A Winning Combination: BlackBull Markets and TradingView Take Charting and Trading to New Heights

Abstract:New Zealand's BlackBull Markets has expanded its partnership with TradingView, granting clients who trade at least one lot per month complimentary access to TradingView Pro. This collaboration integrates BlackBull Markets into TradingView's trading panel, offering users advanced charting tools, real-time data, and the ability to trade directly through charts

New Zealand's BlackBull Markets, a well-known FX and CFDs broker, has broadened its collaboration with the renowned charting and trading platform, TradingView. This partnership expansion will allow traders to have access to valuable resources and tools.

As a human trader, I can appreciate the value that comes with using advanced software like TradingView Pro. While the basic version is free, BlackBull Markets' clients who trade at least one lot per month will receive complimentary access to TradingView Pro, the premium version.

This subscription-based service provides an incredible assortment of charting tools, backtesting capabilities, and bespoke technical indicators, as well as real-time data from numerous exchanges and marketplaces. It's a terrific approach for traders like myself to remain up-to-date on market movements.

Users are not uncommonly charged for real-time access to market data feeds, which generally include fees for aggregated market data providers and some exchange fees. TradingView Pro can be subscribed to on a monthly or annual basis and comes with different pricing tiers based on the features and tools provided. Pro users can enjoy all the perks of a basic account with additional features and capabilities.

Since the initial integration in 2022, BlackBull Markets users have had access to over 300 tradable instruments, such as Forex, Index, and Single Stock CFDs, Commodities, Precious Metals, and Energy. BlackBull Markets, founded in 2014, is an ECN broker based in New Zealand and is licensed by the New Zealand Financial Markets Authority and the Financial Services Authority (FSA) of Seychelles. They offer hundreds of tradeable instruments on the MT4 and MT5 platforms.

This partnership is more than just integrating charting tools; it brings a more comprehensive collaboration with BlackBull Markets. This includes incorporating BlackBull Markets into the TradingView platform as a supported broker in the trading panel, allowing users to trade directly through charts without leaving the site.

For those of us who are both TradingView users and BlackBull Markets brokerage customers, we can receive customized alerts on breaking news, connect with other users, share our thoughts, and keep an eye on the most active stocks of the day.

TradingView today has over 30 million monthly active users and paying clients in over 180 countries, thanks to a growing community of data-driven investors. It's gone a long way from its humble beginnings in 2011 with just 2,000 visits each day.

TradingView includes an online shop where customers may buy access to third-party tools in addition to its basic services. In recent years, the platform has grown in prominence as it has effectively promoted itself as a producer of seamless HTML5 charts spanning a broad variety of asset classes. As a fellow trader, I can confirm the usefulness of this collaboration, and I'm forward to seeing how it develops in the future.

About BlackBull Markets

BlackBull Markets is a New Zealand-based online brokerage that provides trading services for Forex, CFDs, and commodities. Founded in 2014, BlackBull Markets has quickly gained a reputation as a reliable and transparent broker with competitive pricing and excellent customer support.

In terms of regulation, BlackBull Markets is licensed and regulated by New Zealand's Financial Markets Authority (FMA). This adds an additional layer of protection for customers while also ensuring that the broker acts in a transparent and ethical way.

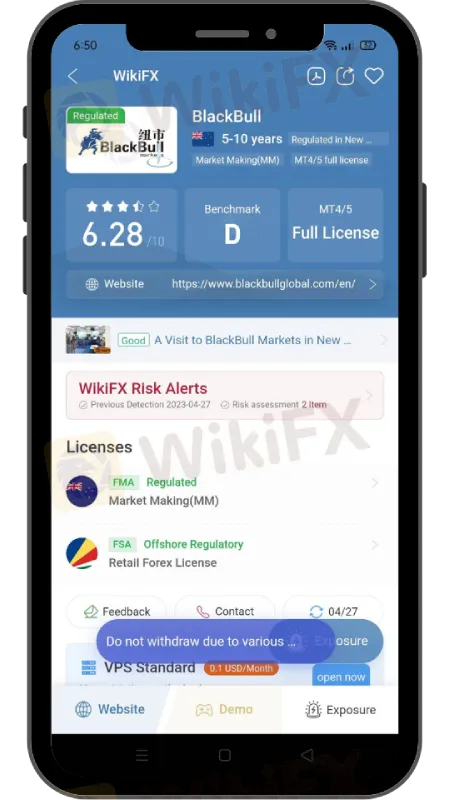

BlackBull Markets has been given a rating of 6.28 on WikiFX, an online platform dedicated to assessing and rating Forex brokers around the world. While BlackBull Markets is known for offering a range of trading services, including Forex, commodities, and indices, its relatively low rate compared to the other brokers may be attributed to a lack of licenses held by the company.

Download and install the WikiFX App on your smartphone to stay updated on the latest brokers news.

Download the app here: https://social1.onelink.me/QgET/px2b7i8n

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc