UW Global -Some important Details about This Broker

Abstract:Registered in Malaysia in 2016, UW Global operates as a broker offering services in Forex, Indices, CFDs, and Metals (Gold & Silver). It provides three types of accounts, along with the advanced trading platforms MT4 and MT5. However, this broker does not hold a legal license issued by any official regulatory institution.

Note: UW Global 's official website - https://www.uw-global.com is currently inaccessible normally.

| UW Global Review Summary | |

| Founded | 2016 |

| Registered Country/Region | Malaysia |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, CFDs, Metals (Gold & Silver) |

| Demo Account | ❌ |

| Leverage | 1:1 for Forex Syariah |

| EUR/USD Spread | Floating for Forex and Metals; Fixed for Forex Syariah |

| Trading Platform | MT4 and MT5 |

| Min Deposit | / |

| Customer Support | Tel: +60 87-415 988 (Landline) |

| Fax: 6087-423 288 | |

| Email: cs1@uw-global.com | |

| Physical address: Unit Level 3A & 3B, Block 4, Financial Park Labuan, Jalan Merdeka, 87000 Federal Territory of Labuan, Malaysia | |

Registered in Malaysia in 2016, UW Global operates as a broker offering services in Forex, Indices, CFDs, and Metals (Gold & Silver). It provides three types of accounts, along with the advanced trading platforms MT4 and MT5. However, this broker does not hold a legal license issued by any official regulatory institution.

Pros and Cons

| Pros | Cons |

| A wide range of trading instruments | No regulation |

| Multiple account types | Limited leverage |

| MT4 and MT5 trading platform | Unclear fee structure |

| Unclear minimum deposit | |

| Unknown payment options |

Is UW Global Legit?

UW Global has failed to obtain authorization from any regulatory body, leading to a lack of legitimate oversight.

What Can I Trade on UW Global?

UW Global offers trading in Forex, Indices, CFDs, and Metals, specifically Gold and Silver.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| CFDs | ✔ |

| Metals | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

UW Global provides three account types, ranging from individual traders to corporate entities.

- Individual - Personal Account

- Individual - Joint Account

- Corporate Account

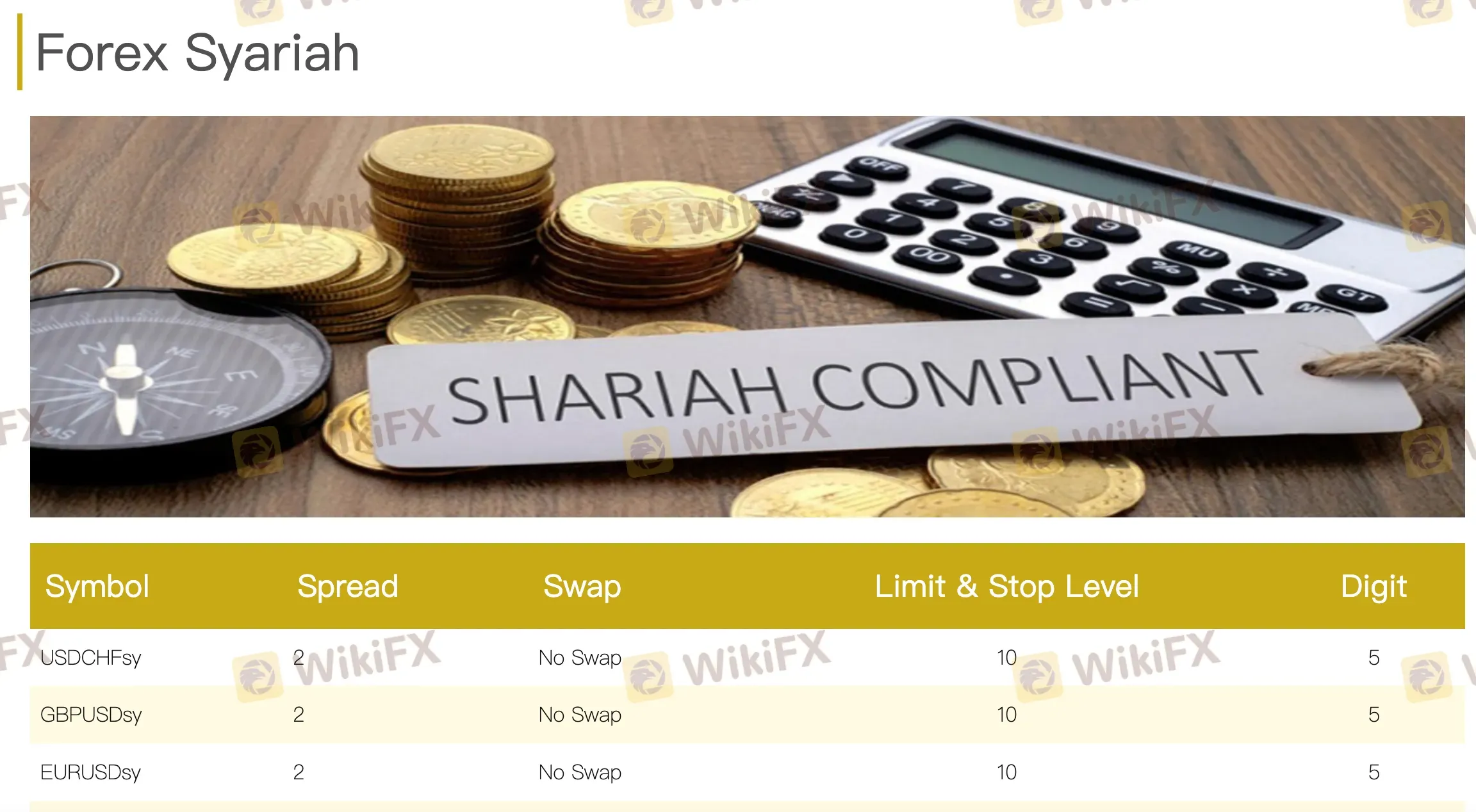

Leverage

In the case of the Forex Syariah account, the leverage is 1:1, indicating that no borrowed funds are utilized in trading. For metal trading, including gold and silver, the leverage details are implicitly tied to the specified contract sizes and margin requirements, despite the absence of explicit leverage ratios.

Spread and Commission

In terms of spreads, for Forex and Metals Trading, the spread is floating. For Syariah-Compliant Forex Trading, the spreads start from 2.0 pips.

As for margins, the margin requirement for Forex trading is listed as $1,000 per lot for day trades and overnight positions, with hedging/locking costing an additional $200 per pair.

| Trading Asset | Spread | Margin Requirement | |

| Forex and Metals | Floating | USD 1,000 per lot, with hedging/locking at USD 200 per pair | |

| Syariah-Compliant Forex | From 2.0 pips | USD 100,000 | |

| Precious Metals | Floating | / | |

Trading Platform

UW Global provides access to both MetaTrader 4 and MetaTrader 5, two of the most professional trading platforms in the forex and CFD trading industry. Both platforms offer technical indicators, graphical objects, and detailed market depth analysis, and they are accessible through web and mobile devices (including phones and iPads).

However, since UW Global is unregulated, there is a possibility that the broker may manipulate your account or even lack permission to offer trading through MT4 and MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web and Mobile | Beginners |

| MT5 | ✔ | Web and Mobile | Experienced traders |

Read more

MTrading Users Report Withheld Funds and High Withdrawal Fees

Traders from Kenya and Thailand have had bad experiences with MTrading as they faced withdrawal restrictions, higher deposit fees, and refusal to release funds. Is MTrading safe to trade forex?

Valetax $35 No Deposit Bonus

Valetax has just upped the ante by offering a $35 no-deposit Welcome Bonus to new traders. Unlike many offers that require an initial deposit or come buried in fine print, Valetax’s bonus lets you begin trading on their MT4 platform—risk-free—immediately after verification. Here’s why this promotion stands out and how you can make the most of it.

Duhani Capital: A Scam Broker Hiding Behind Fake Promises?

Traders from the US, Pakistan, and Indonesia have notably raised complaints about Duhani Capital, a non-regulated broker. It has been proven to indulge in scammy practices, withholding traders’ funds, altering spreads without notifications and account terminations.

iFourX Scam Alert: Trapped Funds and Silent Support

Traders, including one from Japan, have raised concerns about iFourX, an unregulated broker, for their scammy tactics. The trader has witnessed blocked withdrawals, silent customer support, and restrictive account practices when dealing with the platform.

WikiFX Broker

Latest News

MTrading Users Report Withheld Funds and High Withdrawal Fees

How popular is MT4/MT5 in Southeast Asia?

What is smartytrade?

SEC seeks to reopen case against Renwick Haddow to modify asset freeze

Vebson’s False Facade: A Scam Broker Stealing Your Profits?

FTC and Nevada Target $1.2 Billion Investment Scam | IML Exposed

FCA Shuts Down Direct Trading Technologies Over Fraud Concerns

Rate Calc