With BlackRock, BUX Will Provide An ETF Savings Plan Across Europe

Abstract:BUX, a financial technology firm, and neobroker have collaborated with BlackRock, a prominent investment provider, to establish an ETF (exchange-traded fund) savings plan in Europe. The product gives European customers a straightforward method to invest in a diverse portfolio of ETFs managed by iShares, a BlackRock affiliate.

In Europe, BUX and BlackRock have joined forces.

Users may build portfolios using iShares ETFs, which give wide exposure to bonds and equities across global markets. The BUX Savings Plan may be tailored by selecting from a wide range of iShares ETFs, such as equities, bonds, themes, sectors, factors, and sustainable ETFs.

“The desire to begin investing exists, but the knowledge is inadequate, creating a barrier for those who want to begin investing but lack expertise. We have established a suitable solution for customers who are overwhelmed by the number of goods and don't know how and when to start investing by collaborating with Blackrock, a famous specialist in financial markets and products” BUX's CEO, Yorick Naeff, said.

“By working together, BUX and BlackRock can have a significant influence on how Europeans invest and plan for their financial future.”

Investments begin at €10 per ETF every month, with a €1 commission cost per portfolio transaction. The BUX ETF savings plan seeks to assist participants to achieve a more secure financial future by providing a greater knowledge of financial markets and diversification.

Meanwhile

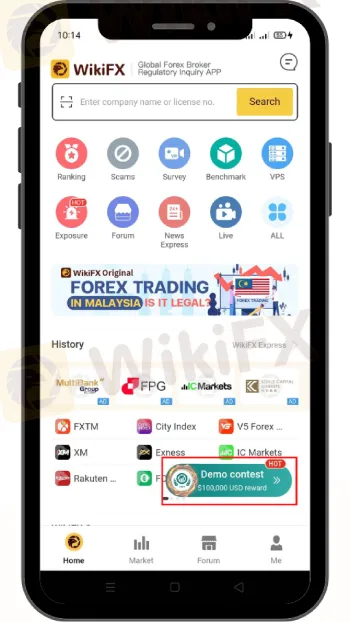

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Create an account by “Signing Up” or “Register”

Once all is done, click on the “Trade Button”

You should see the trading platform and may select trading instruments you wanted to trade

Good luck and enjoy your trading experience!

Concentrating on Passive Investing

According to a BUX poll, a lack of understanding is a big barrier to investing, with 42% of respondents identifying it as a reason for not investing. Despite the fact that long-term investing is critical for establishing a secure financial future, many individuals feel frightened by the investment process.

Picking individual stocks for a stock market portfolio is challenging and needs a great deal of expertise and experience. As a result, the business wishes to promote a savings strategy based on passive investing via ETFs.

“Millions of investors turn to iShares ETFs as instruments to develop investment portfolios and attain financial well-being as investing becomes more affordable and accessible. We are thrilled to be collaborating with BUX; this collaboration provides an efficient way for investors throughout Europe to gain the benefits of ETFs and investing in global markets in a simple, accessible, and cost-effective format ” BlackRock's Head of Digital Distribution Continental Europe, Christian Bimueller, stated.

BUX performed a study to investigate investor behavior in the Netherlands, Italy, and Germany. The most essential thing for everyone is to save and accumulate money over time in order to give security to their family.

Neobroker has completed its active year.

Over the last year, the European mobile brokerage business located in the Netherlands has set its eyes on aggressive expansion. Finance Magnates recently reported on new licenses, staff changes, and product modifications.

BUX gained its Digital Asset Service Provider (DASP) license from the Autorité des Marchés Financiers (AMF) in December and purchased Ninety Nine, the retail brokerage branch of the Spanish neobroker. With these developments, the corporation expanded into new European markets and clientele.

The platform opted to rename its CFD product to Stryk in July, largely to distinguish its various offerings. The platform, formerly known as BUX X, was released in 2014 and provided services similar to BUX Zero, the company's zero-fee trading software.

BUX named Salim Sebbata, the Chief Executive Officer of its United Kingdom branch, as the Managing Director of Stryk a few months after rebranding.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Read more

Valetax $35 No Deposit Bonus

Valetax has just upped the ante by offering a $35 no-deposit Welcome Bonus to new traders. Unlike many offers that require an initial deposit or come buried in fine print, Valetax’s bonus lets you begin trading on their MT4 platform—risk-free—immediately after verification. Here’s why this promotion stands out and how you can make the most of it.

Duhani Capital: A Scam Broker Hiding Behind Fake Promises?

Traders from the US, Pakistan, and Indonesia have notably raised complaints about Duhani Capital, a non-regulated broker. It has been proven to indulge in scammy practices, withholding traders’ funds, altering spreads without notifications and account terminations.

iFourX Scam Alert: Trapped Funds and Silent Support

Traders, including one from Japan, have raised concerns about iFourX, an unregulated broker, for their scammy tactics. The trader has witnessed blocked withdrawals, silent customer support, and restrictive account practices when dealing with the platform.

Alieus Capital Accused of Ignoring Withdrawal Requests and Cutting Off Support

A trader using Alieus Capital has raised serious concerns about the broker’s practices. They have reported an unapproved withdrawal request pending since March 18, with no live support and unanswered emails, which led to concerns about the broker’s operations.

WikiFX Broker

Latest News

OANDA Expands ETF Offerings in EU for Portfolio Diversification

FCA Introduces PASS and AI Testing to Support Financial Innovation

FCA Warns Public About 7 Unauthorised Financial Firms

Webull Canada Launches Options Trading and Advanced Tools

FTX Launches Legal Action to Reclaim Tokens from NFT Star and Delysium

Forex Traders Shift Focus: Risk Management Over High Leverage in 2025

Why High Leverage Causes Massive Losses in Forex Trading

Retiree Loses RM100,000 in Fake Investment Scheme that Promised 18% Return

USD/JPY Struggles Ahead of BoJ Decision Amid Easing Trade Tensions and Mixed Data

How the US Dollar Rules the Global Economy: Will Its Glory Continue?

Rate Calc