TRADE.COM Spreads, leverage, minimum deposit Revealed

Abstract:TRADE.COM presents itself as a Cyprus-based broker that provides its customers with supreme trading platforms and many classes of trading assets. It also claims that it offers pretty competitive low spreads and a choice of four account types.

| TRADE.COM Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Cyprus |

| Regulation | Regulated by CySEC (Cyprus) |

| Market Instruments | Forex, Indices, Commodities, Stocks, ETFs, Crypto |

| Demo Account | ✅ |

| Leverage | Up to 1:300 |

| Spread | From 1.9 pips (EUR/USD, Silver account) |

| Trading Platform | WebTrader, MetaTrader 5 (MT5) |

| Min Deposit | $100 |

| Customer Support | Email: support@trade.com |

| Online chat | |

TRADE.COM Information

TRADE.COM is a Cyprus-based broker founded in 1999, regulated by CySEC. It offers access to over 2,100 instruments and multiple account types suited to different experience levels. Although regulated, the broker is associated with clone license claims in the UK and South Africa, requiring users to verify entity details carefully.

Pros and Cons

| Pros | Cons |

| Regulated by CySEC | Linked to suspicious clone licenses (FCA, FSCA) |

| Offers MT5 and WebTrader platforms | No MetaTrader 4 or cTrader support |

| Multiple account types with flexible trading conditions | Minimum deposit for better accounts is relatively high |

Is TRADE.COM Legit?

TRADE.COM is partially legitimate. It is regulated by CySEC (Cyprus) under Trade Capital Markets (TCM) Ltd, with license number 227/14.

However, it is also linked to suspicious clone licenses in the UK (FCA) and South Africa (FSCA). These clones use similar names but have different entities or websites, indicating they are fake licenses meant to mislead users. Always verify the brokers domain and legal entity with the official regulator.

| Regulatory Status | Regulated By | Licensed Institution | License Type | License Number |

| Regulated | CySEC (Cyprus) | Trade Capital Markets (TCM) Ltd | Market Maker (MM) | 227/14 |

| Suspicious Clone | FCA (United Kingdom) | Trade Capital UK (TCUK) Ltd | Straight Through Processing (STP) | 738538 |

| Suspicious Clone | FSCA (South Africa) | Trade Capital Markets (TCM) Ltd | Financial Service Corporate | 47857 |

What Can I Trade on TRADE.COM?

TRADE.COM offers over 2,100 instruments, including forex, indices, commodities, stocks, ETFs, and cryptocurrencies, allowing traders to access major global markets. The platform supports over 30 ETFs and multiple major currency pairs and indices.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ✅ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ✅ |

| ETF | ✅ |

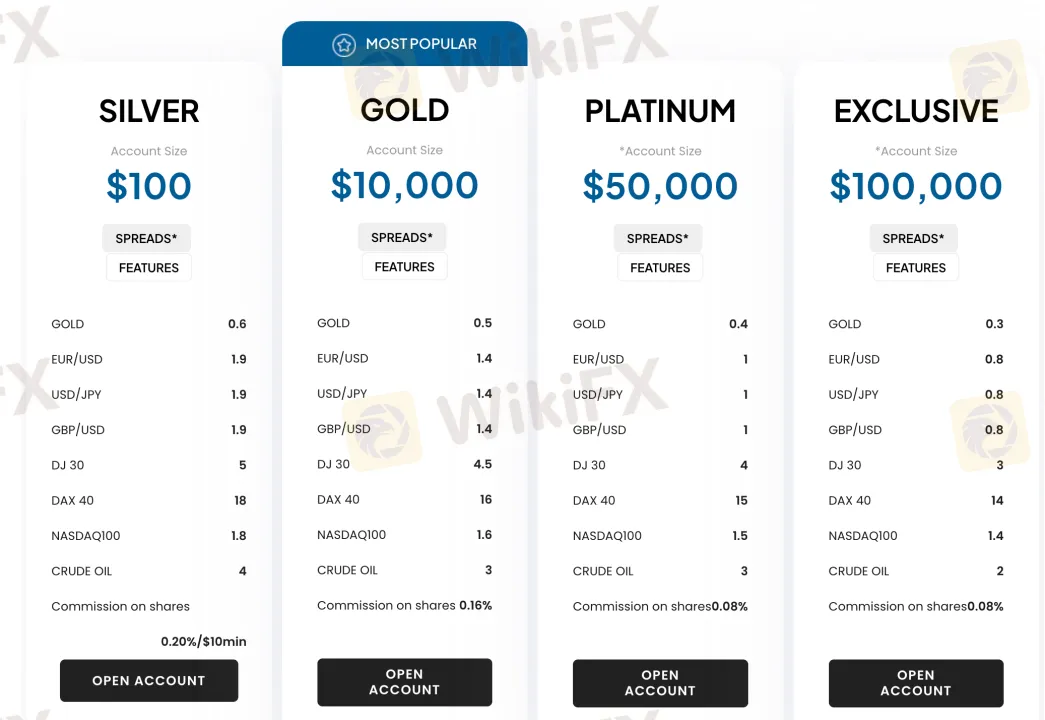

Account Types

TRADE.COM offers four types of live trading accounts: Silver, Gold, Platinum, and Exclusive, each designed for different levels of trader experience and investment size. The broker also provides both a demo account for practice and an Islamic account for clients who require swap-free trading.

| Account Type | Min Deposit | EUR/USD Spread | Commission on Shares | Best For |

| Silver | $100 | 1.9 pips | 0.20% / $10 min | Beginners or low-capital traders |

| Gold | $10,000 | 1.4 pips | 0.16% | Intermediate traders (most popular) |

| Platinum | $50,000 | 1.0 pips | 0.08% | Active or semi-professional traders |

| Exclusive | $100,000 | 0.8 pips | 0.08% | High-net-worth or professional traders |

Leverage

TRADE.COM offers leverage of up to 1:300, depending on the instrument and account type. Leverage allows traders to control larger positions with smaller capital, amplifying both potential profits and losses.

TRADE.COM Fees

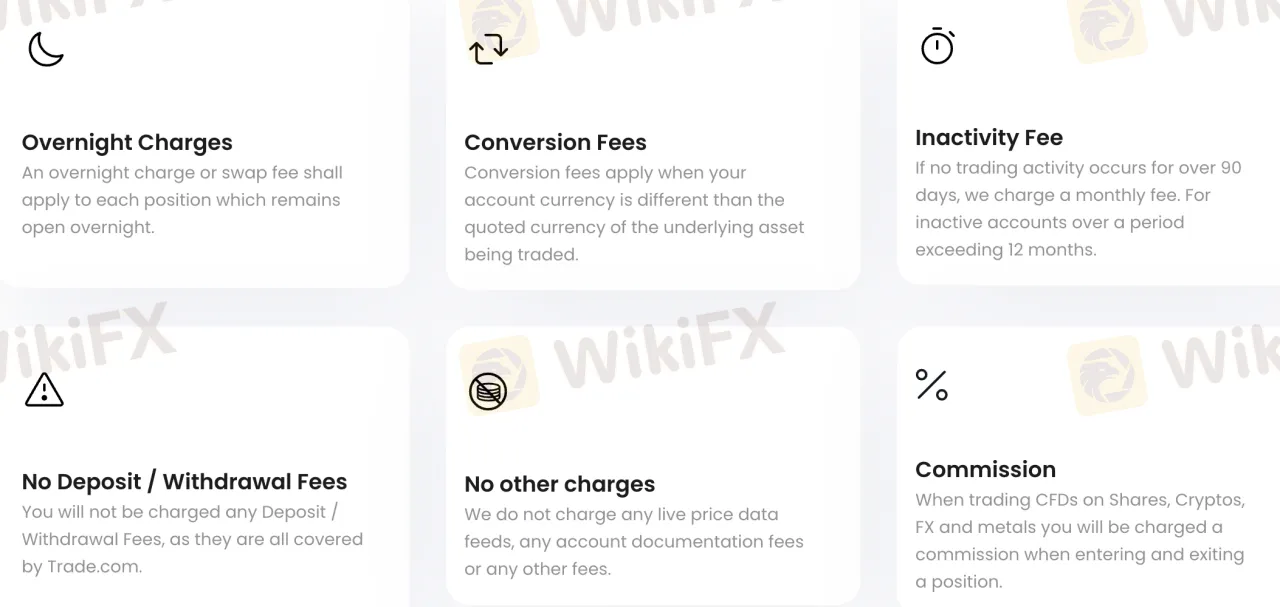

Compared to industry norms, TRADE.COM's fees are reasonable. Depending on account type, trading fees change; higher-tier accounts have tighter spreads and cheaper commissions. For instance, share commissions vary from 0.20% to 0.08% and EUR/USD spreads run from 1.9 pips (Silver) to 0.8 pips (Exclusive). The platform provides swap-free Islamic accounts upon request but charges regular overnight swap fees on open positions.

| Account Type | EUR/USD (pips) | Crude Oil (pips) | Commission on Shares |

| Silver | 1.9 | 4 | 0.20% / $10 minimum |

| Gold | 1.4 | 3 | 0.16% |

| Platinum | 1 | 3 | 0.08% |

| Exclusive | 0.8 | 2 | 0.08% |

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | $0 – Free |

| Withdrawal Fee | $0 – Free (covered by TRADE.COM) |

| Inactivity Fee | Charged monthly after 90 days of inactivity; increases after 12 months |

Trading Platform

TRADE.COM supports both a proprietary WebTrader and the advanced MetaTrader 5 platform, but does not support MT4 or cTrader.

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| WebTrader | ✔ | Web (browser-based) | Beginners and casual traders looking for simplicity and speed |

| MetaTrader 5 (MT5) | ✔ | Windows, macOS, iOS, Android | Intermediate to advanced traders needing advanced tools |

| MetaTrader 4 (MT4) | ❌ | – | – |

| cTrader | ❌ | – | – |

Deposit and Withdrawal

IronTrade does not explicitly charge any deposit or withdrawal fees, but the processing time and possible third-party charges depend on the payment method used. The minimum deposit amount is $10.

Deposit & Withdrawal Methods

| Method | Min. Amount | Fees | Processing Time |

| Visa / Mastercard / Maestro | $10 | Not specified (likely free, but may vary) | From seconds to several days (depends on processor) |

| Bank Wire Transfer | $10 | Not specified (likely free, but depends on bank) | Up to 45 business days |

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Rate Calc