Plus500 Is Launching A New Share BuyBack Programme

Abstract:Plus500 Ltd, a retail Forex and CFD broker, said today that it would launch a fresh share repurchase program worth up to $602 million.

The Share Repurchase Programme comes after the company's two recent share buyback programs, which were launched on February 15, 2022, and April 13, 2022, respectively.

The Share Buyback Programme is meant to show that the Board is still confident in Plus500's future and to show how well the company is doing financially. This optimism is bolstered by Plus500's recent considerable operational and financial momentum, as the Group continues to make progress on its strategic roadmap.

The maximum number of shares that can be bought back through the share buyback program is 9,959,828. This is the number of shares that shareholders gave the Company permission to buy at the company's Annual General Meeting (AGM) in 2022 minus the number of shares that have already been bought back under that authority.

Share purchases will take place on the open market and will be done on an as-needed basis, based on market circumstances, share price, trading volume, and other considerations. Liberum Capital Limited will oversee the Share Buyback Programme, which is an irreversible, non-discretionary share repurchase program designed to repurchase the company's shares on its behalf and within set criteria.

Plus500 and its board members don't have the power to change the share repurchase program, which will be done according to the program's rules at Liberum's sole discretion.

All of the ordinary shares that the company bought back through the Share Buyback Program are now called “treasury shares” or “dormant shares.” These treasury shares do not pay dividends and cannot be voted on at company general meetings.

From the date of this notice until the company announces its preliminary results for the fiscal year ending December 31, 2022, the Share Buyback Programme will be in effect. During any time when the business is closed, you can still make purchases.

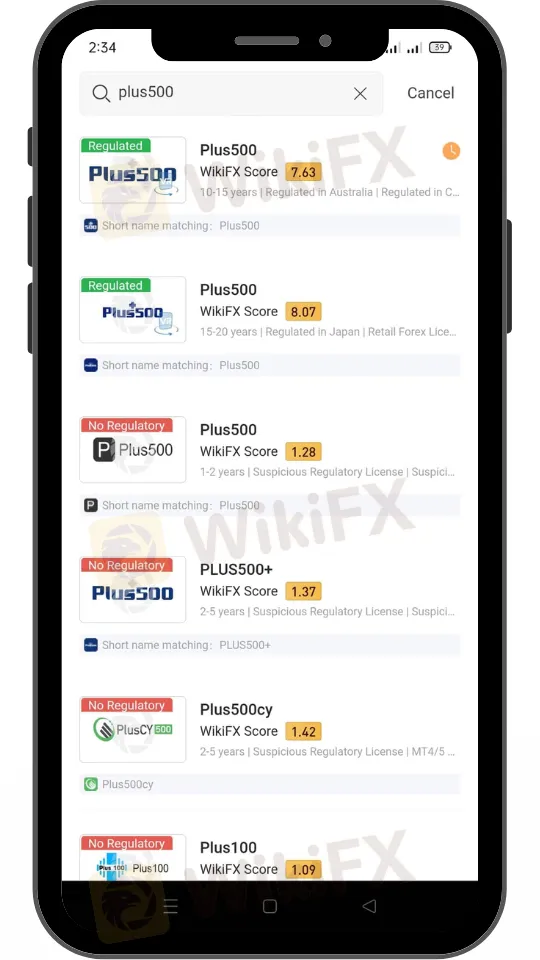

Here's how to use the WikiFX App to search for Plus500.

First: Navigate to the WikiFX App on your browser. To access the mobile app, enter www.wikifx.com or download the app from the App Store or Google Play Store and install it on your phone.

Second: You should be able to view the search bar in the top right corner of the WikiFX App. Enter the broker's name, for example Plus500.

Third: Anticipate a large number of results, including cloned websites. It is for you to know how many scammers are trying to scam traders who wanted to trade with your chosen broker.

Fourth: Choose the correct broker by looking at their official website.

Fifth: After you've found the correct broker, you should be able to access all of the information you want, including trader complaints and reviews. If it's accurate, you should be able to view their offices based on their location, as well as any licenses or regulating agencies.

If you want assistance, please contact WikiFX Support using the contact information provided below.

Plus500's website is at https://www.wikifx.com/en/dealer/0001628446.html.

Keep checking back for more Broker news.

Stay up to speed on the latest news by downloading the WikiFX App from the App Store or Google Play Store.

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc