Technical Analysis & Forecast for November 2023

Abstract:EURUSD has completed a correction to 1.0633. A new fifth decline wave to 1.0125 could start now. Practically, the first structure of this wave is forming, targeting 1.0418. After the price reaches this level, it could correct to 1.0550 (a test from below) and then decline to 1.0277, from where the trend might continue to 1.0125.

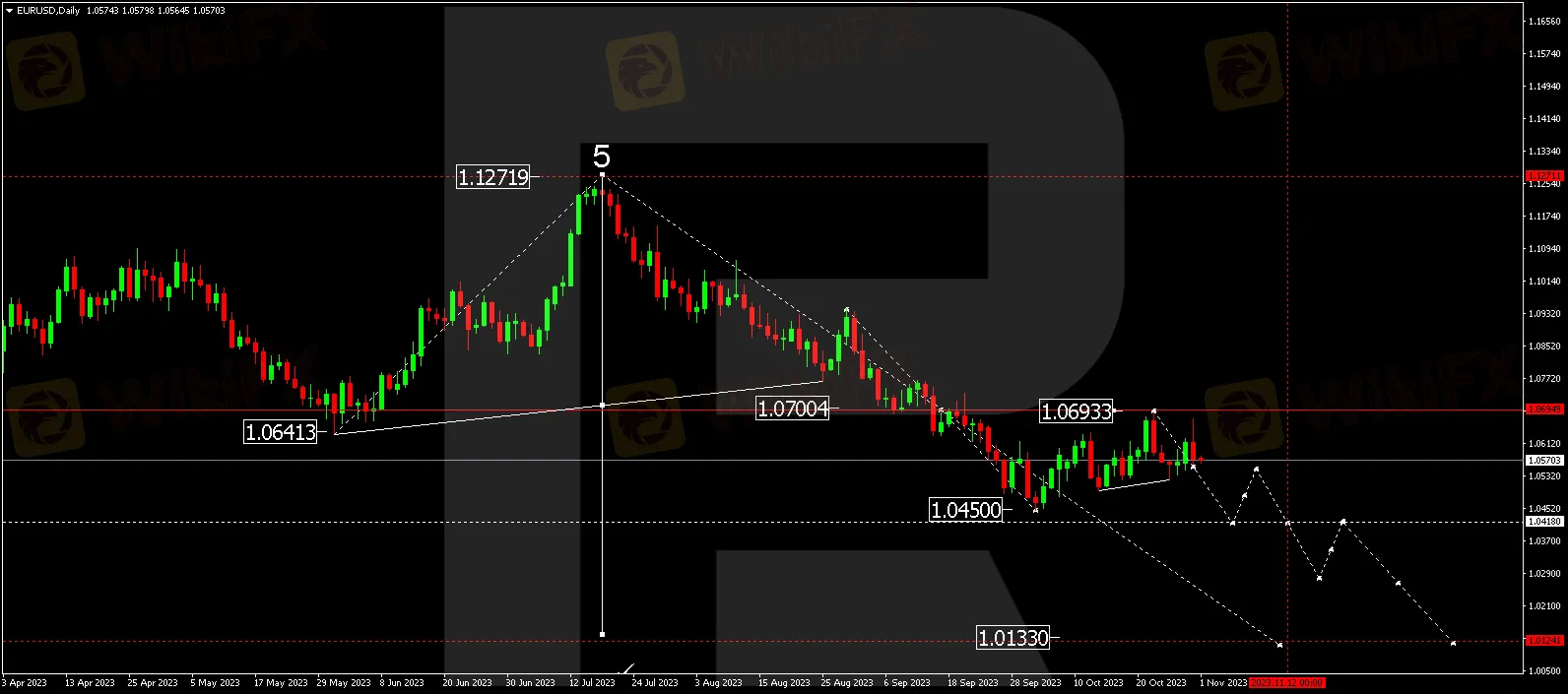

EURUSD, “Euro vs US Dollar”

EURUSD has completed a correction to 1.0633. A new fifth decline wave to 1.0125 could start now. Practically, the first structure of this wave is forming, targeting 1.0418. After the price reaches this level, it could correct to 1.0550 (a test from below) and then decline to 1.0277, from where the trend might continue to 1.0125.

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has corrected to 1.2330. By now, the market has completed a structure of decline to 1.2121. A consolidation range is now forming around this level. A downward breakout will open the potential for a decline to 1.1925. Once the price hits this level, a link of correction to 1.2330 (a test from below) could develop, followed by a decline to 1.1550.

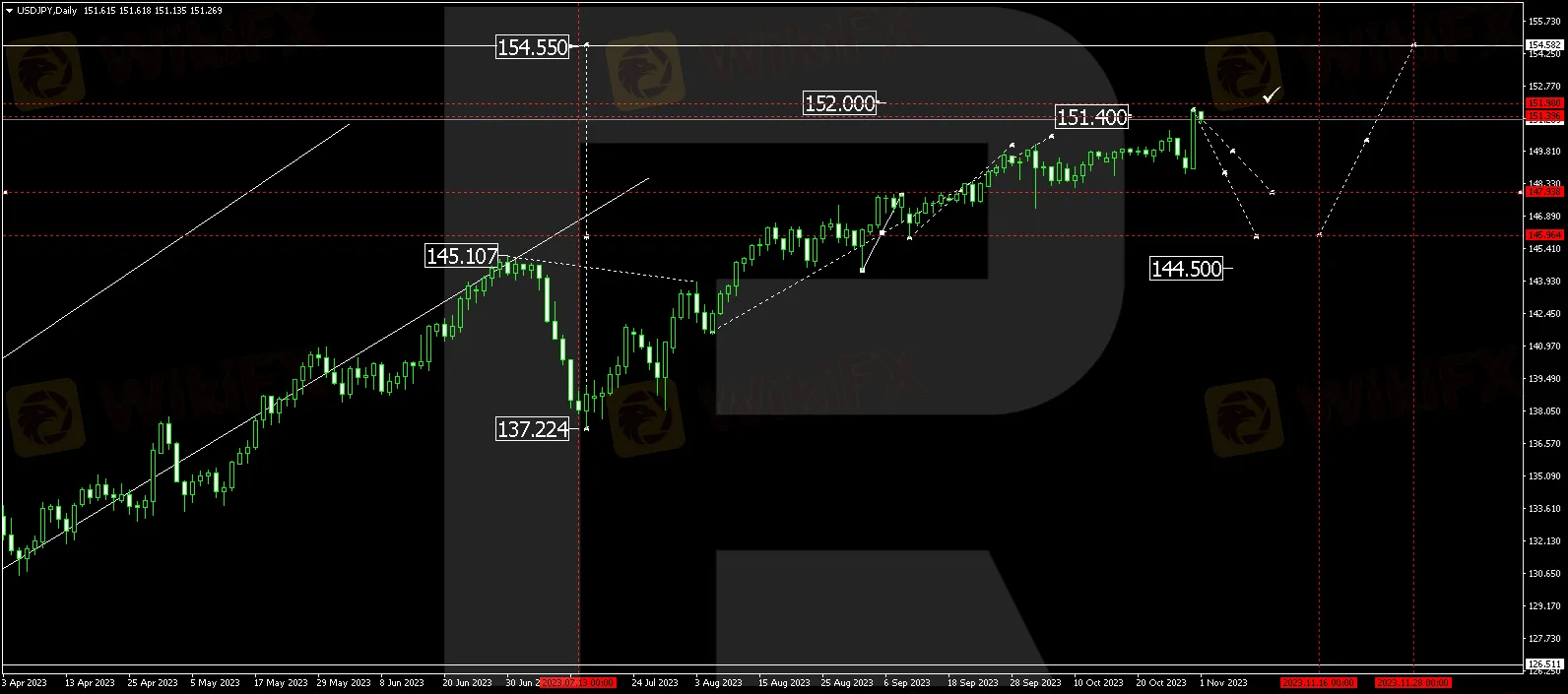

USDJPY, “US Dollar vs Japanese Yen”

USDJPY has completed a growth wave, reaching 151.40. A consolidation range is expected to form below this level. Breaking it downwards, the price might correct to 147.90 (at a minimum). After the correction is over, a rise to 154.55 could follow. This is the primary target.

Read more

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

Prop Trading Firms vs. CFD Brokers: Who’s Winning the Retail Trading Race?

In recent years, a new breed of retailer-focused trading firms has emerged: proprietary (prop) trading outfits that recruit individual traders to trade the firm’s capital under structured rules. Boasting low entry costs, clear risk parameters, and profit-sharing incentives, these prop firms are rapidly winning over retail traders, many of whom previously traded Contracts for Difference (CFDs) with established online brokers. As prop trading revenues accelerate, a key question arises: Are CFD brokers losing business to prop firms?

Another ‘Tan Sri’ Targeted, RM347 Million in Assets Seized in MBI Scam

Malaysia’s police are stepping up their investigation into the MBI investment scam, a multi-billion ringgit fraud that has dragged on for nearly a decade. The Royal Malaysian Police (PDRM) is now planning to arrest another prominent figure with the title ‘Tan Sri’, following recent arrests and major asset seizures.

Tradu Joins TradingView for Seamless CFD and Forex Trading

Tradu, a global trading platform, integrates with TradingView for seamless CFD and forex trading, offering transparency, tight spreads, and fast execution.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc