2025-04-25 13:26

IndustryLiquidity in forex isn't just a simple on/off

#CurrencyPairPrediction

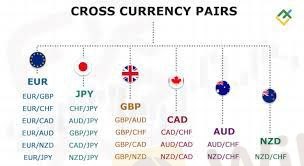

Liquidity in forex isn't just a simple on/off switch; it encompasses several key dimensions that traders need to understand. One crucial aspect is market depth, which refers to the volume of buy and sell orders available at various price levels. A deep market can absorb larger trades without causing significant price fluctuations, offering better execution.

Another vital dimension is the tightness of spreads, the difference between the buying and selling price. Highly liquid markets typically exhibit tighter spreads due to fierce competition among participants. Finally, market resilience describes the market's ability to quickly recover from large orders or shocks without prolonged periods of illiquidity. Understanding these facets provides a more comprehensive view of how easily and efficiently trades can be executed in different currency pairs and market conditions.

Like 0

meena3737

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Liquidity in forex isn't just a simple on/off

Malaysia | 2025-04-25 13:26

Malaysia | 2025-04-25 13:26#CurrencyPairPrediction

Liquidity in forex isn't just a simple on/off switch; it encompasses several key dimensions that traders need to understand. One crucial aspect is market depth, which refers to the volume of buy and sell orders available at various price levels. A deep market can absorb larger trades without causing significant price fluctuations, offering better execution.

Another vital dimension is the tightness of spreads, the difference between the buying and selling price. Highly liquid markets typically exhibit tighter spreads due to fierce competition among participants. Finally, market resilience describes the market's ability to quickly recover from large orders or shocks without prolonged periods of illiquidity. Understanding these facets provides a more comprehensive view of how easily and efficiently trades can be executed in different currency pairs and market conditions.

Like 0

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.