Forex Technical Analysis & Forecast 22.11.2022

Abstract:The currency pair has completed a structure of a declining wave to 1.0222. Today a link of correction to 1.0277 is not excluded (a test from below). Then falling to 1.0160 should follow. from where the wave might continue to 1.0111. The goal is local.

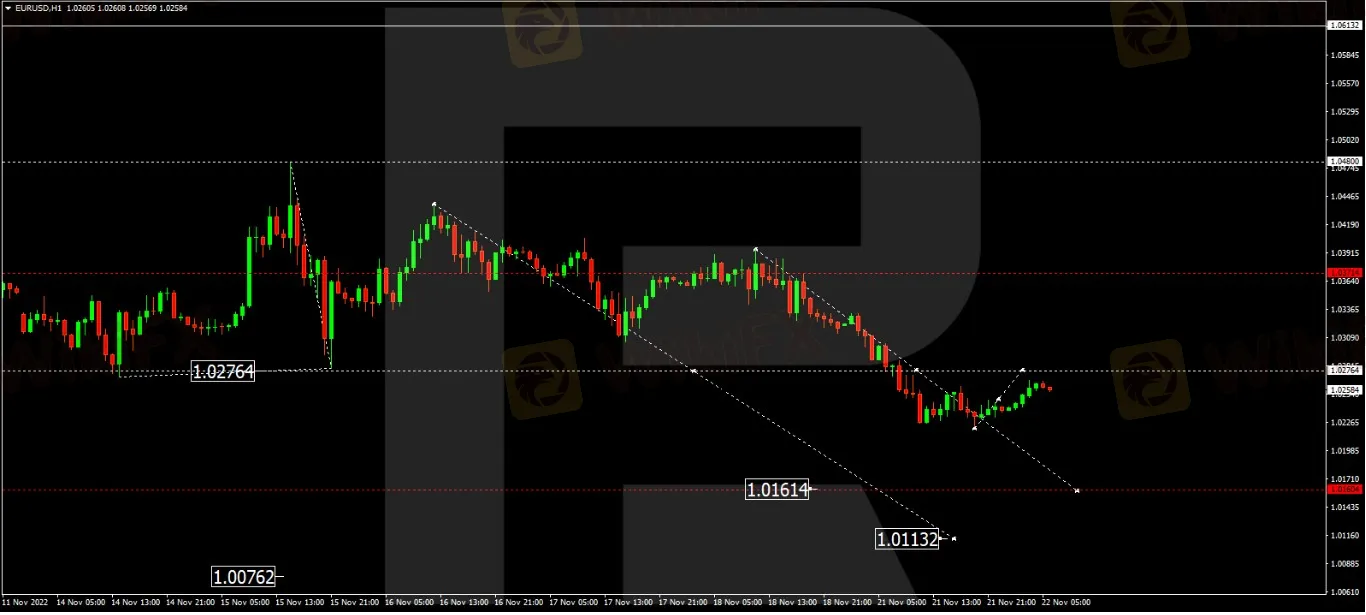

EURUSD, “Euro vs US Dollar”

The currency pair has completed a structure of a declining wave to 1.0222. Today a link of correction to 1.0277 is not excluded (a test from below). Then falling to 1.0160 should follow. from where the wave might continue to 1.0111. The goal is local.

The currency pair has completed a wave of decline to 1.1777 and a correction to 1.1863. Today another decline to 1.1777 is expected. And with a breakaway of this level downwards, the wave might continue to 1.1588. The goal is local. After this level is reached, correction to 1.1777 might develop.

USDJPY, “US Dollar vs Japanese Yen”

The currency pair has performed a wave of growth to 142.07. Today the market is forming a consolidation range around this level. Expansion of the range to 142.55 is not excluded, followed by falling to 139.94 and growth to 144.66.

USDCHF, “US Dollar vs Swiss Franc”

The currency pair has completed a wave of growth to 0.9595. After this level is reached, a link of correction to 0.9555 is not excluded, followed by growth to 0.9606.

AUDUSD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of decline to 0.6585. After this level is reached, a link of correction to 0.6690 is not excluded, followed by a decline to 0.6555.

BRENT

Crude oil has extended the structure of decline to 82.42. Today the market is forming a link of growth to 89.42, and after this level is reached, another link of decline to 81.00 is not excluded, followed by growth to 89.44.

XAUUSD, “Gold vs US Dollar”

Gold has completed a structure of a wave of decline to 1732.48. Today a link of correction to 1748.22 is not excluded, followed by a decline to 1728.30, from where the wave might continue to 1710.50.

S&P 500

The stock index continues forming a consolidation range around 3959.9. Today a wave of decline may continue to 3873.7. The goal is first. Then a correction to 3959.0 and a decline to 3777.7 should follow.

Note!

All the market forecasts displayed in this article reflects only our analysis and observation according to the market insights, and should therefore not be considered as a guidance for trading. Wikifx bears no responsibility for any trading losses.

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

Pi Network: Scam Allegations Spark Heated Debate

A whistleblower report has surfaced, casting doubt on the legitimacy of Pi Network, alleging psychological manipulation, opaque operations, and potential financial exploitation. What is your take on this?

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc