GFX-Some important Details about This Broker

Abstract:GFXRoyal is an offshore forex broker registered in Marshall Islands, offering currency trading services for both retail and professional traders. GFX claims that it offers five trading accounts for traders to choose from.

Note: GFX's official website - https://www.gfxroyal.com/ is currently inaccessible normally.

| GFX Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Marshall Islands |

| Regulation | No regulation |

| Market Instruments | Currency pairs, CFDs on indices, commodities, stocks, and cryptocurrencies |

| Demo Account | / |

| Leverage | Up to 1:5 (cryptocurrency) |

| Spread | 6.2 pips (Explorer Account) |

| Trading Platform | Web Trader |

| Min Deposit | $500 |

| Customer Support | Emai: support@gfxroyal.com |

GFXRoyal is an offshore forex broker registered in Marshall Islands, offering currency trading services for both retail and professional traders. GFX claims that it offers five trading accounts for traders to choose from.

GFXRoyal says that it is the trading name of GFX Finance who belongs to CAPITTAL LETTER GMBH, German Investment Firm Incorporation: HRB242418, 23/07/18.

Please note that this brokerage is not subject to any regulatory authorities, please be aware of the risk.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Inaccessible website |

| Various accounts choices | Lack of regulation |

| Wide spreads | |

| No MT4 or MT5 | |

| High minimum deposit | |

| Limited payment options | |

| Inactivity fee charged | |

| Only email support |

Is GFX Legit?

No, it is not regulated by the financial services regulatory authority in Marshall Islands, which means that the company lacks regulation from its registration site. Besides, AMF, a French regulatory authority issued a warning notice about this company. Therefore, please be aware of the potential risks!

What Can I Trade on GFX?

GFX offers several types of products, including currency pairs, CFDs on indices, commodities, stocks, and cryptocurrencies.

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| CFDs | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Leverage

Trading on cryptocurrencies can use leverage up to 1:5, while leverage for other particular instruments is not mentioned.

Account Type

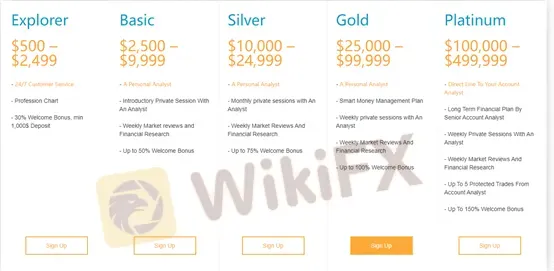

GFX provides 5 types of accounts, including Explorer, Basic, Silver, Gold, and Platinum.

| Account Type | Min Deposit | Max Deposit |

| Explorer | $500 | $,2499 |

| Basic | $2,500 | $9,999 |

| Silver | $10,000 | $24,999 |

| Gold | $25,000 | $99,999 |

| Platinum | $100,000 | $499,999 |

Trading Platform

GFX uses a web-based platform, and it does not support MT4 or MT5.

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Trader | ✔ | Web | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

GFX supports 3 types of payment options, including Wire Transfer, Vload, and Cashier. However, other details such as the processing time and fees are not clear.

Fees

If a trader did not login and trade from his account within three months, then his account will be subject to a deduction of 10% each month.

Read more

MTrading Users Report Withheld Funds and High Withdrawal Fees

Traders from Kenya and Thailand have had bad experiences with MTrading as they faced withdrawal restrictions, higher deposit fees, and refusal to release funds. Is MTrading safe to trade forex?

Valetax $35 No Deposit Bonus

Valetax has just upped the ante by offering a $35 no-deposit Welcome Bonus to new traders. Unlike many offers that require an initial deposit or come buried in fine print, Valetax’s bonus lets you begin trading on their MT4 platform—risk-free—immediately after verification. Here’s why this promotion stands out and how you can make the most of it.

Duhani Capital: A Scam Broker Hiding Behind Fake Promises?

Traders from the US, Pakistan, and Indonesia have notably raised complaints about Duhani Capital, a non-regulated broker. It has been proven to indulge in scammy practices, withholding traders’ funds, altering spreads without notifications and account terminations.

iFourX Scam Alert: Trapped Funds and Silent Support

Traders, including one from Japan, have raised concerns about iFourX, an unregulated broker, for their scammy tactics. The trader has witnessed blocked withdrawals, silent customer support, and restrictive account practices when dealing with the platform.

WikiFX Broker

Latest News

Forex Traders Shift Focus: Risk Management Over High Leverage in 2025

Yen's Dramatic Rebound: What Should Investors Do Now?

SEC Charges Dallas Trio in $91M Ponzi Scheme Defrauding Investors

MTrading Users Report Withheld Funds and High Withdrawal Fees

Will Gold Hit $4,000 in 2025? Key Drivers to Watch

How Two Simple Messages Led to a Million-Ringgit Disaster

Valetax $35 No Deposit Bonus

iFourX Scam Alert: Trapped Funds and Silent Support

The Trader’s Dilemma: Dead Cat Bounce vs. Genuine Recovery

He Lost RM558,000 Overnight: Are You Falling for the Same Scam?

Rate Calc