User Reviews

More

User comment

10

CommentsWrite a review

2022-11-27 11:07

2022-11-27 11:07

2023-02-15 17:36

2023-02-15 17:36

Score

5-10 years

5-10 yearsRegulated in South Africa

Financial Service Corporate

MT5 Full License

Suspicious Overrun

Medium potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index3.51

Business Index7.30

Risk Management Index0.00

Software Index9.59

License Index3.51

Single Core

1G

40G

Danger

More

Company Name

IFX BROKERS HOLDINGS (PTY) LTD

Company Abbreviation

IFX Brokers

Platform registered country and region

South Africa

Company website

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| IFX Brokers Review Summary | |

| Founded | 2016 |

| Registered Country/Region | South Africa |

| Regulation | FSCA (exceeded) |

| Market Instruments | Forex, indices, commodities, cryptos, and shares |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 1.3 pips (iFX Standard account) |

| Trading Platform | MT4, MT5 |

| Minimum Deposit | $10 |

| Customer Support | Contact form |

| Phone: +27 87 944 7273 07:30-16:30 GMT (Monday-Thursday) / 07:30-16:00 GMT (Friday) | |

| Email: support@iFXbrokers.com | |

| Address: 79 Da Gama Road, Jeffreys Bay, South Africa | |

| Regional Restrictions | Afghanistan, Canada, Democratic Peoples Republic of Korea, EU Member States, Ghana, Iceland, Indonesia, Iran, Iraq, Liechtenstein, Libya, Norway, Mongolia, Myanmar, Nicaragua, Panama, Somalia, Syrian Arab Republic, UAE, Uganda, United Kingdom, United States of America, United States Minor Outlying Islands, Yemen, Zimbabwe |

IFX Brokers, a trading name of IFX Brokers Holdings (Pty) Ltd, is allegedly a multi-asset broker registered in South Africa that claims to provide its clients with various tradable financial instruments with flexible leverage up to 1:1000 and floating spreads from 0 pips on the MT4 and MT5 trading platforms via 6 different live account type. However, its FSCA license has been exceeded.

| Pros | Cons |

| Wide range of trading instruments | Exceeded FSCA license |

| MT4 and MT5 provided | No 24/7 customer support |

| Flexible leverage ratios | Regional restrictions |

| Various methods to deposit |

IFX Brokers is not regulated well. Its license of the Financial Sector Conduct Authority (FSCA) has been exceeded, holding Financial Service Corporate license with No. 48021.

| Financial Sector Conduct Authority (FSCA) | |

| Regulatory Status | Exceeded |

| Regulated by | South Africa |

| Licensed Institution | IFX BROKERS HOLDINGS (PTY) LTD |

| Licensed Type | Financial Service Corporate |

| Licensed Number | 48021 |

IFX Brokers supports trading forex, indices, commodities, crypto, and shares. There's no ETFs trading or bonds trading. But overall, you still have a good mix of investment options.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

IFX Brokers has six kinds of accounts: the iFX Premium, iFX Standard, iFX Vip, iFX Islamic, iFX Cent, and iFX Raw accounts. The minimum deposit requirements for each account are as follows:

| Account Type | Minimum Deposit |

| iFX Islamic | $10 |

| iFX Cent | |

| iFX Raw | $250 |

| iFX Premium | |

| iFX Standard | |

| iFX Vip | $1,000 |

IFX Brokers offers flexible leverage up to 1:1000 for accounts. However, high leverage can magnify profits, but it also significantly amplifies the potential for losses.

| Account Type | Maximum Leverage |

| iFX Premium | 1:500 |

| iFX Standard | |

| iFX Vip | |

| iFX Islamic | |

| iFX Raw | |

| iFX Cent | 1:1000 |

IFX Brokers sets rather high spreads for their accounts. In addition, a commission of $6 is levied on the iFX Vip and the iFX Raw accounts. No commission is charged for the other accounts.

| Account Type | Spread | Commission |

| iFX Raw | From 0 pips | $6 |

| iFX Vip | From 0.5 pips | |

| iFX Premium | From 1 pip | ❌ |

| iFX Standard | From 1.3 pips | |

| iFX Islamic | ||

| iFX Cent | From 1.6 pips |

iFX Brokers offers traders access to both the Metatrader 4 and Metatrader 5 platforms, which are suitable for both beginners and experienced traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web/ Phone/ Desktop | Beginners |

| MT5 | ✔ | Web/ Phone/ Desktop | Experienced traders |

IFX Brokers offers a variety of deposit methods, including popular options like Visa, Mastercard, OZOW, PAYFAST, SKRILL, NETELLER, wire transfer, digital currencies like Bitcoin, Ethereum, and more.

Deposit Options

| Deposit Method | Deposit Currency | Deposit Fees | Deposit Processing Time |

| OZOW | ZAR | ❌ | Instant |

| PAYFAST | |||

| MASTER CARD (Supported by PAYFAST) | |||

| VISA (Supported by PAYFAST) | |||

| WIRE TRANSFER | 2.50% | 24 - 48 business hours | |

| SKRILL | USD/ZAR | ❌ | Instant |

| NETELLER | |||

| DIGITAL CURRENCIES | USD |

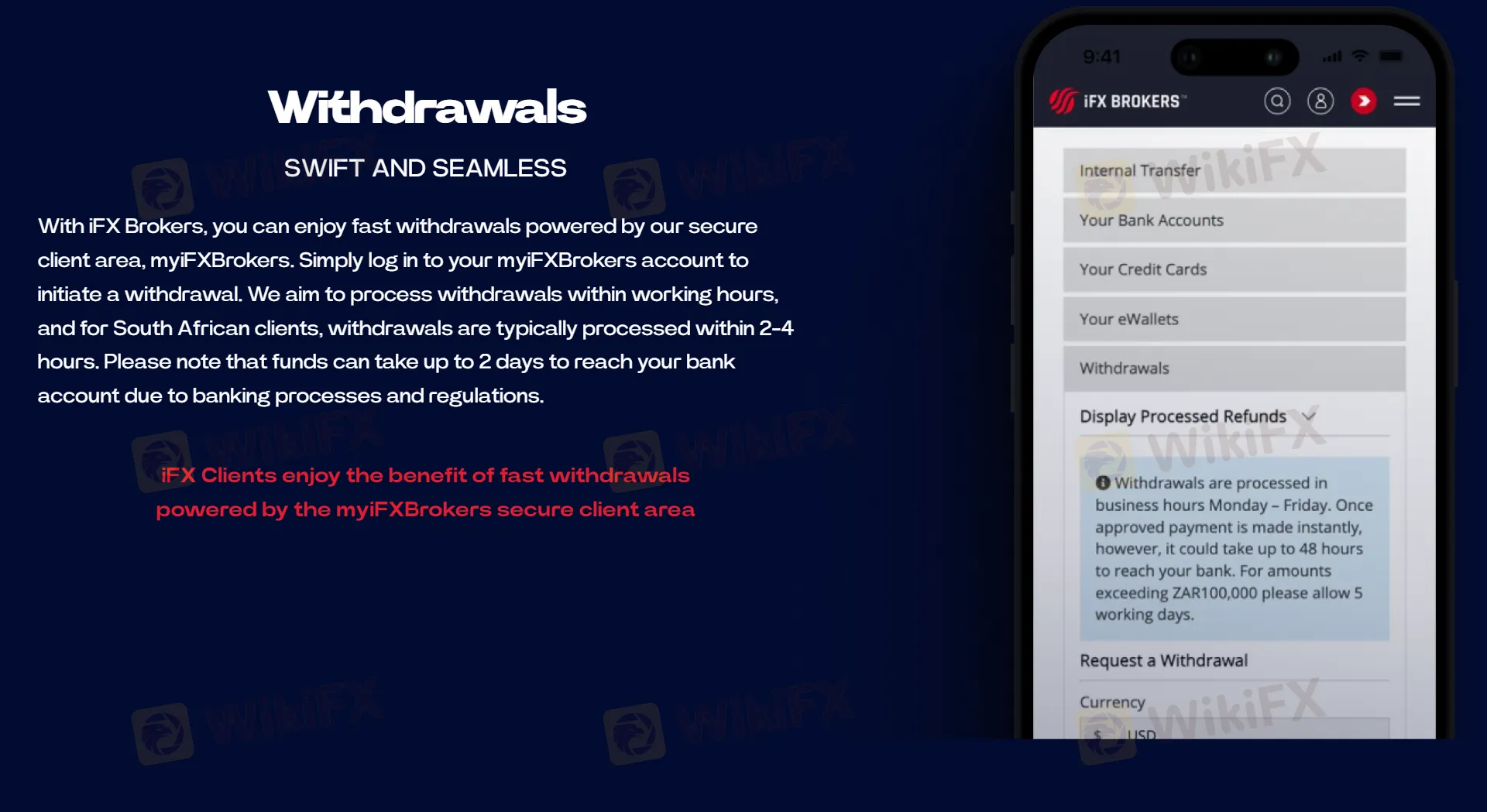

As for withdrawal, you can log in to your myiFXBrokers account to initiate a withdrawal. Withdrawals are typically processed within 2-4 hours

Commitment, transparency, and trust are the most important traits that a client looks for in a broker or trading organization. It's encouraging to realize that IFX Brokers, a South African internet trading broker system, was formed on these principles. For its clientele all across the world, the firm has come to represent all of this and more.

WikiFX

WikiFX

IFX Brokers is a South African-based online trading broker that offers its clientele ground-breaking technology. IFX Brokers facilitates one-stop trading and investing experience for private and institutional clients, providing them with the highly advanced MetaTrader 4 and Metatrader 5 platforms for online trading of more than 200 instruments across 6 asset classes.

WikiFX

WikiFX

The BIS Innovation Hub and the South African Reserve Bank have announced the completion of a prototype system that allows international settlements to be made using central bank digital currencies.

WikiFX

WikiFX

A strong rand typically makes all South Africans happy since it represents a vote of confidence in the country. The rand, on the other hand, is being propped up by expectations that the South African Reserve Bank would undertake a more aggressive rate-hiking cycle to head off any stagflationary price shocks in food and petrol, while maintaining in lockstep with the US Federal Reserve's more hawkish posture.

WikiFX

WikiFX

The Central Bank of Nigeria (CBN) has established the RT200 FX Program, which aims to boost foreign currency revenues.

WikiFX

WikiFX

The fact that there are many brokers today in South Africa; seeking to attract traders to invest with them, makes it very difficult to choose the best broker for trading. Not all brokers are suitable for traders. Some are fraudulent sites manifesting as brokers and seeking for traders to scam. We have therefore provided in this article the basic guidelines for choosing a broker for trading; bothering on their proof of regulation and approval from WikiFX.

WikiFX

WikiFX

Forex trading has become increasingly popular in Nigeria today. With the recent ban placed on all deposit Money Banks (DMBs) in Nigeria not to permit any form of crypto transactions; many Nigerians have resorted to forex trading which is in itself a legal business in Nigeria. To this end, most forex brokers operating in Nigeria have deemed it necessary to provide multiple account types for the Nigerian trader to choose from. Hence this work has elaborated on the five different types of accounts that Nigerian traders could choose after they have registered with their chosen broker.

WikiFX

WikiFX

Skrill is a popular online payment provider that is partnered with globally-recognised forex brokers, providing forex traders with a fast, reliable, and secure way to transfer funds from a trading account to their bank accounts. Of all the forex brokers that accept the use of Skrill online payments, the following are the best forex brokers in South Africa that accept Skrill deposits and withdrawals.

WikiFX

WikiFX

More

User comment

10

CommentsWrite a review

2022-11-27 11:07

2022-11-27 11:07

2023-02-15 17:36

2023-02-15 17:36