2025-04-25 14:06

IndustryA key characteristic of safe-haven currencies

#CurrencyPairPrediction

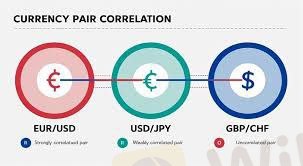

A key characteristic of safe-haven currencies is their tendency to exhibit an inverse relationship with riskier assets. When investor confidence wanes and uncertainty rises, capital often flows out of assets like equities, high-yield bonds, and emerging market currencies and into the perceived safety of the Yen, Franc, and sometimes the Dollar. This "flight to safety" phenomenon results in a negative correlation between the performance of these safe havens and risk assets. For example, during periods of strong economic growth and market optimism, we often see investors favoring higher-yielding, albeit riskier, investments, leading to potential depreciation in safe-haven currencies. Conversely, during market downturns or periods of heightened risk aversion, the demand for and value of safe havens typically increases as investors seek to preserve capital rather than chase higher returns. Understanding this inverse correlation is fundamental for risk management and asset allocation strategies.

Like 0

FX6584323772

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

A key characteristic of safe-haven currencies

Malaysia | 2025-04-25 14:06

Malaysia | 2025-04-25 14:06#CurrencyPairPrediction

A key characteristic of safe-haven currencies is their tendency to exhibit an inverse relationship with riskier assets. When investor confidence wanes and uncertainty rises, capital often flows out of assets like equities, high-yield bonds, and emerging market currencies and into the perceived safety of the Yen, Franc, and sometimes the Dollar. This "flight to safety" phenomenon results in a negative correlation between the performance of these safe havens and risk assets. For example, during periods of strong economic growth and market optimism, we often see investors favoring higher-yielding, albeit riskier, investments, leading to potential depreciation in safe-haven currencies. Conversely, during market downturns or periods of heightened risk aversion, the demand for and value of safe havens typically increases as investors seek to preserve capital rather than chase higher returns. Understanding this inverse correlation is fundamental for risk management and asset allocation strategies.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.