Gold Price Trims Gains, Can This Key Support Hold?

Abstract:Gold rallied above the $2,000 and $2,050 resistance. It even spiked toward $2,150 before the bears appeared. A high was formed near $2,145 and the price corrected lower.

Key Highlights

• Gold prices rallied toward $2,150 before a downside correction.

• It broke a key bullish trend line with support near $2,035 on the 4-hour chart.

• Crude oil prices extended losses and traded below the $72.00 support.

• EUR/USD failed to stay above the key 1.0820 support.

Gold Price Technical Analysis

Gold rallied above the $2,000 and $2,050 resistance. It even spiked toward $2,150 before the bears appeared. A high was formed near $2,145 and the price corrected lower.

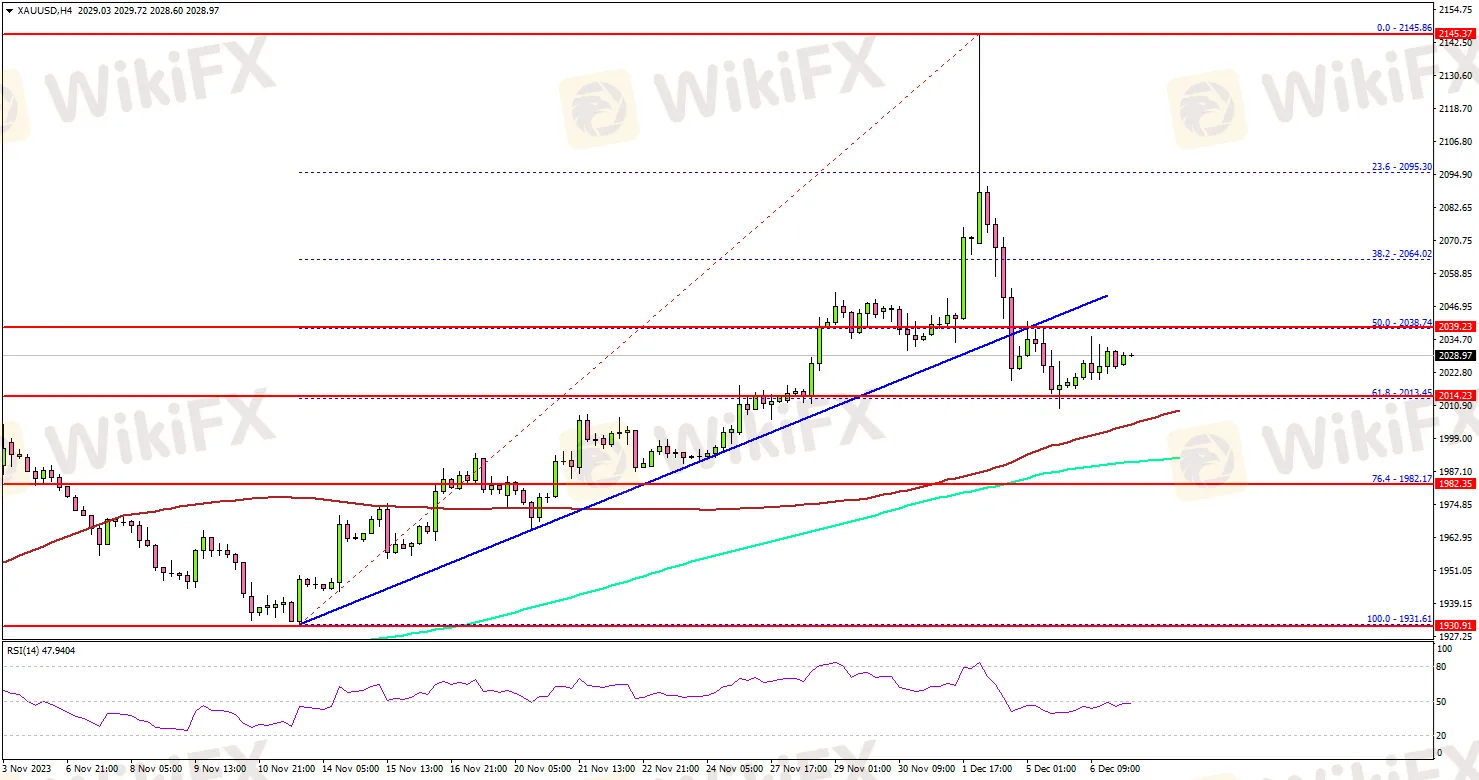

The 4-hour chart of XAU/USD indicates that the price declined heavily below the $2,120 and $2,100 levels. It broke a key bullish trend line with support near $2,035.

The bears were able to push the price below the 50% Fib retracement level of the upward move from the $1,931 swing low to the $2,145 high. The price is now testing the $2,010 support and trading above the 100 Simple Moving Average (red, 4 hours).

The 61.8% Fib retracement level of the upward move from the $1,931 swing low to the $2,145 high is also acting as a support. The next major support could be $1,985 or the 200 Simple Moving Average (green, 4 hours). Any more losses might call for a move toward the $1,960 level.

On the upside, the price is facing resistance near $2,040. An upside break above the $2,040 level could send the price soaring toward the $2,080 resistance. The next major resistance is near the $2,095 level, above which Gold could test $2,120.

Looking at crude oil, the bears remained in action, and they were able to push the price below the $72.00 support.

Read more

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

Webull and SK Growth complete their business combination, with Webull now trading under the ticker “BULL.” App hits 50 million downloads worldwide.

PrimeXBT Expands with Stock CFDs for Major Global Companies

PrimeXBT introduces stock CFDs, allowing trading of major US stocks like Amazon, Tesla, and MicroStrategy with crypto or fiat margin options.

TRADE.com UK Sold to NAGA Group Amid 2024 Revenue Drop

TRADE.com UK sold to NAGA Group for £1.24M after a 65% revenue drop and £346K loss in 2024, marking NAGA's UK return.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc