FX Analysis – Falling Yields Pressure USD, the Key Levels to Watch

Abstract:Recent US figures have seen a rout in treasury yields with the flagship 10-year now yielding 4.435% after starting November at 16-year highs north of 5% and in a seemingly unstoppable uptrend. A cooler CPI and PPI showing inflation is decelerating at a faster pace than the market anticipated, along with weaker employment and industrial production figures have traders re-adjusting for a less hawkish Fed and bringing their timing forward for the pricing in of rate cuts.

Recent US figures have seen a rout in treasury yields with the flagship 10-year now yielding 4.435% after starting November at 16-year highs north of 5% and in a seemingly unstoppable uptrend. A cooler CPI and PPI showing inflation is decelerating at a faster pace than the market anticipated, along with weaker employment and industrial production figures have traders re-adjusting for a less hawkish Fed and bringing their timing forward for the pricing in of rate cuts.

Why this is important to serious FX traders is because rates and FX have a high correlation, even more in the post pandemic period of cuts, hikes and peak rates and maybe cuts again, big FX traders look for yield and that can be used as important information for smaller players to position themselves to take advantage of that. An example of this relationship can be seen on the weekly chart of the US Dollar index below.

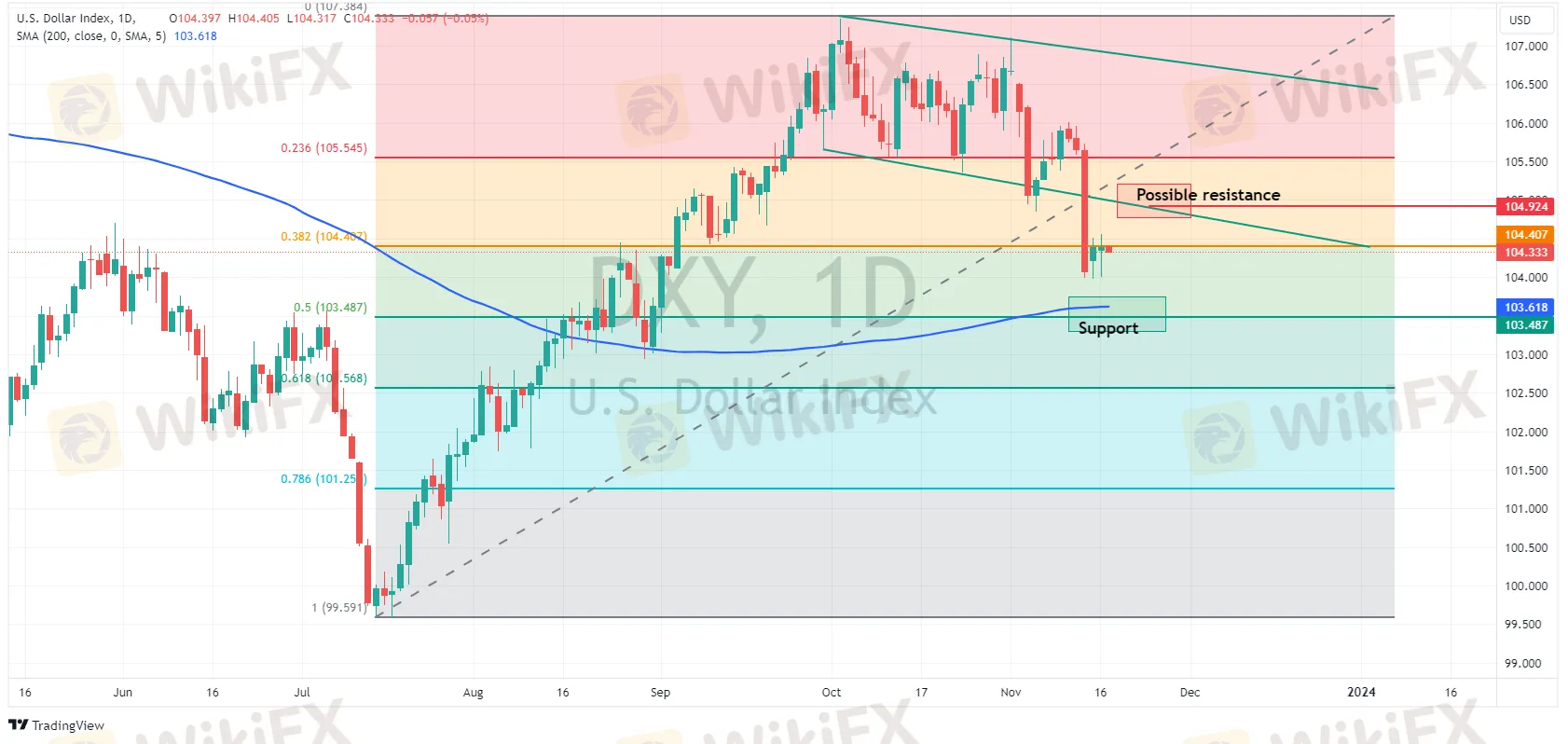

The US dollar Index has fallen 2.5% so far in November, a move first started with the big miss in NFP which saw support at the 23.6 Fib level broken, then accelerating this week on a Cooler CPI which saw it take out the 38.2 Fib level support which the price is currently hovering around at 104.41.

This along with the situation in yields will be the level to watch in the short term, if yield and dollar bulls take charge a break and support hold could see USDollar first test the lower trend line resistance, with the next stop from a technical point of view being the 23.6 Fib level resistance at 105.545. To the downside if yields continue their fall the next technical support will be the 50% fib level, paired with the 200-day moving average.

Next week there are a few important data points with FOMC minutes, consumer sentiment and manufacturing figures all scheduled. For FX traders they will be worth watching for any further clues as to yields and where traders think they will go as they work to front run the Fed.

Read more

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

Shocking Move: Yen Breaks Past 140 Barrier!

The yen's breakout above the 140 mark has caught global attention, and the reasons behind it are more than technical.

FINRA fines SpeedRoute for alleged rule violations

The Financial Industry Regulatory Authority (FINRA) has imposed a $300,000 fine on SpeedRoute LLC for a series of supervisory, risk management, and anti-money laundering (AML) program deficiencies spanning from 2017 to the present. Of this amount, $75,000 is payable to FINRA, with the remainder offset by SpeedRoute’s limited ability to pay. In addition to the monetary penalty, SpeedRoute has been censured and ordered to overhaul its compliance framework, including enhancing its written supervisory procedures (WSPs) for market access controls and strengthening its AML program.

Nigeria's Oil Crisis: How Are Stakeholders Responding?

Despite being rich in oil, Nigeria struggles with refining shortages. What’s behind this paradox, and how are different actors reacting?

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

StoneX Subsidiary, Gain Global Markets Bermuda, Penalized for Trading Misconduct

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Rate Calc