Asian Open – Hawkish FOMC sees US stocks slide again, USD rally.

Abstract:Asian indices are looking to open soft in Thursday’s session after major US Indices extended their sell-off in Wednesdays session on stronger than expected US data and a “hawkish” FOMC minutes where Fed officials saw ‘upside risks’ to inflation possibly leading to more rate hikes.

Asian indices are looking to open soft in Thursday‘s session after major US Indices extended their sell-off in Wednesdays session on stronger than expected US data and a “hawkish” FOMC minutes where Fed officials saw ’upside risks‘ to inflation possibly leading to more rate hikes. The Russell 2000 led losses (-1.28%) in the US on the continued underperformance of regional banks, though the risk sensitive Nasdaq (-1.15%) wasn’t far behind in a broad-based sell-off.

FX Markets

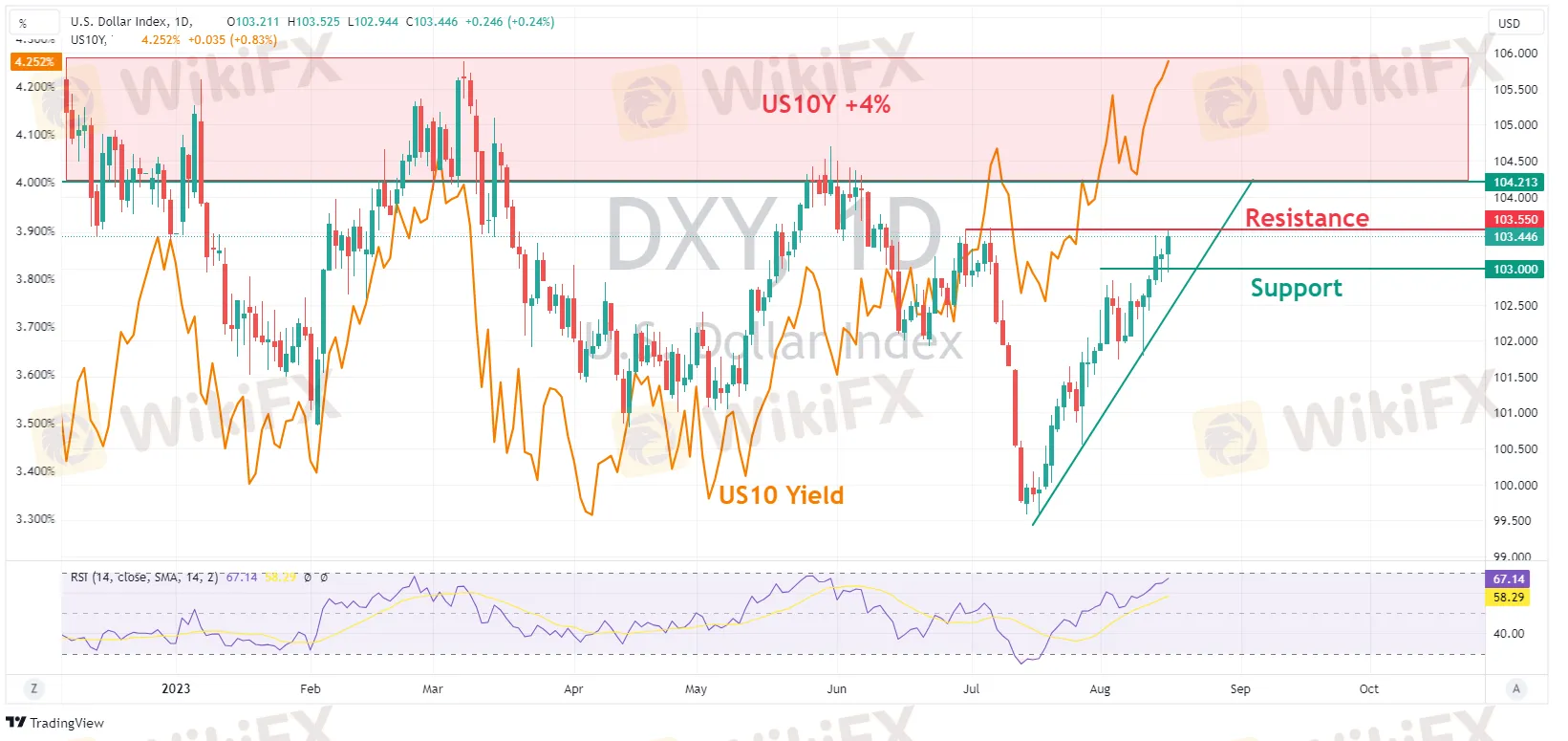

A jump in US treasury yields, which saw the US 10 year pushing higher above its 4% resistance level, and a risk off tone in the market saw the USD surge higher again, DXY testing and holding the big 103 level and pushing up to test cycle highs resistance at 103.55. Strong US data (Industrial Production smashing expectations) and the aforementioned FOMC minutes also being strong tailwinds for the USD.

JPY was markedly weaker on a perfect storm of rising US10 and JP10 yield differentials and a rampant USD. USDJPY hit a high of 146.38, well into the “intervention zone” where the BoJ entered the market to strengthen the Yen late last year. There is Japanese CPI data on Friday, but my feeling is nothing short of robust BoJ action will reverse this grind higher in USDJPY.

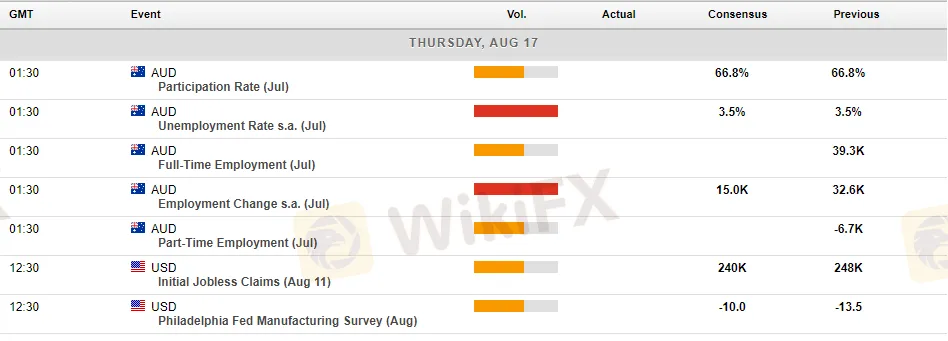

AUD and NZD were softer against the USD weighed down by the risk-off market tone and concerns about Chinas economic recovery. The Kiwi did outperformed the Aussie after Yesterdays RBNZ rate decision where they kept rates on hold but gave what was seen as hawkish forward guidance, this saw AUDNZD push down to test the big figure at 1.08 before finding some support. AUD traders have a pivotal employment report to look forward to today at 11:30 AEST

Gold continued its month-long downtrend, higher yields and a strong USD weighing heavily on the precious metal, with haven flows seeing to go anywhere but to Gold at the moment. XAUUSD pushing below its support level at 1903 USD an ounce and hitting lows not seen since March.

Todays calendar is fairly light with the major risk events being jobs data out of Australia and the US later in the session.

Read more

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

Prop Trading Firms vs. CFD Brokers: Who’s Winning the Retail Trading Race?

In recent years, a new breed of retailer-focused trading firms has emerged: proprietary (prop) trading outfits that recruit individual traders to trade the firm’s capital under structured rules. Boasting low entry costs, clear risk parameters, and profit-sharing incentives, these prop firms are rapidly winning over retail traders, many of whom previously traded Contracts for Difference (CFDs) with established online brokers. As prop trading revenues accelerate, a key question arises: Are CFD brokers losing business to prop firms?

Another ‘Tan Sri’ Targeted, RM347 Million in Assets Seized in MBI Scam

Malaysia’s police are stepping up their investigation into the MBI investment scam, a multi-billion ringgit fraud that has dragged on for nearly a decade. The Royal Malaysian Police (PDRM) is now planning to arrest another prominent figure with the title ‘Tan Sri’, following recent arrests and major asset seizures.

Tradu Joins TradingView for Seamless CFD and Forex Trading

Tradu, a global trading platform, integrates with TradingView for seamless CFD and forex trading, offering transparency, tight spreads, and fast execution.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc