User Reviews

More

User comment

4

CommentsWrite a review

2024-11-14 12:11

2024-11-14 12:11

2023-03-23 10:13

2023-03-23 10:13

Score

5-10 years

5-10 yearsRegulated in Indonesia

Retail Forex License

MT4 Full License

Influence

Add brokers

Comparison

Quantity 2

Exposure

Score

Regulatory Index4.94

Business Index7.33

Risk Management Index9.67

Software Index9.02

License Index4.94

Single Core

1G

40G

More

Company Name

PT Trijaya Pratama Futures

Company Abbreviation

TPFX

Platform registered country and region

Indonesia

Company website

X

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| TPFX Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Indonesia |

| Regulation | BAPPEBTI |

| Market Instruments | Forex, Commodities (Gold, Silver, Oil), Stock Indices, CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:400 |

| Spread | From 1.2 pips (Standard account) |

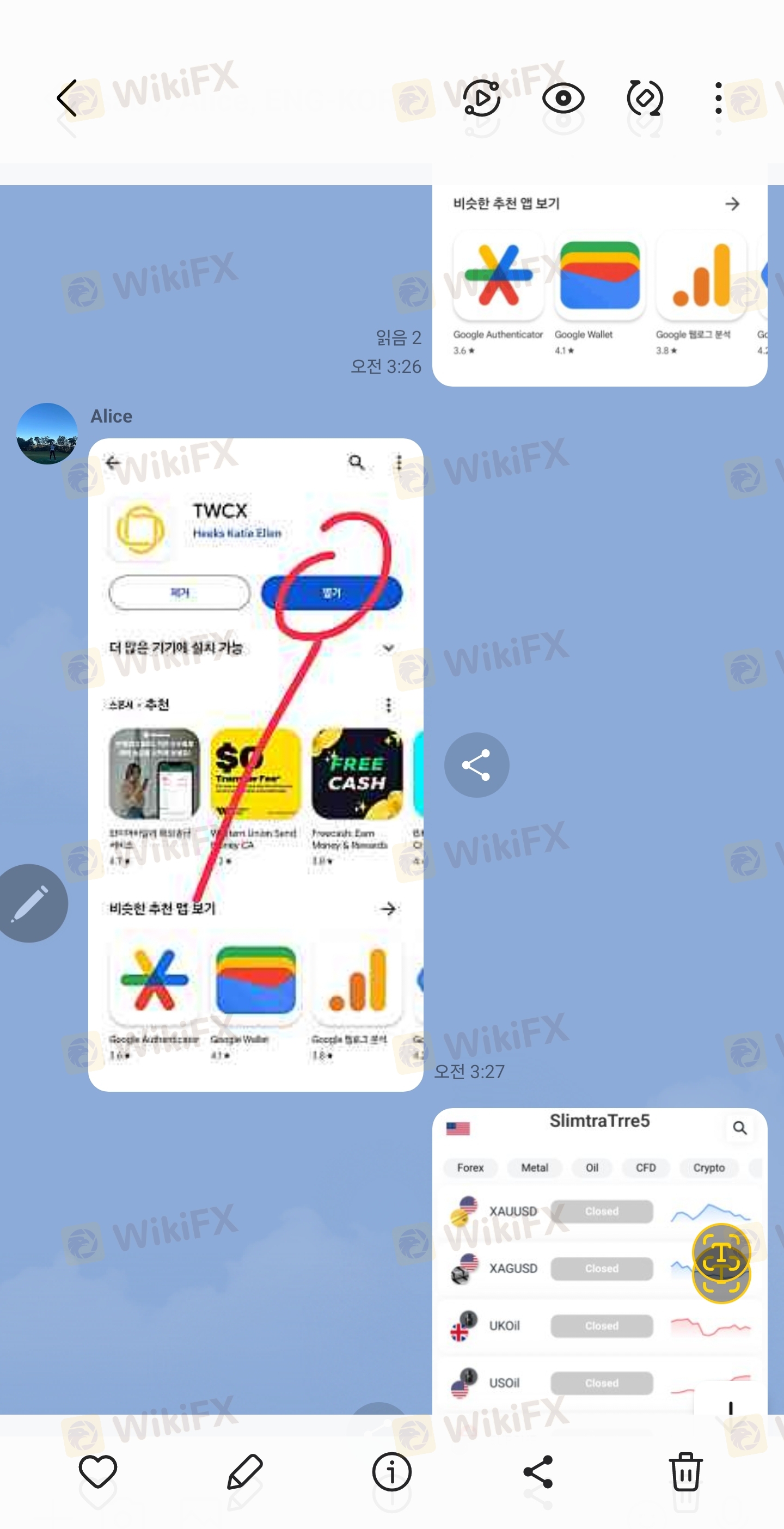

| Trading Platform | MetaTrader 4 (Desktop, iOS, Android), MetaTrader 5 (Desktop, iOS, Android) |

| Min Deposit | Not mentioned |

| Customer Support | Email: support@tpfx.co.id |

| Call Center: (+62) 21 252 75 77 | |

TPFX is an Indonesian forex broker founded in 2004, regulated by BAPPEBTI. It offers a range of account types and supports both MT4 and MT5 platforms. The broker provides flexible spreads and swap-free options but lacks transparency on minimum deposit requirements.

| Pros | Cons |

| Regulated by BAPPEBTI | Minimum deposit not clearly disclosed |

| Offers both MT4 and MT5 platforms | No crypto or stock trading |

| Multiple account types with low commissions | Limited international payment options |

| Swap-free (Islamic) accounts available | No cTrader or WebTrader |

TPFX is a legitimate and regulated forex broker. It is supervised by BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi), which operates under the Ministry of Trade of Indonesia. The company holds a Retail Forex License with the license number 407/BAPPEBTI/SI/VII/2004.

TPFX offers a range of trading products, including multiple currency pairs, 3 commodities (Gold, Silver, Oil), and 5 major stock indices. These instruments cover key global markets through Forex, CFDs, and index trading.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ✅ |

| Crypto | ❌ |

| CFD | ✅ |

| Indexes | ✅ |

| Stock | ❌ |

| ETF | ❌ |

TPFX offers a total of 6 types of live trading accounts, each tailored to different trading styles and experience levels. In addition, TPFX provides demo accounts for practice and Islamic (swap-free) accounts, suitable for traders who follow Sharia law. The accounts differ mainly in their spread structure and commission fees, allowing traders to choose the best fit based on cost preference and strategy.

| Account Type | Spread Type | Starting Spread | Commission | Best For |

| ZERO ECN | Variable | From 0.0 | $5 | Advanced traders needing raw spreads |

| PROFESSIONAL (Variable) | Variable | From 0.4 | $2 | Active traders wanting balance |

| STANDARD (Variable) | Variable | From 1.2 | $1 | Beginners favoring low commission |

| STANDARD (Fix-Variable) | Fixed + Variable Mix | From 1.5 | $2 | Traders preferring spread stability |

| PROFESSIONAL (Fix-Variable) | Fixed + Variable Mix | From 0.8 | $1 | Cost-conscious traders with flexibility |

| PRIME | Variable | From 0.8 | $1 | General-purpose low-cost trading |

TPFX offers leverage of up to 1:400, allowing traders to control larger positions with a relatively small capital outlay.

Overall, TPFX's trading fees are considered slightly lower than industry averages, especially with their flexible account types offering low commissions and tight spreads.

Spreads start as low as 0.0 pips on the ZERO ECN account, and up to 1.5 pips on some fixed-variable accounts.

Commissions are range from $1 to $5 per trade, depending on the account.

| Account Type | Spread From (pips) | Commission (per trade) |

| ZERO ECN (Variable) | 0 | $5 |

| PROFESSIONAL (Variable) | 0.4 | $2 |

| STANDARD (Variable) | 1.2 | $1 |

| STANDARD (Fix-Variable) | 1.5 | $2 |

| PROFESSIONAL (Fix-Variable) | 0.8 | $1 |

| PRIME | 0.8 | $1 |

TPFX offers Swap-Free accounts across all account types (Islamic-friendly), meaning no overnight interest is charged on held positions. However, for regular accounts, standard swap fees apply depending on the instrument and holding period.

TPFX maintains a trader-friendly fee structure with no hidden non-trading charges.

| Non-Trading Fees | Details |

| Deposit Fee | $0 (Free) |

| Withdrawal Fee | $0 (Free) |

| Inactivity Fee | None disclosed |

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| MetaTrader 4 (MT4) | ✅ | Desktop, iOS, Android | All traders; beginner-friendly with essential tools |

| MetaTrader 5 (MT5) | ✅ | Desktop, iOS, Android | Advanced traders; supports algorithmic trading and deeper analysis |

| cTrader | ❌ | – | – |

| WebTrader | ❌ | – | – |

TPFX does not charge any deposit or withdrawal fees, making it cost-effective for clients to fund and withdraw from their trading accounts. However, the minimum deposit amount is not specifically stated.

Deposit Options

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Bank Transfer – BCA | Not mentioned | Free | Within 30 minutes (if before 22:00 WIB) |

| Bank Transfer – AGI | Not mentioned | Free | Within 30 minutes (if before 22:00 WIB) |

| Bank Transfer – China Construction Bank | Not mentioned | Free | Within 30 minutes (if before 22:00 WIB) |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Bank Transfer – BCA | Not mentioned | Free | Same day if requested before 11:00 WIB; next day if after |

| Bank Transfer – AGI | Not mentioned | Free | Same day if requested before 11:00 WIB; next day if after |

| Bank Transfer – China Construction Bank | Not mentioned | Free | Same day if requested before 11:00 WIB; next day if after |

The US dollar slipped after data showed the number of Americans filing new claims for unemployment benefits hit a three-month high last week, with data showing an increase of 13,000 to 231,000 on week, well above market expectations of 220,000.

WikiFX

WikiFX

Gold fell more than 1% on Friday and headed for its second straight weekly decline on waning safe-haven demand while Federal Reserve Chair Jerome Powell's hawkish stance was key to weakening gold prices.

WikiFX

WikiFX

Gold prices hovered near the key $2,000 psychological level on Monday, supported by safe-haven demand amid Middle East conflicts, while market players looked forward to the US Federal Reserve's policy meeting this week.

WikiFX

WikiFX

Gold markets maintained strong gains even as the minutes of the Federal Reserve's September monetary policy meeting showed that the central bank was committed to maintaining a “higher for longer” monetary policy stance.

WikiFX

WikiFX

The Federal Reserve has expressed its stance that the war on inflation is far from over, signaling that the US central bank's monetary policy is expected to stay restrictive for a longer duration than previously anticipated. Such a policy has the capacity to elevate credit expenses, potentially exerting a slowdown on the economy.

WikiFX

WikiFX

Gold extended its decline for the third straight time on Thursday, weighed down by a jump in the US Dollar and US bond yields after the Federal Reserve reiterated its hawkish stance on interest rates. Gold fell 0.5% to hit a low of 1,913.91.

WikiFX

WikiFX

More

User comment

4

CommentsWrite a review

2024-11-14 12:11

2024-11-14 12:11

2023-03-23 10:13

2023-03-23 10:13