Why a Broker’s Customer Service Matters More Than You Think

Abstract:Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Many traders focus on regulation when choosing a broker. While this is important, it is not enough. A broker's customer service can be just as vital. If you cannot reach support when you need help, it could lead to problems.

Responsive customer service is not just a bonus; it is a sign of reliability. A broker that answers questions quickly shows they care about their clients. They help resolve issues like login errors, deposit delays, or sudden changes in trading conditions. On the other hand, brokers that fail to respond on time can leave traders stuck. This affects not just their trading performance but also their peace of mind.

Poor customer service can also violate traders rights. When issues are ignored, traders lose time and money. For example, if a trade gets stuck due to a technical glitch, every second counts. If the broker does not act fast, the trader may face losses. Over time, this could ruin their trading account.

Many traders underestimate this risk. They think regulation is the only thing that matters. But even regulated brokers can have slow or unhelpful support. This is why traders must do more research before choosing a broker.

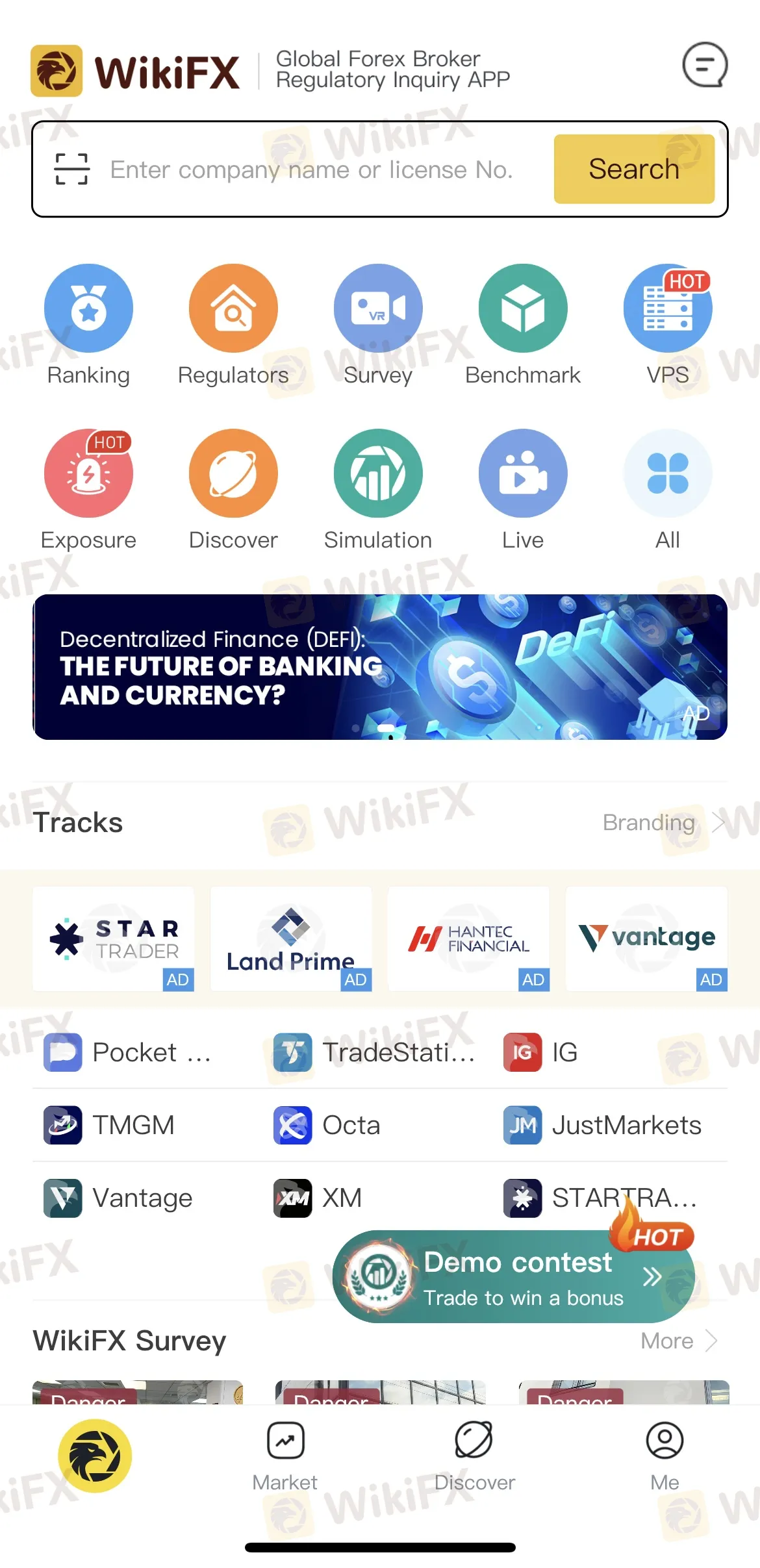

One of the easiest ways to check a brokers reliability is by using the free WikiFX mobile app. This app provides detailed reviews and ratings of brokers. It also shows whether a broker is regulated. More importantly, traders can see feedback from other users about customer service. This information helps traders make a better decision, at no cost.

Choosing a broker is a big step. Traders should not rush this process. A reliable broker with good support can make a huge difference. They can protect traders from unnecessary risks and help them perform better.

In conclusion, dont ignore customer service when picking a broker. A lack of support can lead to problems and even losses. Take the time to research brokers carefully. Use tools like WikiFX to check reviews and ratings. This simple step can save you a lot of trouble.

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc