User Reviews

More

User comment

3

CommentsWrite a review

2024-03-22 17:57

2024-03-22 17:57

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Investment Advisory License

Global Business

Suspicious Overrun

High potential risk

Influence

Add brokers

Comparison

Quantity 9

Exposure

Score

Regulatory Index2.78

Business Index7.42

Risk Management Index0.00

Software Index4.00

License Index2.78

Single Core

1G

40G

More

Company Name

Santander UK plc

Company Abbreviation

Santander

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

| Santander Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Exceeded |

| Products and Services | Mortgages, Credit Cards, Savings and ISAs, Investments, Insurance, Personal Loans, Current Accounts |

| Trading Platform | Online Banking, Mobile Banking app |

| Min Deposit | Not mentioned |

| Customer Support | 24/7 Live chat |

Santander, founded in 2003 and registered in the UK, is an online trading platform that offers many financial services accessible through online and mobile banking. While the Investment Advisory License is now exceeded, this platform provides diverse products including mortgages, credit cards, savings, ISAs, investments, insurance, and personal loans, alongside various current account options.

| Pros | Cons |

|

|

|

|

Santander once had an Investment Advisory License regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 106054, but now it is exceeded. The WHOIS search shows the domain santander.co.uk was registered on August 14, 2003.

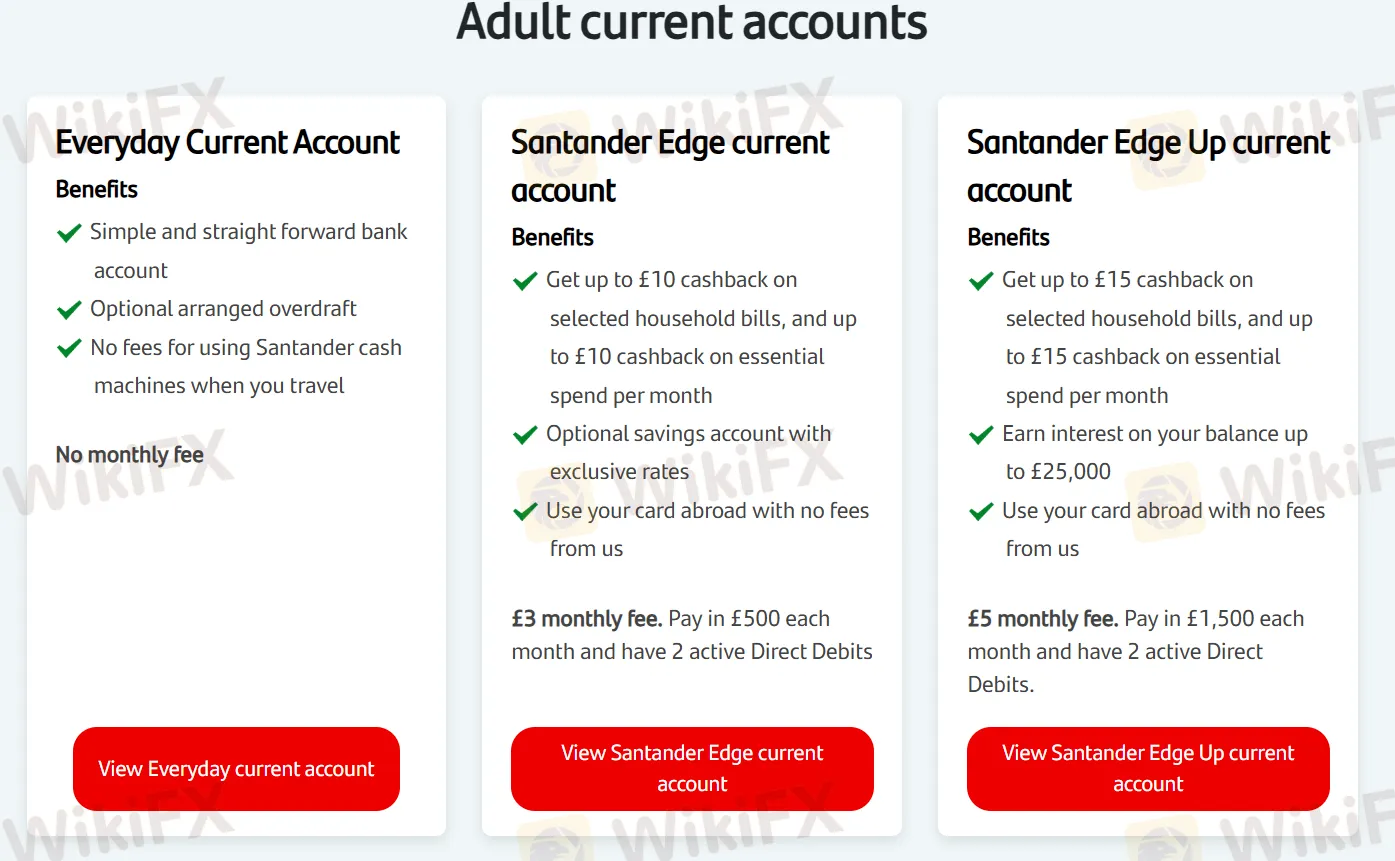

| Account Name | Benefits | Monthly Fee | Key Requirements |

| Everyday Current Account | Simple bank account, optional overdraft, no fees at Santander ATMs abroad. | No fee | None explicitly stated. |

| Santander Edge current account | Up to £10 cashback on bills & essential spend, optional savings account with exclusive rates, no card usage fees abroad from Santander. | £3 | Pay in £500/month and have 2 active Direct Debits. |

| Santander Edge Up current account | Up to £15 cashback on bills & essential spend, earn interest on balances up to £25,000, no card usage fees abroad from Santander. | £5 | Pay in £1,500/month and have 2 active Direct Debits. |

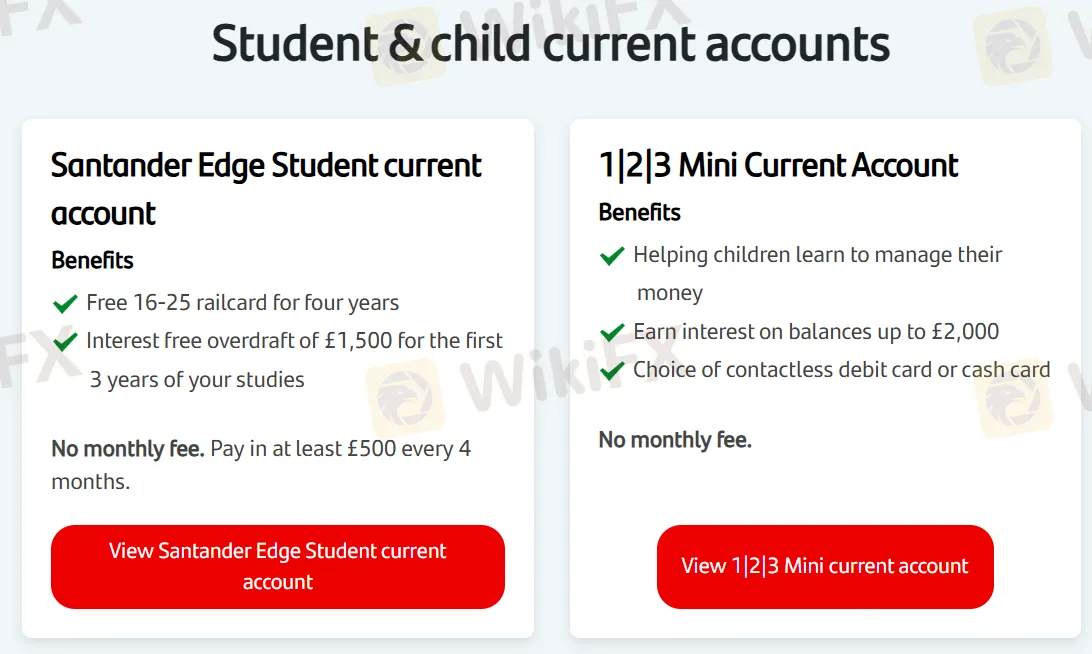

Other current accounts

| Trading Platform | Supported | Available Devices | Suitable for |

| Online Banking | ✔ | PC and Mobile | Investors of all experience levels |

| Mobile Banking app | ✔ | IOS and Android | Investors of all experience levels |

Deposit/Withdrawal Fees and Minimum Deposit are not mentioned on the website. But you should pay attention to:

Santander unveils a substantial €1.46B share buyback scheme and dividend hike. Discover how these strategic moves aim to fortify investor trust and drive shareholder value.

WikiFX

WikiFX

Santander Asserts Compliance Amid Financial Times' Claims on Iran-Linked Accounts: Get the latest updates on the bank's stance and commitment to international financial regulations.

WikiFX

WikiFX

Santander's Q4 net profit soars 28% to €2.93B, driven by robust lending in Europe and Brazil, surpassing analyst expectations and highlighting strategic growth.

WikiFX

WikiFX

Santander Mexico's Openbank Launch: The path to digital banking excellence! Openbank's launch is imminent, revolutionizing Mexico's banking landscape. Stay tuned for the digital banking wave!

WikiFX

WikiFX

Spain's Santander is the only major bank operating in Germany that has not declared a special payment to local employees to assist them to cope with surging inflation, despite the firm's statement that negotiations were underway.

WikiFX

WikiFX

The Financial Conduct Authority (FCA) of the United Kingdom fined Santander UK £107.79 million for frequent and significant failures in its anti-money laundering (AML) measures.

WikiFX

WikiFX

More

User comment

3

CommentsWrite a review

2024-03-22 17:57

2024-03-22 17:57