US stocks end slightly lower in a choppy session after hot PPI data and mixed FOMC minutes.

Abstract:US markets mostly tread water ahead of CPI on 13th October figure, equities and the USD traded in a fairly tight range, a lack of expected chaos out of the UK and what were considered a mixed FOMC minutes saw markets in a holding pattern as traders await US inflation data.

US markets mostly tread water ahead of CPI on 13th October figure, equities and the USD traded in a fairly tight range, a lack of expected chaos out of the UK and what were considered a mixed FOMC minutes saw markets in a holding pattern as traders await US inflation data.

Though a modest drop as compared to recent times, it still marked the 6th down day in a row for the S&P 500 and Nasdaq, with the S&P 500 now down over 25% from the highs, putting it well into bear market territory.

US PPI figures (Change in the price of finished goods and services sold by producers) came in at 0.4% for September, a steep rise from the previous month and handily surpassing analyst expectations of 0.2% showing that US inflation is sticking around and could bode for an elevated CPI figure later on 13th.

The VIX index (or fear index as it is sometimes known) was bid on 13th, spiking back up above 34 to touch its highest reading this month as investors rushed to hedge themselves ahead of CPI observed on 13th October.

The USD had an initial rally on hot PPI figures, dipped on mixed FOMC minutes and managed to catch a bid to finish the day mostly unchanged for the day.

In commodities, Oil was down for 3rd straight day, finding support after hitting the 50% Fibonacci retracement of its October gains. This came on the back of growth concerns after a report from OPEC/EIA cutting global demand growth expectations.

Gold climbed modestly for the day, rallying after the FOMC minutes but giving that spike back late in the session as the USD caught a bid.

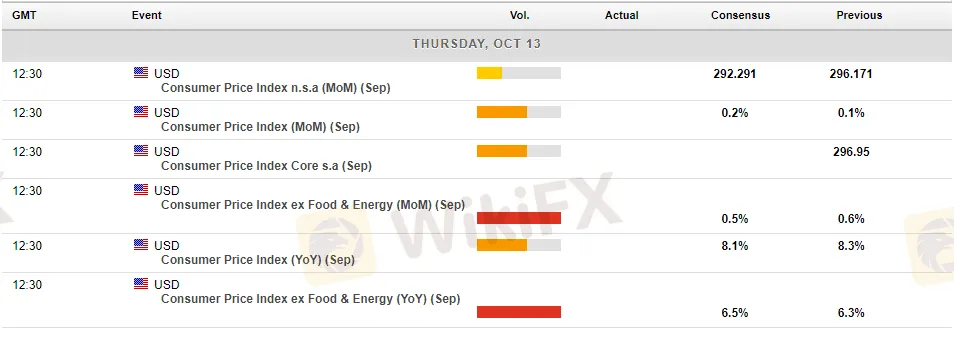

In economic announcements, all eyes will be on tonights US CPI figure. Analysts expects to see inflation increase 8.1% from a year ago in September. Anything above the prior reading of 8.3% should see a sharp decline in risk assets. On the flip side, a much softer reading may result in a sharp relief rally as markets re-price their Fed hiking predictions.

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc