2025-04-25 14:13

IndustryThe landscape of safe-haven assets is not static

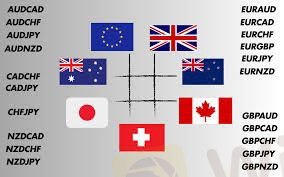

#CurrencyPairPrediction

The landscape of safe-haven assets is not static, and discussions around emerging safe havens are gaining traction. While the Yen, Franc, and Dollar have historically dominated this space, factors like shifting global economic power, the rise of new financial centers, and even the potential for certain commodities or digital assets to offer stability are being considered. For instance, the Singapore Dollar (SGD) or the Canadian Dollar (CAD), with their relatively stable economies and strong financial systems, are sometimes viewed as regional or alternative safe havens. Even gold, while not a currency, is a traditional store of value that sees increased demand during uncertainty. The long-term dominance of the traditional safe havens may be challenged as the global financial order evolves, prompting investors to consider a broader range of assets for protection during turbulent times.

Like 0

de hua

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

The landscape of safe-haven assets is not static

Malaysia | 2025-04-25 14:13

Malaysia | 2025-04-25 14:13#CurrencyPairPrediction

The landscape of safe-haven assets is not static, and discussions around emerging safe havens are gaining traction. While the Yen, Franc, and Dollar have historically dominated this space, factors like shifting global economic power, the rise of new financial centers, and even the potential for certain commodities or digital assets to offer stability are being considered. For instance, the Singapore Dollar (SGD) or the Canadian Dollar (CAD), with their relatively stable economies and strong financial systems, are sometimes viewed as regional or alternative safe havens. Even gold, while not a currency, is a traditional store of value that sees increased demand during uncertainty. The long-term dominance of the traditional safe havens may be challenged as the global financial order evolves, prompting investors to consider a broader range of assets for protection during turbulent times.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.