2025-04-28 12:39

IndustryThe role of news and events in currency markets

#CurrencyPairPrediction

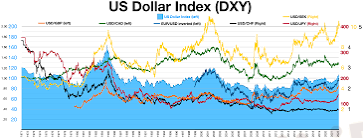

The role of news and events in currency markets is paramount, as they often trigger significant price volatility and directional shifts. Scheduled economic releases, such as inflation figures, employment data, GDP growth rates, and central bank announcements on interest rates, provide crucial insights into a country's economic health and future monetary policy. These releases can lead to rapid and substantial currency movements as traders react to the data and adjust their expectations.

Unscheduled events, including political developments, natural disasters, geopolitical tensions, and unexpected global crises, can also have a profound impact on currency valuations. These events often introduce uncertainty and can lead to sudden shifts in investor sentiment, driving flows towards safe-haven currencies or away from those perceived as riskier. The market's interpretation of news and events, rather than just the raw data itself, is a key factor in determining the resulting currency price action. Therefore, staying informed about the global economic and political landscape is essential for anyone involved in currency prediction and trading.

Like 0

nurul2919

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The role of news and events in currency markets

Malaysia | 2025-04-28 12:39

Malaysia | 2025-04-28 12:39#CurrencyPairPrediction

The role of news and events in currency markets is paramount, as they often trigger significant price volatility and directional shifts. Scheduled economic releases, such as inflation figures, employment data, GDP growth rates, and central bank announcements on interest rates, provide crucial insights into a country's economic health and future monetary policy. These releases can lead to rapid and substantial currency movements as traders react to the data and adjust their expectations.

Unscheduled events, including political developments, natural disasters, geopolitical tensions, and unexpected global crises, can also have a profound impact on currency valuations. These events often introduce uncertainty and can lead to sudden shifts in investor sentiment, driving flows towards safe-haven currencies or away from those perceived as riskier. The market's interpretation of news and events, rather than just the raw data itself, is a key factor in determining the resulting currency price action. Therefore, staying informed about the global economic and political landscape is essential for anyone involved in currency prediction and trading.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.