HOW WILL OPEC-JMMC MEETINGS AFFECT OIL PRICES?

Abstract:The JMMC was established following OPEC’s 171st Ministerial Conference Decision of 30 November 2016 and the subsequent Declaration of Cooperation made at the joint OPEC-non-OPEC ministerial meeting held on 10 December 2016.

The JMMC was established following OPECs 171st Ministerial Conference Decision of 30 November 2016 and the subsequent Declaration of Cooperation made at the joint OPEC-non-OPEC ministerial meeting held on 10 December 2016.

At the December meeting, 11 non-OPEC oil producers cooperated with the 13 OPEC Member Countries in a concerted effort to accelerate the rebalancing of the global oil market through an adjustment in combined production of 1.8 million barrels per day.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent, intergovernmental Organization, created at the Baghdad Conference on September 10–14, 1960, by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela.

The two joint organizations OPEC-JMMC arranged a meeting, which will take place on 2nd December, 2021. The meeting may possibly be virtual.

What will happen after the meeting?

The OPEC-JMMC meetings which will be hosted on Thursday, December 2 during the whole day attended by representatives from the 13 OPEC members and 11 other oil-rich nations. They will discuss a range of issues regarding energy markets and, most importantly, agree on how much oil they will produce.

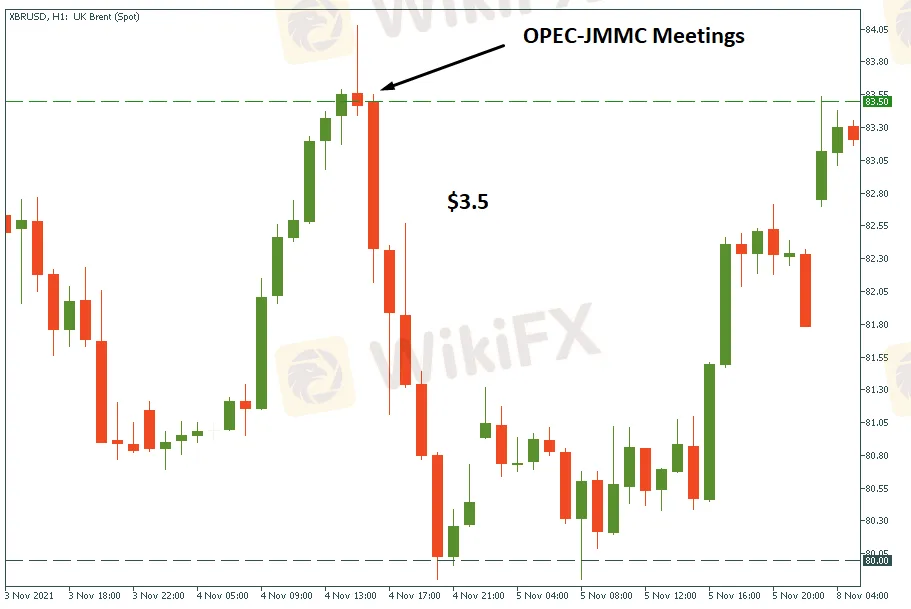

The last time the global supply was not changed, XBR/USD lost $3.5.

To use the OPEC-JMMC meetings and trade, below are the key notes to know?

• If the supply increases, the oil will likely weaken.

• If the supply decreases, the oil will likely strengthen.

Instruments to trade: XBR/USD, XTI/USD.

Read more

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

Webull and SK Growth complete their business combination, with Webull now trading under the ticker “BULL.” App hits 50 million downloads worldwide.

PrimeXBT Expands with Stock CFDs for Major Global Companies

PrimeXBT introduces stock CFDs, allowing trading of major US stocks like Amazon, Tesla, and MicroStrategy with crypto or fiat margin options.

TRADE.com UK Sold to NAGA Group Amid 2024 Revenue Drop

TRADE.com UK sold to NAGA Group for £1.24M after a 65% revenue drop and £346K loss in 2024, marking NAGA's UK return.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc