FX Analysis – Yield spike on hot retail sales fails to lift USD, AUD outperforms, JPY , NZD.

Abstract:On Tuesday, despite a significant rise in treasury yields driven by better-than-expected US retail sales figures (which increased by 0.7% month-on-month compared to the expected 0.3%), the US dollar (USD) remained within a narrow trading range.

On Tuesday, despite a significant rise in treasury yields driven by better-than-expected US retail sales figures (which increased by 0.7% month-on-month compared to the expected 0.3%), the US dollar (USD) remained within a narrow trading range. The Dollar Index (DXY) experienced sharp fluctuations, reaching a high of 106.52 initially in response to the retail sales data, but quickly retracing gains and hitting a low of 106.02. Federal Reserve (Fed) member Barkin also commented that the Federal Open Market Committee (FOMC) would have a thorough discussion concerning the possibility of a Fed rate hike at their November meeting. In the coming days, market participants should expect to hear from more Fed speakers, including Chair Powell on Thursday. Additionally, any update on geopolitical events will be closely monitored by USD traders.

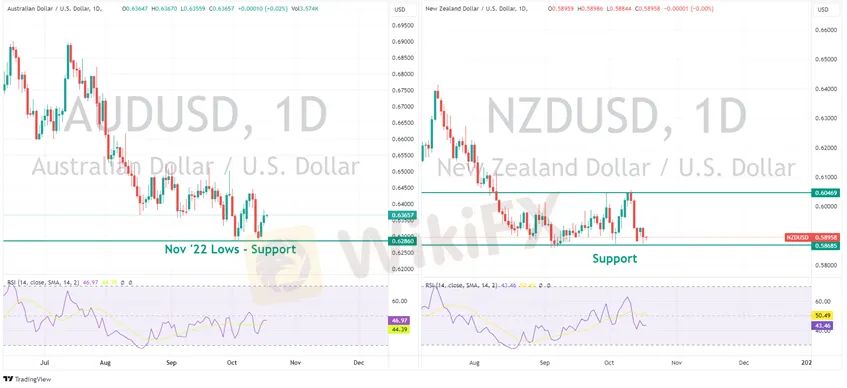

AUD and NZD were divergent on Tuesday, with the Aussie the G10 outperformer and the Kiwi the laggard. AUDUSD continuing its bounce off the major support at 0.6286 to rally to a high of 0.6380, helped along by what was seen as hawkish RBA minutes released during the session. NZDUSD on the other hand struggled after a not as hot as expected NZ CPI, NZDUSD dipping to test the October lows at 0.5871 before finding some support..

AUDNZD surged higher, retaking the key 1.07 level and within a whisker of also breaching 1.08

JPY faltered against the USD despite seeing strength early in the session after a Bloomberg report that the BoJ was considering revising their inflation forecasts higher. The surge in the Yen swiftly faded with yield differentials pushing USDJPY higher, to hover just below the 150 “intervention zone”

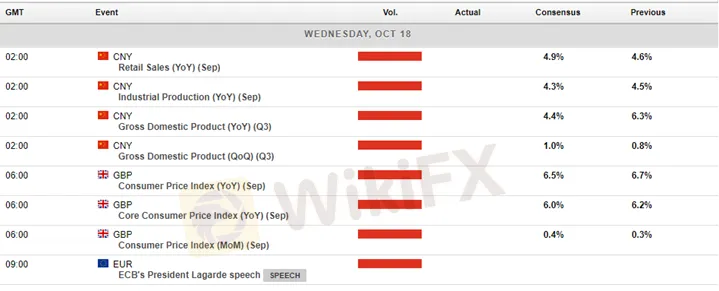

Check Todays calendar below:

Read more

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

Shocking Move: Yen Breaks Past 140 Barrier!

The yen's breakout above the 140 mark has caught global attention, and the reasons behind it are more than technical.

FINRA fines SpeedRoute for alleged rule violations

The Financial Industry Regulatory Authority (FINRA) has imposed a $300,000 fine on SpeedRoute LLC for a series of supervisory, risk management, and anti-money laundering (AML) program deficiencies spanning from 2017 to the present. Of this amount, $75,000 is payable to FINRA, with the remainder offset by SpeedRoute’s limited ability to pay. In addition to the monetary penalty, SpeedRoute has been censured and ordered to overhaul its compliance framework, including enhancing its written supervisory procedures (WSPs) for market access controls and strengthening its AML program.

Nigeria's Oil Crisis: How Are Stakeholders Responding?

Despite being rich in oil, Nigeria struggles with refining shortages. What’s behind this paradox, and how are different actors reacting?

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc