Saxo Bank Japan will Discontinue MT4 Support in September 2022

Abstract:Saxo Bank established the "SaxoInvestor" platform for the GCC industry earlier this year. Investors may trade equities, bonds, cryptocurrency, ETFs, mutual funds, and managed portfolios on the new platform.

Some clients will be excused and will be able to continue trading on MetaTrader4.

The demise of the MT4 will have no impact on the SaxoInvestor platform in the GCC region.

With the exception of specific clients, Saxo Bank will discontinue support for MetaTrader4 (MT4) on September 4, 2022. The webpage has been updated with the following translation from Japanese:

“With the exception of select clients, we have decided to discontinue usage of MT4 on September 4, 2022 (Sunday) as the last day.” We would like to thank all of our clients who have utilized Saxo Bank Securities MT4 thus far.

“We regret for any trouble caused by our present clients' abrupt contact, but we appreciate your understanding.”

Even after you have stopped using MT4, you may trade the open interest account balance in the MT4(A) account using our trading program 'Saxo Trader Go/Pro.'

A New Platform for the Gulf Cooperation Council Region

Saxo Bank established the “SaxoInvestor” platform for the GCC industry earlier this year. Investors may trade equities, bonds, cryptocurrency, ETFs, mutual funds, and managed portfolios on the new platform.

“The investing market is multifaceted, with many diverse options open to aspiring investors,” said Damian Hitchen, CEO of Saxo Bank in the MENA region.

“The SaxoBank platform provides high-quality information, variety, and investing topics that will allow everyone, from new entrants to the market to seasoned investors, to have a meaningful effect with their investment decisions.”

Saxo Bank has seen a 150 percent growth in new investors from the MENA area in the last several years. Female investors have also grown. Notably, 18% of new clients in 2022 will be female. Only 11% of new customers in 2020 were female investors.

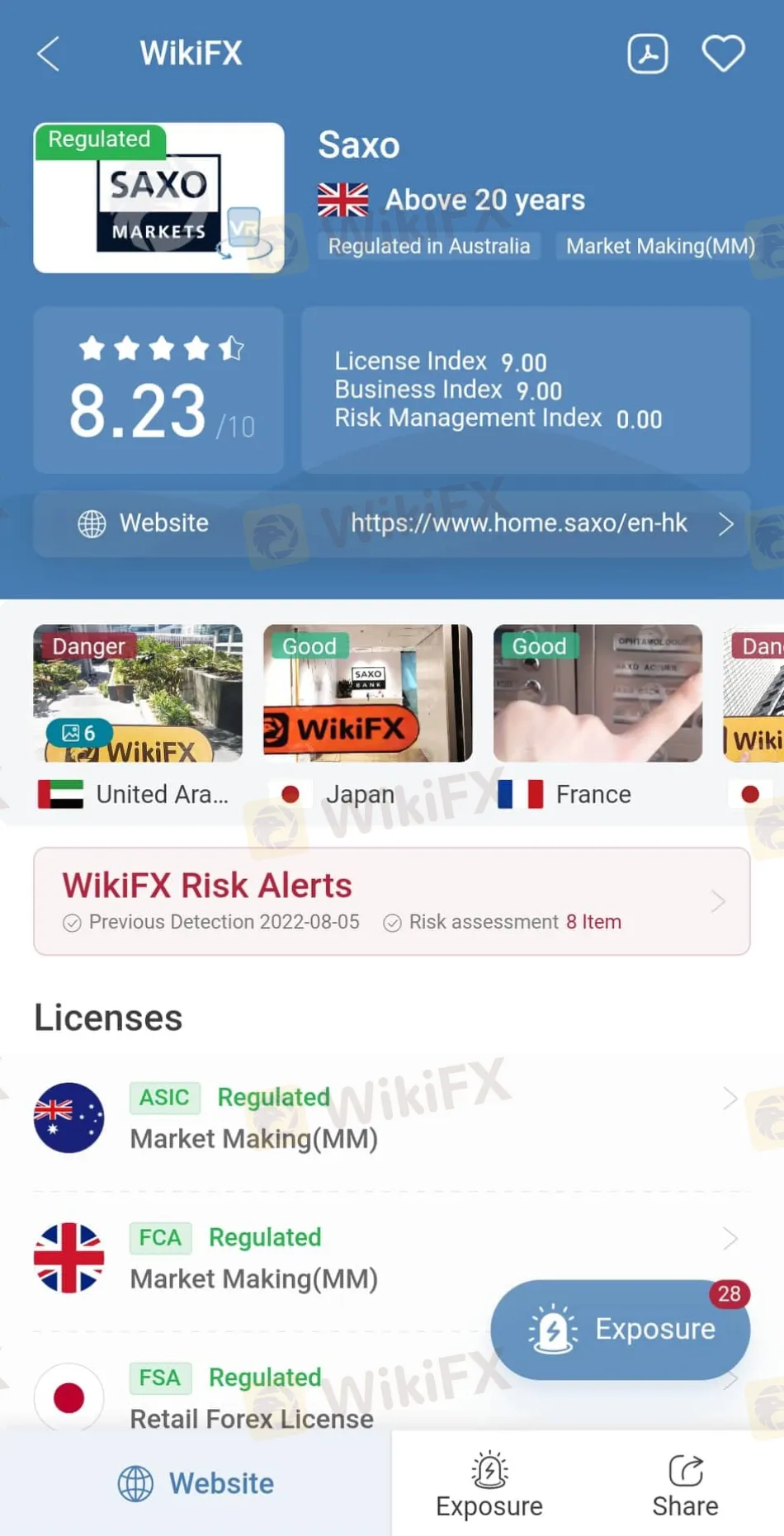

Saxo Bank on WikiFX App

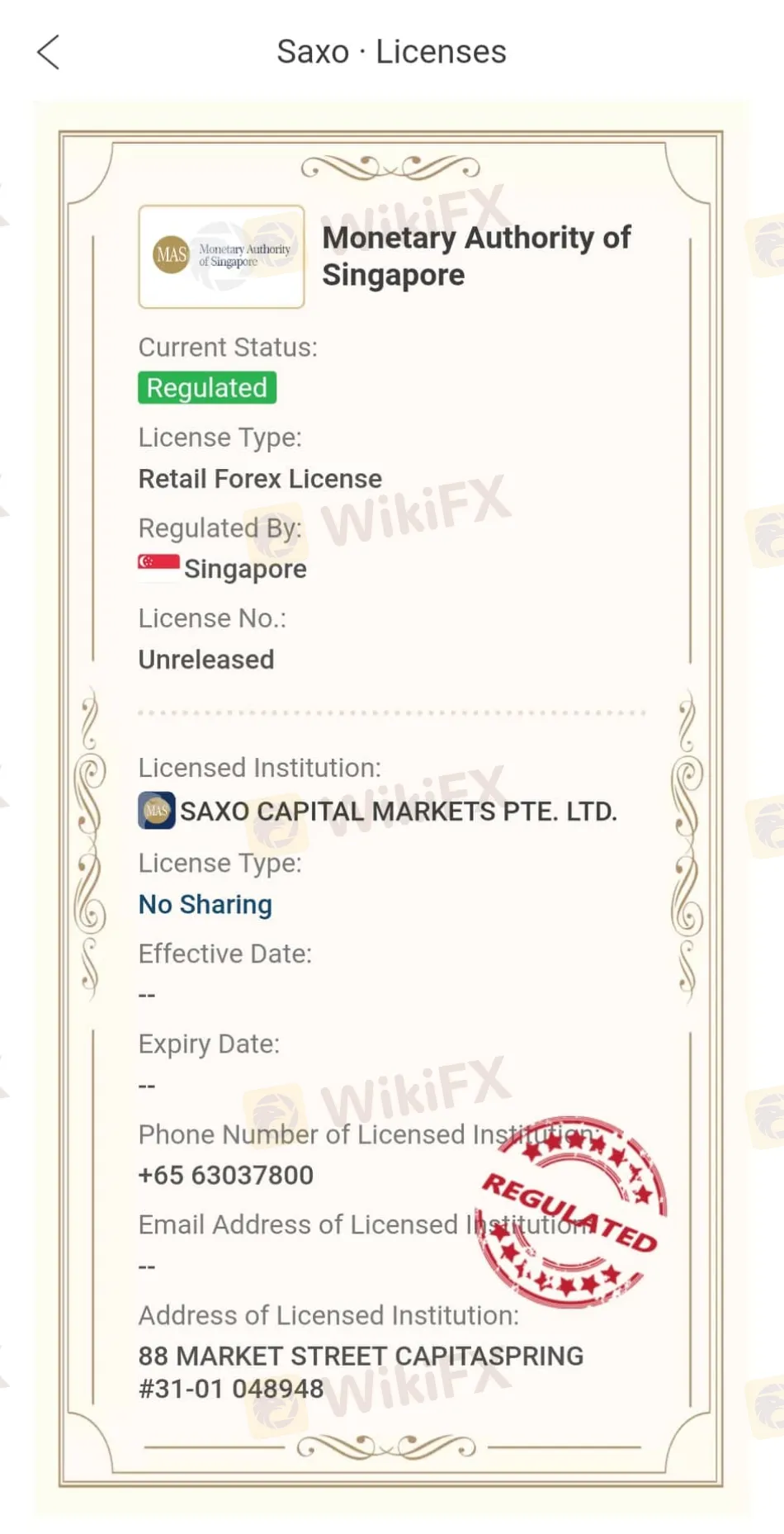

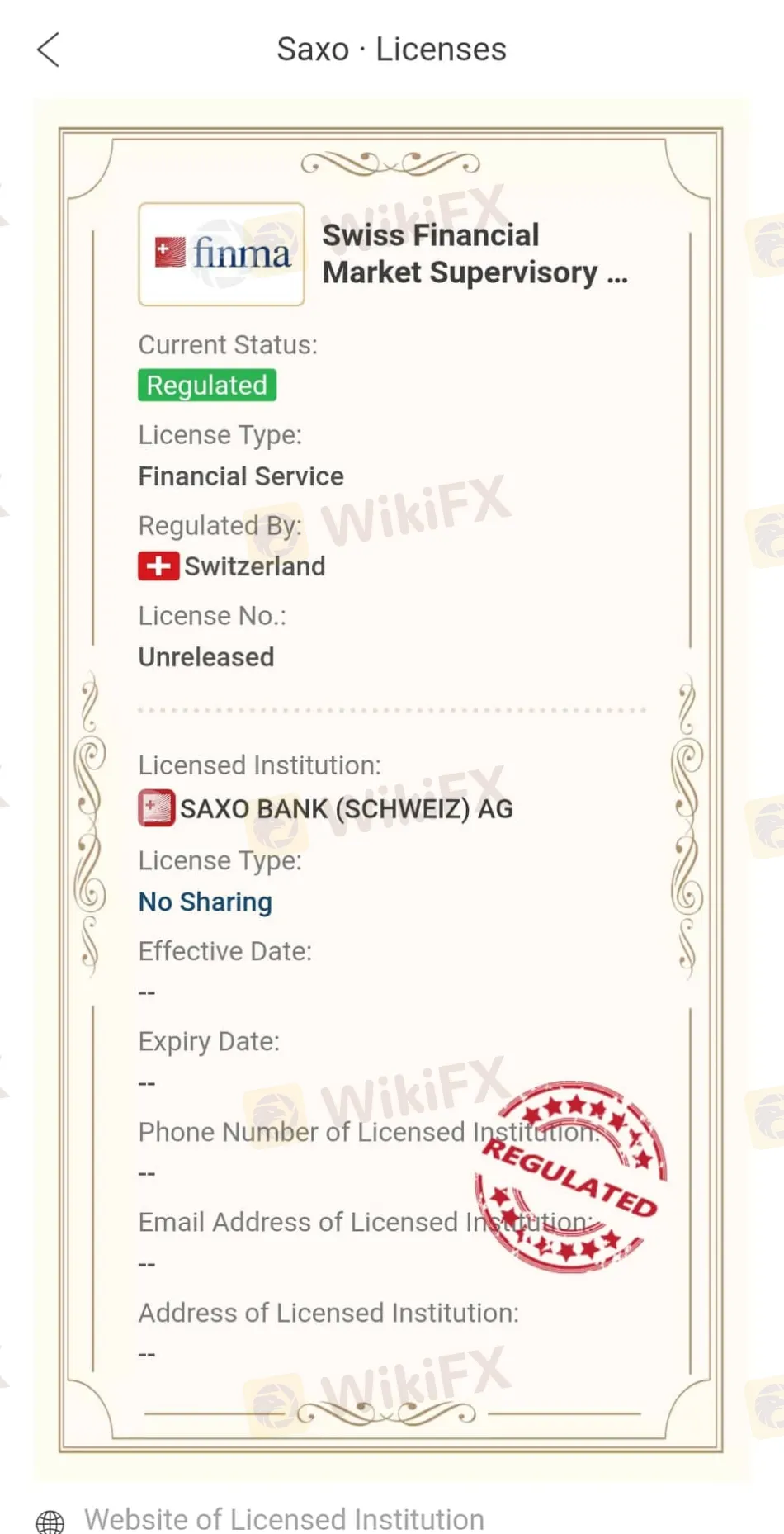

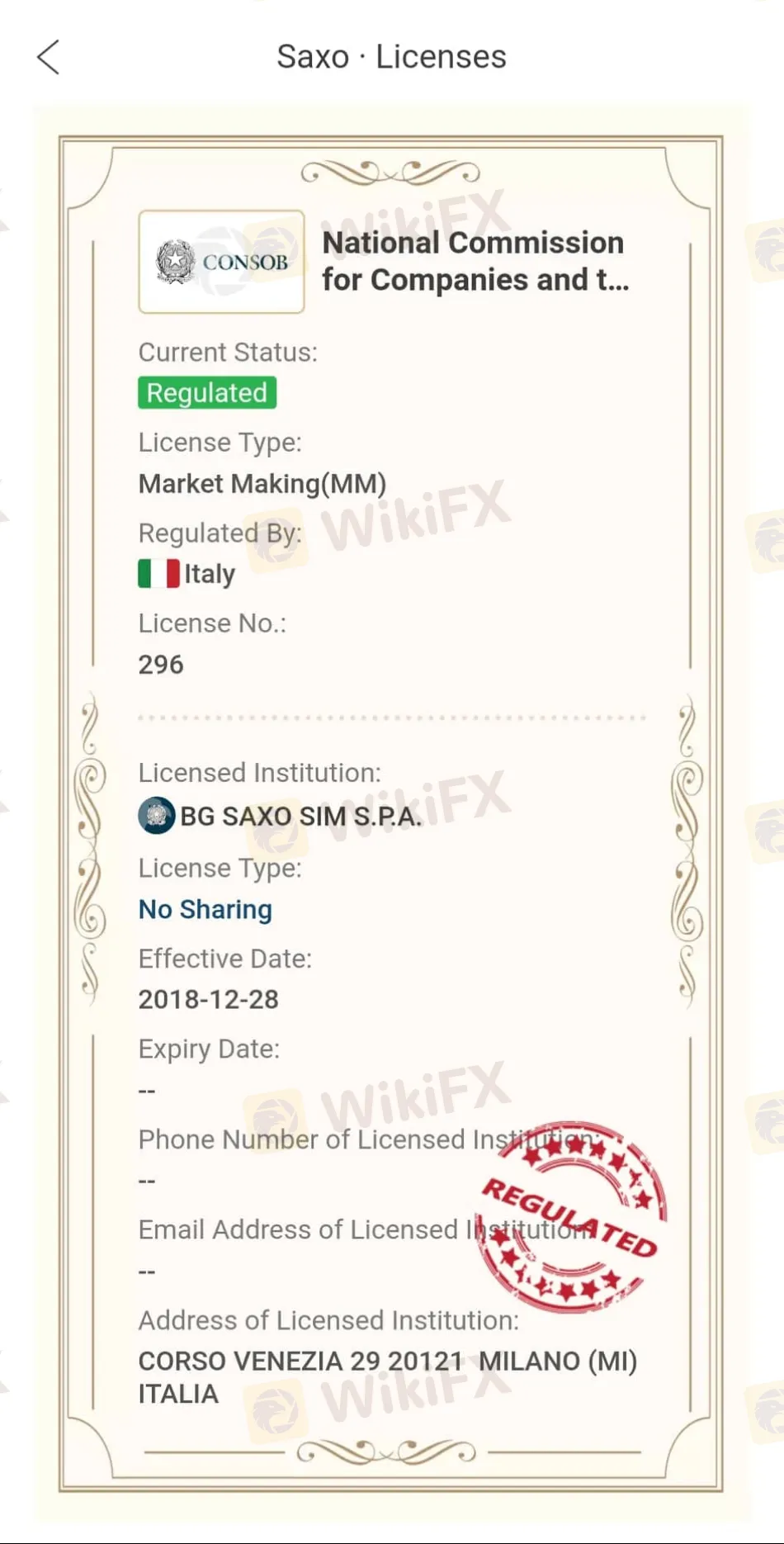

Saxo Bank has a solid score on the WikiFX App, which basically implies that Saxo Bank's regulation and validity to operate have been validated. It also has operations in France, Japan, Singapore, and Hong Kong. ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, and MAS are among the regulators that have overseen Saxo Bank.

LICENSES

What exactly is WikiFX?

Wikifx is a platform for searching worldwide company financial information. Its primary duty is to give the included foreign exchange trading organizations with basic information searching, regulatory license seeking, credit assessment, platform identification, and other services.

WikiFX, on the other hand, has over 37,000 brokers and is actively collaborating with 30 financial authorities in order to deliver reliable information to its users and traders.

Saxo Bank Information

Saxo Bank was founded in 1992 as a privately held enterprise. The bank's headquarters are in Copenhagen, Denmark, and it has distinguished itself as one of Europe's top retail brokerage innovators.

The bank's trade is secure because of the 10+ financial authorities, including the UK FCA. The bank is one of the world's top retail brokerage innovators, both in Europe and beyond.

Stay tuned for more information about Saxo Bank.

WikiFX App is available for free download on the App Store and Google Play Store.

Read more

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc