The BlackRock and crypto connection is much deeper than what people know of

Abstract:After filing for a spot Bitcoin ETF, BlackRock triggered a substantial debate in the cryptocurrency market this year. The final result is uncertain and at the mercy of the Securities and Exchange Commission (SEC). Regardless, the company continues to remain invested in various aspects of the cryptocurrency industry, unbeknownst to many.

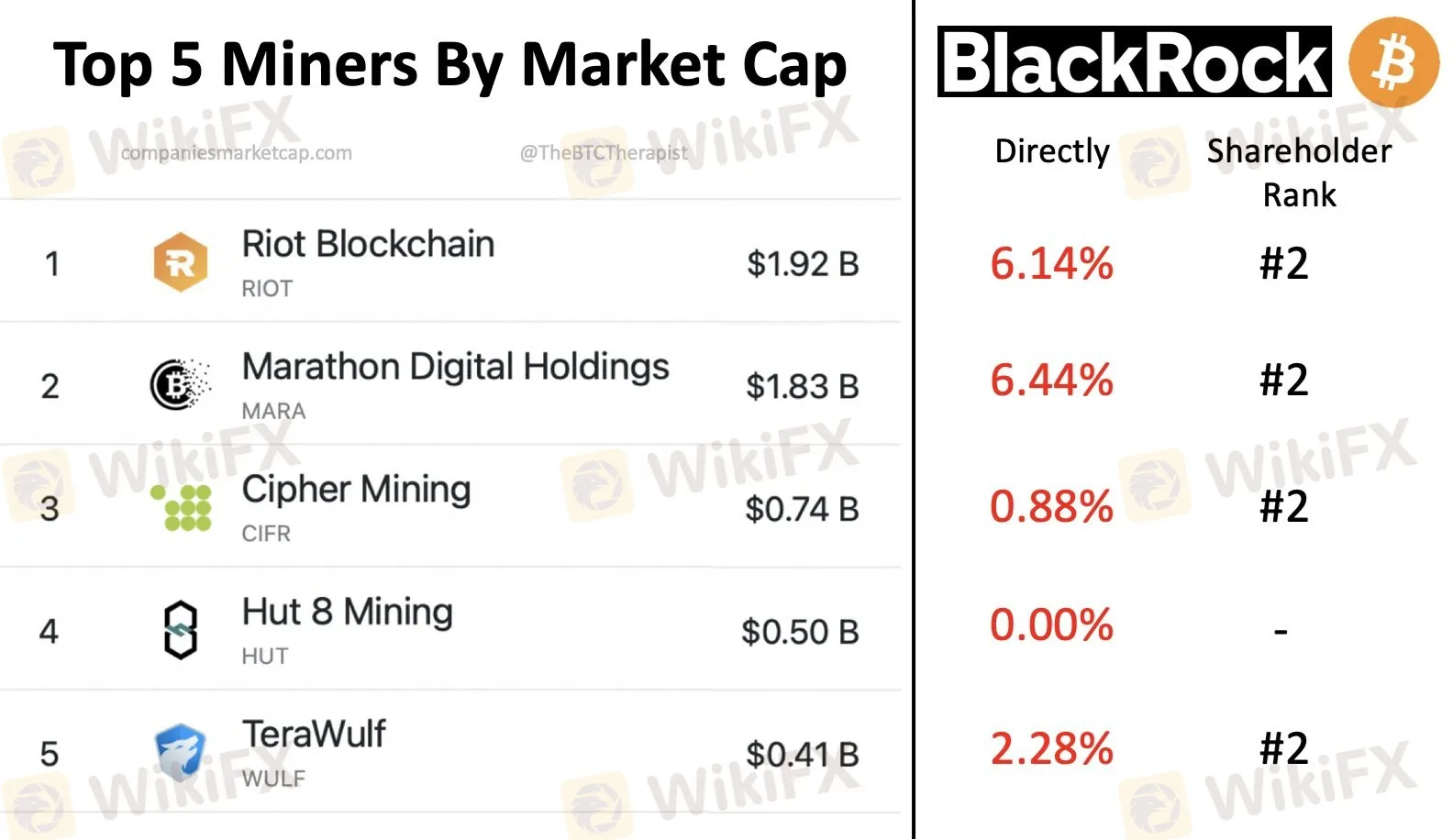

• BlackRock reportedly is one of the biggest shareholders in four out of the top five mining companies.

• Bitcoin mining is considered to be one of the most lucrative investments as long as the price remains steadily high.

• With the chances of BlackRock‘s spot Bitcoin ETF receiving approval soon, the asset manager fund’s standing in the crypto market could explode.

After filing for a spot Bitcoin ETF, BlackRock triggered a substantial debate in the cryptocurrency market this year. The final result is uncertain and at the mercy of the Securities and Exchange Commission (SEC). Regardless, the company continues to remain invested in various aspects of the cryptocurrency industry, unbeknownst to many.

BlackRock Bitcoin connection

BlackRock has been reported to be involved in the crypto market beyond the Exchange Traded Fund (ETF) application. According to the Bitcoin miner market capitalization index, BlackRock has its reach in four out of the five biggest BTC mining companies.

Among the top 13F filings, BlackRock is the second-largest shareholder, holding 6.14% of the shares in Riot Blockchain, 6.44% in Marathon Digital Holdings, 0.88% in Cipher Mining and 2.28% in TeraWulf.

BlackRock shareholding in top Bitcoin miners

Bitcoin mining is one of the most profitable investments, provided BTC is not suffering through a bear market. As long as the operation costs are lower than the rewards obtained from mining, miners can keep making good bucks no matter what the condition of the market is. Thus, BlackRock is certainly in the right to ensure they have a footing in a certainly profitable crypto investment.

This is a smart move on BlackRock‘s end since the approval of the spot Bitcoin ETF application is very uncertain. Earlier this month, the SEC already delayed the decision on ARK Invest’s spot Bitcoin ETF application and is most certainly going to maintain a similar stance over the next couple of days when it comes to making a decision on other similar applications.

If the regulatory body approves the BlackRock application, the company's presence in the cryptocurrency market would significantly increase. This would likely cause a surge in Bitcoin (BTC). Increased demand results in elevated transaction volumes, providing miners with more opportunities to generate profits. Consequently, this would offer advantages to the asset manager.

Nevertheless, if the application is rejected, BlackRock would still manage to make a gain from cryptocurrencies regardless, thanks to its investment in the mining sector.

Read more

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

Prop Trading Firms vs. CFD Brokers: Who’s Winning the Retail Trading Race?

In recent years, a new breed of retailer-focused trading firms has emerged: proprietary (prop) trading outfits that recruit individual traders to trade the firm’s capital under structured rules. Boasting low entry costs, clear risk parameters, and profit-sharing incentives, these prop firms are rapidly winning over retail traders, many of whom previously traded Contracts for Difference (CFDs) with established online brokers. As prop trading revenues accelerate, a key question arises: Are CFD brokers losing business to prop firms?

Another ‘Tan Sri’ Targeted, RM347 Million in Assets Seized in MBI Scam

Malaysia’s police are stepping up their investigation into the MBI investment scam, a multi-billion ringgit fraud that has dragged on for nearly a decade. The Royal Malaysian Police (PDRM) is now planning to arrest another prominent figure with the title ‘Tan Sri’, following recent arrests and major asset seizures.

Tradu Joins TradingView for Seamless CFD and Forex Trading

Tradu, a global trading platform, integrates with TradingView for seamless CFD and forex trading, offering transparency, tight spreads, and fast execution.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc