1

Pair: GOLD (XAU/USD)

Trend: Bullish (Uptrend)

---

1. Arah Market

Dari dua timeframe utama (H4 & D1), pergerakan GOLD saat ini masih dominan naik. Di timeframe Daily (D1), harga menembus resistance sebelumnya dan membentuk candle bullish yang kuat—menandakan buyer masih pegang kendali.

Sementara di H4, terlihat ada sedikit rejection di area resistance 3220–3230, namun secara struktur masih higher high & higher low, artinya tren naik tetap valid.

---

2. Support & Resistance

Resistance (Zona Seller):

R1: 3220.00

R2: 3230.00

R3: 3244.54 (all-time high terdekat)

Support (Zona Buyer):

S1: 3195.00 (minor support intraday)

S2: 3160.00 (support kuat sebelumnya)

S3: 3140.00 (area demand utama jika koreksi lebih dalam)

---

3. Strategi Pending Order

Buy Limit (strategi buy on dip):

Buy Limit #1 @ 3160.00

SL: 3135

TP: 3220

Buy Limit #2 @ 3140.00

SL: 3110

TP: 3220

Sell Limit (jika harga gagal breakout dan terbentuk rejection):

Sell Limit @ 3230.00

SL: 3246

TP: 3195

---

4. Kesimpulan

Market masih dominan bullish, namun waspadai potensi koreksi setelah lonjakan tajam. Pending order di area support-resistance bisa jadi strategi aman, terutama untuk scalping intraday atau swing harian. Disarankan tetap pantau candlestick pattern di H4 sebagai konfirmasi entry.

#XAUUSD

#WikiFXMarketForecas

#TradingIA

#TradingPlan

좋아요 0

나 도 댓 글 달 래.

제출

0코멘트

댓글이 아직 없습니다. 첫 번째를 만드십시오.

제출

댓글이 아직 없습니다. 첫 번째를 만드십시오.