Quant Pip FX-Some Important Details about This Broker

Abstract:Registered in the United Kingdom, Quant Pip FX is a forex broker providing a series of trading services to retail clients. With the Quant Pip FX platform, five trading accounts are available and the maximum leverage that can be used is up to 1:500.

Since the Quant Pip FXs official website (https://www.quantpipfx.com/) cannot be opened for now, we could only piece together the rough picture of this forex broker by gathering some relevant information from other websites.

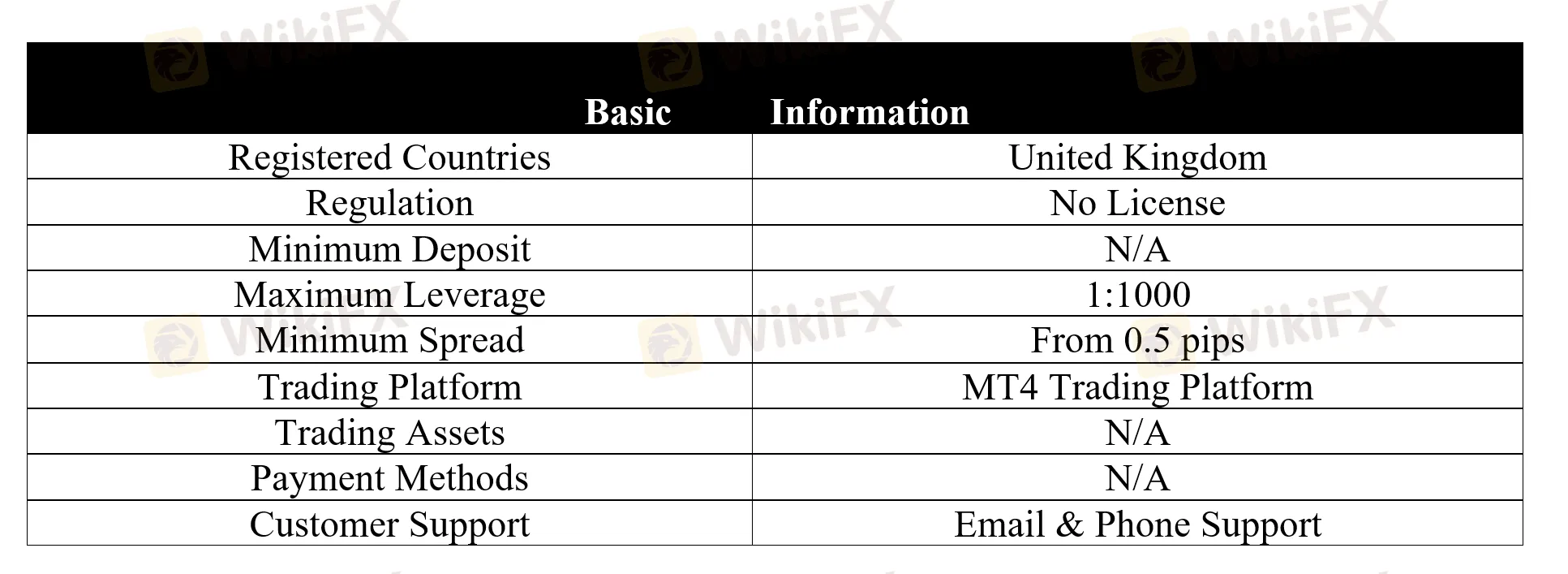

General Information

Registered in the United Kingdom, Quant Pip FX is a forex broker providing a series of trading services to retail clients. With the Quant Pip FX platform, five trading accounts are available and the maximum leverage that can be used is up to 1:500.

Quant Pip FX does not hold any regulatory license to show it operates legally. Please be aware of the risk.

Account Types

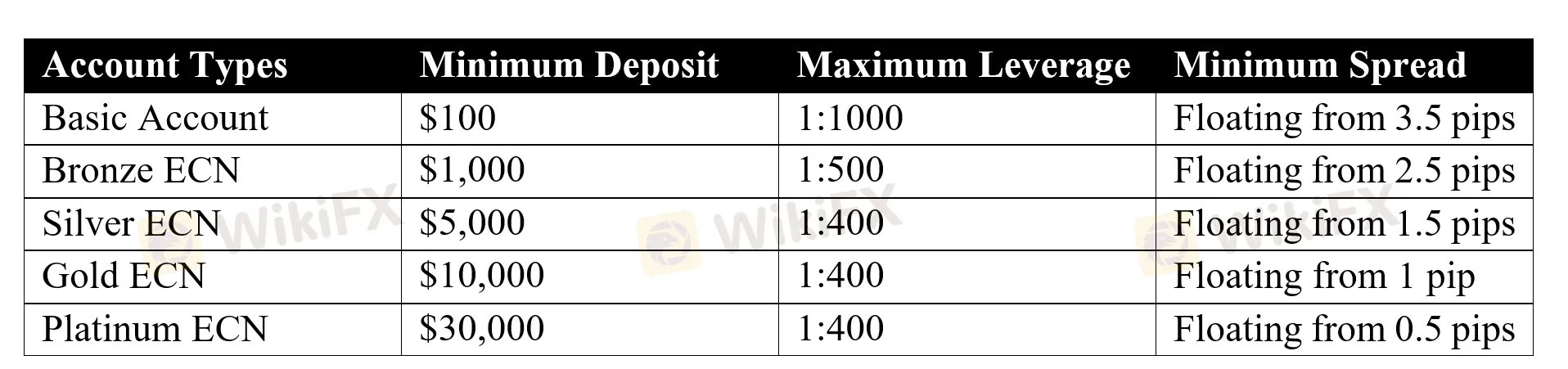

A total of five trading accounts are available, namely Basic, Bronze, Silver, Gold, and Platinum.

To open a Basic account, only $100 is required. While the other four trading accounts requires high deposits, with the Bronze account from $1,000, the Silver ECN account from $5,000, the Gold ECN account from 10,000 and the Platinum ECN account from $30,000.

Leverage

When it comes to leverage, Quant Pip FX allows its clients to use leverage of up to 1:1000, absurdly higher than the levels regarded appropriate by many regulators, with the maximum leverage for major forex up to 1:30 in Europe and Australia, and 1:50 in Canada and U.S.

Since leverage can magnify gains as well as losses, it can also cause serious fund losses, especially to inexperienced traders. Therefore, it is wise for beginners to choose the smaller size no more than 1:10 until they gain more trading experience.

Spreads & Commissions

With no commission charged, spread is determined by trading accounts, with the Basic account from 3.5 pips, the Bronze account from 2.5 pips, the Silver account from 1.5 pips, the Gold account from 1 pip, and the platinum account from 0.5 pips.

Trading Platform

Quant Pip FX provides access to the industry-leading MT4 trading platform, featuring one-click operations for opening and closing trades, setting stops and entry limits, placing direct orders, setting and editing limit and stop loss, as well as charting.

Customer Support

If clients have any trading-related issues, they can try to reach out to Quant Pip FX through the following channels:

Telephone: 020 7946 020

Email: support@quantpipfx.com

Registered Company Address: Unit no 44, headway business center, knowles lane, bradford,BD1 2AF ,United Kingdom.

Risk Warning

Trading leveraged products such as forex, cryptocurrencies and derivatives may not be suitable for all investors as they carry a high degree of risk to your capital. Please ensure that your fully understand the risks involved, taking into account your investments objectives and level of experience.

The information presented in this article is intended solely for reference purposes.

Read more

Valetax $35 No Deposit Bonus

Valetax has just upped the ante by offering a $35 no-deposit Welcome Bonus to new traders. Unlike many offers that require an initial deposit or come buried in fine print, Valetax’s bonus lets you begin trading on their MT4 platform—risk-free—immediately after verification. Here’s why this promotion stands out and how you can make the most of it.

Duhani Capital: A Scam Broker Hiding Behind Fake Promises?

Traders from the US, Pakistan, and Indonesia have notably raised complaints about Duhani Capital, a non-regulated broker. It has been proven to indulge in scammy practices, withholding traders’ funds, altering spreads without notifications and account terminations.

iFourX Scam Alert: Trapped Funds and Silent Support

Traders, including one from Japan, have raised concerns about iFourX, an unregulated broker, for their scammy tactics. The trader has witnessed blocked withdrawals, silent customer support, and restrictive account practices when dealing with the platform.

Alieus Capital Accused of Ignoring Withdrawal Requests and Cutting Off Support

A trader using Alieus Capital has raised serious concerns about the broker’s practices. They have reported an unapproved withdrawal request pending since March 18, with no live support and unanswered emails, which led to concerns about the broker’s operations.

WikiFX Broker

Latest News

OANDA Expands ETF Offerings in EU for Portfolio Diversification

FCA Introduces PASS and AI Testing to Support Financial Innovation

FCA Warns Public About 7 Unauthorised Financial Firms

Webull Canada Launches Options Trading and Advanced Tools

FTX Launches Legal Action to Reclaim Tokens from NFT Star and Delysium

Forex Traders Shift Focus: Risk Management Over High Leverage in 2025

SEC Charges Dallas Trio in $91M Ponzi Scheme Defrauding Investors

Why High Leverage Causes Massive Losses in Forex Trading

Retiree Loses RM100,000 in Fake Investment Scheme that Promised 18% Return

USD/JPY Struggles Ahead of BoJ Decision Amid Easing Trade Tensions and Mixed Data

Rate Calc