User Reviews

More

User comment

6

CommentsWrite a review

2024-07-24 19:00

2024-07-24 19:00

2023-02-24 15:59

2023-02-24 15:59

Score

5-10 years

5-10 yearsSuspicious Regulatory License

MT4 Full License

United Kingdom Appointed Representative(AR) Revoked

High potential risk

Influence

Add brokers

Comparison

Quantity 12

Exposure

Score

Regulatory Index0.00

Business Index7.54

Risk Management Index0.00

Software Index9.08

License Index0.00

Single Core

1G

40G

Danger

More

Company Name

MYFX Markets Pty Ltd

Company Abbreviation

MYFX Markets

Platform registered country and region

New Zealand

Company website

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| Myfx Markets | Basic Information |

| Registered Country/Region | United Kingdom |

| Regulations | N/A |

| Tradable Assets | FX Trading、Index CFDS、Metals & Commodities,、Crypto Currencies |

| Account Types | MT4 Standard Account, MT4 Pro Account, MT5 Standard Account, MT5 Pro Account |

| Minimum Deposit | $200 |

| Maximum Leverage | 500:1 |

| Minimum spread | from 0.0 pips |

| Deposit & Withdrawal | Bitwallet, Bank Wire, Bitcoin, USDT Deposit, and Credit Card |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Customer Support | Phone, Email, Live chat, |

| Education Resources | N/A |

MyFX Markets is a broker that was founded in 2013. MyFX Markets is registered as Milson's Fintech which is incorporated in the republic of Mauritius. While it offers an extensive selection of market instruments, including over 50 currency pairs, cryptocurrencies, metals, and commodities, it operates without regulatory oversight.Traders can choose from different account types, each offering unique features and trading conditions.

Myfx Markets offers a maximum leverage of 500:1 across all account types. This allows traders to control larger positions in the market with a smaller capital investment, but it also increases the risk associated with trading. The brokerage provides advanced trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their comprehensive charting tools, technical analysis capabilities, and automated trading options. Deposits and withdrawals can be made using various methods, including Bitwallet, bank wire, Bitcoin, USDT deposit, and credit card.

Myfx Markets is registered in the United Kingdom but operates without any licensing or regulation from regulatory authorities. As an unregulated entity, it does not fall under the supervision of any regulatory body. Traders should be aware that engaging with an unregulated broker carries inherent risks.

Myfx Markets offers a wide range of market instruments for traders to choose from. Here are the categories of market instruments available:

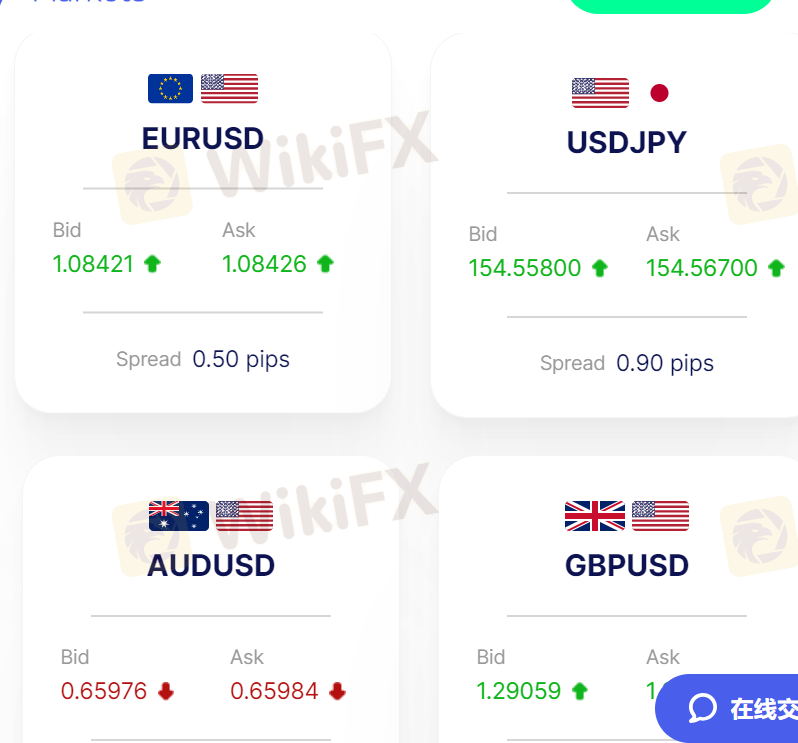

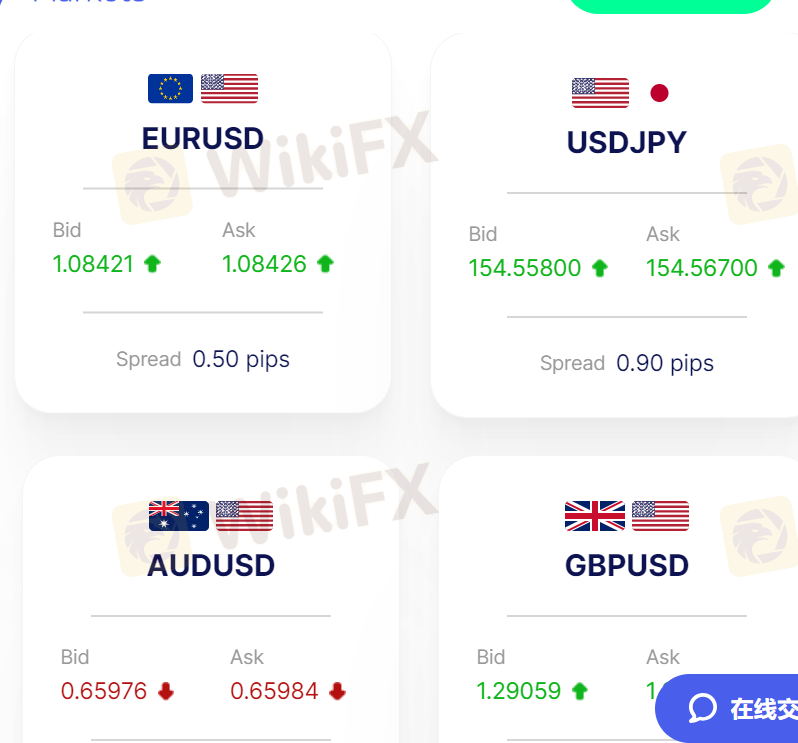

FX TRADING: Myfx Markets provides a comprehensive selection of currency pairs for foreign exchange (FX) trading. Traders can participate in major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as numerous minor and exotic currency pairs. FX trading allows investors to speculate on the price movements of different currencies and take advantage of market fluctuations.

INDEX CFD'S: Myfx Markets offers Contracts for Difference (CFDs) on various stock market indices. Traders can trade popular indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 30. Index CFDs enable traders to speculate on the overall performance of a specific stock market index without owning the underlying assets. This provides an opportunity to profit from both rising and falling markets.

METALS & COMMODITIES: Myfx Markets allows traders to trade precious metals and commodities. This includes popular metals like gold and silver, as well as commodities like oil, natural gas, and agricultural products. Trading metals and commodities provides diversification and the opportunity to profit from price movements in these markets.

CRYPTO CURRENCIES: Myfx Markets also offers trading in cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin. Traders can take advantage of the high volatility and potential profitability of the crypto market. Cryptocurrency trading allows investors to speculate on the price movements of digital currencies without actually owning them.

Overall, Myfx Markets provides a diverse range of market instruments, including FX trading, index CFDs, metals and commodities, and cryptocurrencies, catering to the different trading preferences and strategies of its clients.

Myfx Markets offers several advantages, including a wide range of market instruments for trading, flexible account types, high maximum Leverage, advanced trading platforms (MT4 and MT5), and multiple customer support channels for assistance. However, it's important to consider the drawbacks, such as the lack of regulatory oversight as an unlicensed broker, which poses inherent risks to traders. Furthermore, the absence of educational resources on the official website may limit learning opportunities for traders. Conducting thorough research, practicing responsible trading, and seeking education from external sources are crucial to mitigate the risks associated with trading on Myfx Markets.

| Pros | Cons |

| Diverse Market Instruments | Lack of Regulation |

| Multiple Account Types | Limited Educational Resources |

| User-Friendly Trading Platforms | High Minimum Deposit Requirements |

| Customer Support | Commission Charges |

| Maximum Leverage: Up to 500:1 |

Myfx Markets offers a variety of account types to satisfy different trading needs and preferences. Here are the details of the four account types available:

MT4 STANDARD ACCOUNT: This account type features a starting spread of 0.6 pips with no commission charges. The maximum leverage offered is 500:1. Traders using this account type can access the popular MetaTrader 4 platform.

MT4 PRO ACCOUNT: The MT4 PRO account offers a starting spread of 0.0 pips, making it a favorable choice for traders seeking tight spreads. However, there is a commission charge of $7 per lot traded. Similar to the MT4 Standard account, and the maximum leverage available is 500:1. Traders using this account type also have access to the powerful MetaTrader 4 platform.

MT5 STANDARD ACCOUNT: Myfx Markets provides the MT5 Standard account with a starting spread of 0.6 pips and no commission charges. The maximum leverage offered is 500:1. Traders opting for this account type can utilize the advanced features and enhanced capabilities of the MetaTrader 5 platform.

MT5 PRO ACCOUNT: The MT5 PRO account offers traders a starting spread of 0.0 pips, similar to the MT4 PRO account. It also charges a commission of $7 per lot traded. The minimum deposit requirement and maximum leverage offered are the same as the other account types, providing a maximum leverage of 500:1. Traders using this account type can take advantage of the advanced features and tools provided by the MetaTrader 5 platform.

Although the account table of this broker clearly states that there is no minimum deposit requirement, the FAQ section states that the minimum requirement for a Standard Account is $200, while the Pro Account requires a minimum of $1000. It is advisable to confirm the specific information with their customer service for accurate details.

Opening an account with Myfx Markets involves several steps to ensure a smooth and efficient process. Here is a general overview of the account opening procedure:

Registration: Visit the Myfx Markets website and navigate to the account registration page. Provide the required personal information, such as name, email address, and phone number. Create a unique username and password for account access.

2. Account Type Selection: Choose the preferred account type that aligns with your trading needs and objectives. Consider factors such as leverage, spreads, and commissions when making your selection.

3. Submit Documentation: Complete the verification process by submitting the necessary identification documents. This typically includes providing a valid ID (such as a passport or driver's license) and proof of address (such as a utility bill or bank statement).

4. Account Funding: Deposit funds into your trading account. Follow the provided instructions to select a deposit method, such as bank transfer, credit card, or cryptocurrency. Ensure that you meet the minimum deposit requirement specified for your chosen account type.

5. Account Activation: Once your documents and funds have been verified, your account will be activated. You will receive confirmation and login details to access your trading account through the provided trading platform.

The Standard and Pro Account each come with a leverageof 500:1. In this respect, MyFX Markets is different than other brokerage firms. Most of the time, brokers will either limit your leverage as you deposit more funds (to minimize risks) or, conversely, increase the buying power when an experienced trader has a sizable account balance (therefore, incentivizing them to transfer more capital). MyFX Markets takes a middle ground by giving different accounts the same leverage. The minimum deposit requirements are $200 and $1,000 to open a Standard and Pro Account, respectively. No information about the minimum deposit per transaction is provided.

MyFX Markets has 0.01 lots as the minimum trade size and 50 lots as the maximum trade size.

t Myfx Markets, the spreads and commissions vary depending on the account type. The MT4 STANDARD ACCOUNT and MT5 STANDARD ACCOUNT offer a starting spread of 0.6 pips with zero commissions. This means that traders using these accounts can enjoy pricing without incurring any additional commission charges. On the other hand, the MT4 PRO ACCOUNT and MT5 PRO ACCOUNT feature a starting spread of 0.0 pips, which provides traders with tighter pricing. However, these accounts do charge a commission of $7 per lot traded.

Myfx Markets provides traders with advanced and user-friendly trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4) is a widely recognized platform known for its comprehensive charting capabilities, technical analysis tools, and automated trading options. It offers a customizable interface, allowing traders to tailor their trading experience. With MT4, traders can access a vast range of financial instruments, execute trades with precision, and utilize expert advisors for automated trading strategies.

MetaTrader 5 (MT5) builds upon the features of MT4 and introduces additional functionalities. It offers an enhanced interface, improved charting tools, and expanded order types. MT5 also allows traders to access a wider range of markets, including stocks, futures, and options, in addition to Forex trading.

Myfx Markets offers deposit and withdrawal options for its clients. The minimum deposit requirement for the Standard Account is $200, while for the Pro Account, it is $1000.

Traders can choose from a variety of deposit methods, including Bitwallet, Bank Wire, Bitcoin, USDT Deposit, and Credit Card. For withdrawals, traders can submit a withdrawal request from their Client Office. It's important to note that funds can only be sent back to an account that is registered under the same name as the trading account. For instance, if the trading account is in the name of a company, withdrawals can not be processed into an individual's account.

Myfx Markets is committed to providing customer support to its clients. Traders can reach the customer support team through multiple channels. They can contact the support team via phone, ensuring direct and immediate assistance with any queries or concerns. Additionally, traders can reach out via email, allowing for detailed communication and timely responses. For quick assistance, Myfx Markets also offers a live chat feature on its website, enabling traders to engage in real-time conversations with support representatives. With these various communication channels, Myfx Markets ensures that traders receive prompt and efficient support to address their trading needs.

Myfx Markets is a UK-based brokerage offering a wide range of market instruments, including currencies, cryptocurrencies, metals, and commodities. It operates without regulatory oversight, posing inherent risks. The broker provides different account types with maximum leverage of 500:1, and advanced trading platforms (MT4 and MT5). Traders can access customer support via phone, email, and live chat. However, the absence of regulatory oversight and educational resources on the official website should be taken into consideration.

Does Myfx Markets offer a demo account?

Yes, Myfx Markets offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

What trading platforms does Myfx Markets offer?

Myfx Markets offers two trading platforms, including MetaTrader 4, MetaTrader 5. Clients can choose the platform that best suits their trading needs and preferences.

What is the minimum deposit required to open an account with Myfx Markets?

The minimum deposit required to open an account with Myfx Markets is $200 for Standard Account and $1000 for Pro Account

Does Myfx Markets offer any bonuses or promotions?

Yes, Myfx Markets has previously offered promotions and bonuses to its clients. As of now, the specific promotions have expired.

What is the maximum leverage offered by Myfx Markets?

The maximum leverage offered by Myfx Markets is 1:500.

More

User comment

6

CommentsWrite a review

2024-07-24 19:00

2024-07-24 19:00

2023-02-24 15:59

2023-02-24 15:59