Dollar Index Rebounds from Lows as Gold Faces Near-Term Selling Pressure

Abstract:“Dollar Stabilizes, Non-U.S. Currencies Under Pressure”The U.S. Dollar Index experienced significant volatility last week. Initially shaken by President Trumps public criticism of Federal Reserve Chai

“Dollar Stabilizes, Non-U.S. Currencies Under Pressure”

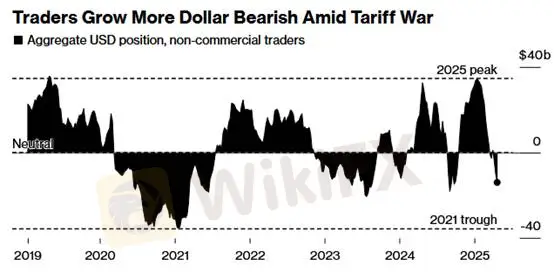

The U.S. Dollar Index experienced significant volatility last week. Initially shaken by President Trump's public criticism of Federal Reserve Chairman Jerome Powell, confidence in U.S. assets wavered, sending the Dollar Index to its lowest level since March 2022. However, as Trump softened his stance and expressed optimism about U.S.-China trade negotiations, the dollar gradually recovered, closing at 99.61—its first weekly gain in five weeks. The dollar‘s rebound weighed on non-U.S. currencies, halting the euro’s four-week rally and ending the yens three-week advance. The British pound and the Australian dollar, however, remained resilient, each posting a third consecutive weekly gain. Analysts emphasized that the dollar's future trajectory will remain closely tied to developments in trade negotiations and Federal Reserve policy expectations.

“Dollar Vulnerabilities Persist Amid Geopolitical Easing”

Despite a rebound in U.S. Treasury markets, the Dollar Index still posted a near three-year low on April 21. Tony Pasquariello, Head of Hedge Fund Coverage at Goldman Sachs, warned that the dollar could remain overvalued by as much as 20% if economic conditions continue to deteriorate. On the geopolitical front, U.S. envoy Whitcoff met with Russian President Putin last week, reporting narrowing differences between the two sides. Additionally, the U.S. and Iran agreed to resume nuclear talks, with Iran adopting a cautious approach while President Trump expressed strong confidence in reaching an agreement.

[Image source: Bloomberg]

“Gold Faces Short-Term Pressure, Fundamentals Remain Intact”

Amid easing trade tensions, spot gold prices fell more than 5% from last week's highs. According to CFTC data, hedge funds have cut their net long positions in gold futures and options to the lowest level in over a year. Despite near-term weakness, Goldman Sachs noted that physical gold ETF holdings remain well below their 2020 peak, suggesting ample room for long-term upside. Goldman emphasized that periodic liquidations are a normal market behavior and that sharp pullbacks may present opportunities for re-entry.

“Super Data Week Ahead: Focus on Employment Metrics”

While last week's “hard data” such as March CPI and nonfarm payrolls remained robust, “soft data” indicators—including manufacturing and services PMIs and consumer confidence—continued to weaken, signaling a more cautious outlook. This week, all eyes will be on key U.S. employment data, including Tuesday‘s JOLTS job openings, Wednesday’s ADP employment report, Thursday‘s initial jobless claims, and Friday’s pivotal nonfarm payrolls. These releases will offer crucial insights into the resilience of the U.S. economy and the future trajectory of Fed policy.

“Gold Options Surge as Market Divides Deepen”

As gold prices touched new highs, options activity on the SPDR Gold Shares ETF (GLD) exploded, with volume exceeding 1.3 million contracts—a record high. While put protection costs remain low, implied volatility has surged, indicating heightened uncertainty about gold's future path. Analysts at Bloomberg Intelligence noted that both gold and bitcoin have recently exhibited a rare phenomenon of simultaneous spot price and volatility increases, mirroring the dynamics observed among the “Magnificent Seven” stocks in recent years.

Conclusion:

While the dollar has staged a short-term rebound, most analysts believe the broader depreciation trend remains intact. Unless the Fed officially cuts rates, the U.S. and China reach a trade agreement, and American consumer spending shows sustained strength, the dollar is likely to face continued outflow pressures. A prolonged weakening of the dollar would further support gold prices, underpinned by strong safe-haven demand and solid long-term fundamentals.

[Gold Price Technical Outlook]

From a technical perspective, gold has sharply fallen below $3,300/oz and is now poised to test support at $3,263/oz. A break below this level could open the door toward $3,200/oz. In the near term, golds movement will continue to be influenced by a combination of fundamental and technical factors. Investors should closely monitor support zones to identify potential strategic entry points.

Resistance Levels: $3,363 / $4,000 per ounce

Support Levels: $3,263 per ounce

Risk Disclaimer:

The views, analyses, research, prices, or other information presented herein are intended solely for general market commentary and do not constitute investment advice from this platform. Readers should exercise their own judgment and trade at their own risk.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc