WIKIFX REPORT: ATFX UK sees Revenues drop in 2021 as it ceases serving Retail clients

Abstract:ATFX UK (or more formally AT Global Markets UK Limited), the FCA regulated arm of Chinese controlled retail FX broker ATFX, saw a slight decrease in Revenues is fiscal 2021 (year ended October 31, 2021), although by reducing costs the company was able to reverse the previous year’s net loss.

ATFX UK (or more formally AT Global Markets UK Limited), the FCA regulated arm of Chinese controlled retail FX broker ATFX, saw a slight decrease in Revenues is fiscal 2021 (year ended October 31, 2021), although by reducing costs the company was able to reverse the previous years net loss.

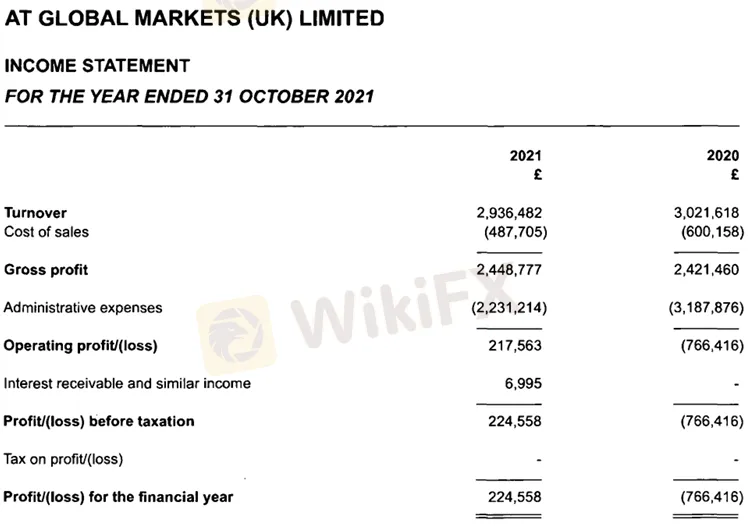

ATFX UK reported Revenues of £2.94 million in 2021, down 3% from £3.02 million in 2020. The company earned a net profit of £225,000 in 2021, versus a loss of £766,000 in 2020.

As a result of the UK leaving the European Union and the continued long term impact of COVID-19, ATFX UK said that it took the decision to cease offering services to Retail clients. Retail client activity was wound down during 2021. The firm shifted its focus to the provision or services to Professional institutional clients, via ATFX Connect. This resulted in a significant reduction of costs. The new focus of the business has resulted in lower costs, while volume has increased.

ATFX UK client assets were reduced to just £344,730 at year-end 2021, down from £3,116,832 in 2020, due mainly to the aforementioned decision to stop servicing Retail clients.

ATFX is controlled by Chinese entrepreneur Hiu Keung (Joe) Li. The group has licensed subsidiaries in the UK (FCA), Cyprus (CySEC), and offshore in Mauritius.

ATFX UKs 2021 income statement follows:

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc