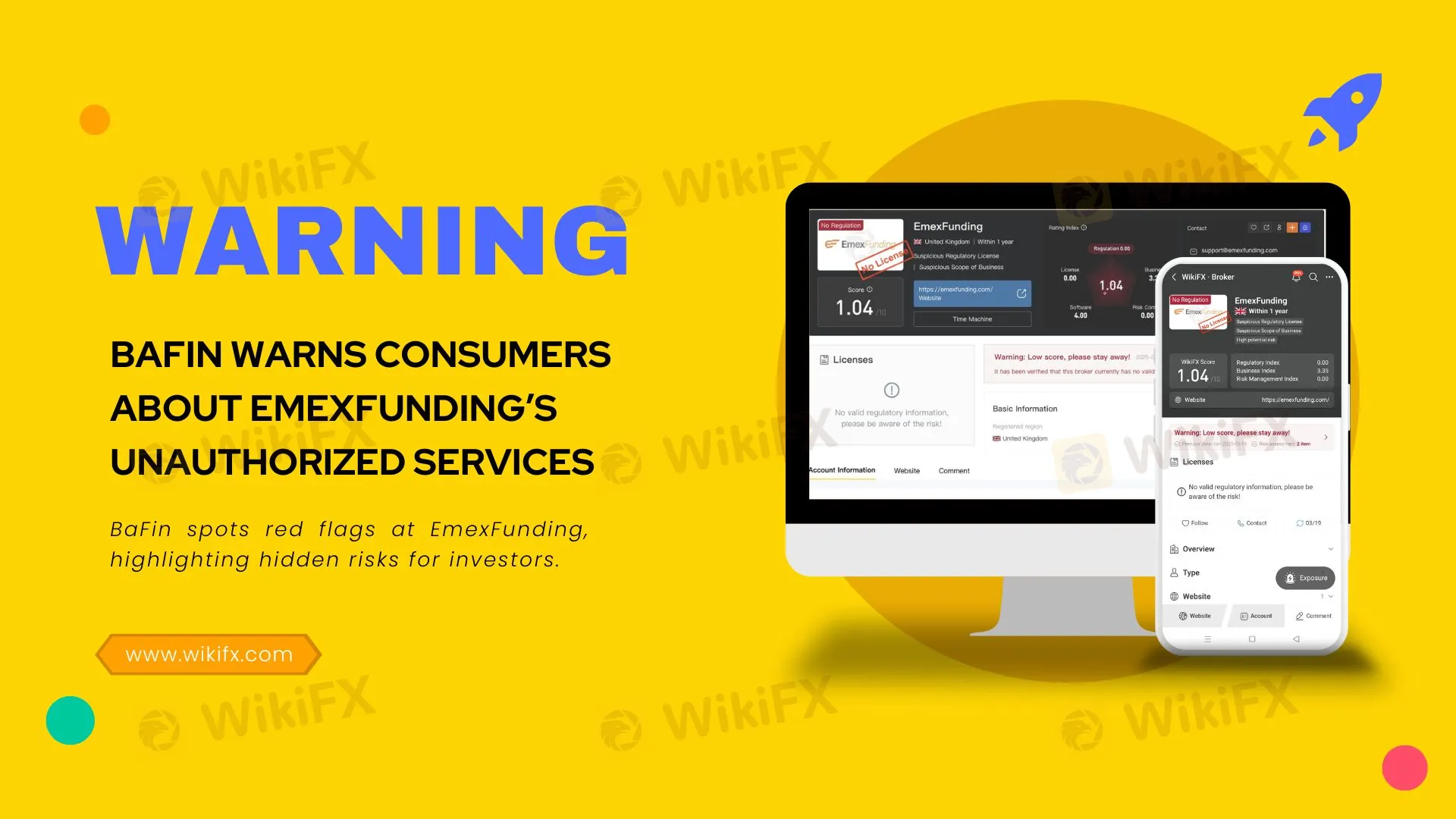

BaFin Warns Consumers About EmexFunding’s Unauthorized Services

Abstract:BaFin spots red flags at EmexFunding, highlighting hidden risks for investors.

The German Federal Financial Supervisory Authority (BaFin) has issued a critical consumer alert about the activities of EmexFunding, an unauthorized financial services provider operating through the website emexfunding.com.

BaFin's investigation revealed that EmexFunding, whose operators remain unidentified, is offering financial, investment, and cryptocurrency services without the necessary regulatory permissions. The company falsely operates under the business name “EmexFunding GmbH,” claiming its registered office is in Corby, United Kingdom. However, official records verify that such a company does not exist, indicating a clear attempt to mislead potential customers.

A significant concern raised by BaFin involves EmexFunding's promotion of a so-called “Handelskreditvertrag” (trading credit agreement). Through this misleading document, the firm encourages consumers to secure loans specifically for trading financial products and cryptoassets on its platform. Such tactics pose considerable risks, potentially leading consumers into substantial financial losses and debt.

Under German legislation—including the German Banking Act (Kreditwesengesetz - KWG) and the German Cryptomarkets Supervision Act (Kryptomärkteaufsichtsgesetz)—entities must obtain explicit authorization from BaFin to offer financial or investment-related services. EmexFunding lacks such authorization, rendering its operations unlawful and exposing investors to significant risks.

Additionally, a search conducted through the regulatory verification platform WikiFX corroborates BaFin's concerns. WikiFX reports EmexFunding as having no valid regulatory licenses and assigns it a notably low reliability rating, further emphasizing the dangers of engaging with this unauthorized provider.

BaFin strongly advises investors to perform thorough due diligence by consulting official regulatory databases and trusted platforms such as WikiFX before committing funds to any financial service providers. Engaging with unauthorized companies such as EmexFunding can result in limited legal protections and the inability to recover invested funds.

Read more

Pi Network: Scam Allegations Spark Heated Debate

A whistleblower report has surfaced, casting doubt on the legitimacy of Pi Network, alleging psychological manipulation, opaque operations, and potential financial exploitation. What is your take on this?

PayPal Account Holders Warned of Surge in Scams

Experts warn of increased PayPal scams, including fake emails and gift cards. Stay alert to protect your account from cybercriminals.

BaFin Flags 5 Unauthorised Financial Platforms for Consumer Risk

Germany’s financial watchdog BaFin has raised alarms over five unlicensed platforms—FxMiracles Inc., Aktien Network, Euro Pro Markets, ZukunftsFinanz Stiftung, and ConsorsGlobal. These entities were found offering investment and crypto-related services to German users without proper regulatory approval, often using misleading websites, fake affiliations, or anonymous messaging channels.

UN Warns Asian Scam Operations are Spreading Worldwide

UN report reveals Asian scam operations expanding globally, targeting Africa, Latin America with cyberfraud, generating billions amid crackdowns.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

StoneX Subsidiary, Gain Global Markets Bermuda, Penalized for Trading Misconduct

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Rate Calc