User Reviews

More

User comment

3

CommentsWrite a review

2025-02-19 15:49

2025-02-19 15:49

2023-07-09 10:50

2023-07-09 10:50

Score

2-5 years

2-5 yearsRegulated in South Africa

Financial Service Corporate

White label MT5

Regional Brokers

Suspicious Overrun

High potential risk

Influence

Add brokers

Comparison

Quantity 3

Exposure

Score

Regulatory Index3.51

Business Index5.64

Risk Management Index0.00

Software Index8.25

License Index0.00

Single Core

1G

40G

More

Company Name

Elite Financial Services (Pty) Ltd

Company Abbreviation

Accumarkets

Platform registered country and region

South Africa

Company website

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| AccumarketsReview Summary | |

| Founded | 2022 |

| Registered Country/Region | South Africa |

| Regulation | FSCA (Exceeded) |

| Market Instruments | Forex, indices, metals |

| Demo Account | ❌ |

| Leverage | Up to 1:1000 |

| Spread | From 1 pip |

| Trading Platform | MT5 |

| Minimum Deposit | R50 |

| Customer Support | Contact form, live chat |

| Tel: +27 66 052 8229 | |

| Email: support@accumarkets.co.za | |

| Physical address: 51 Shannon Road Noordheawel Krugersdorp Gauteng 1739 | |

| Operating address: Accumarkets 36 Wierda Road Wierda Valley Johannesburg | |

| Social media: Instagram, Facebook, TikTok | |

| Regional Restriction | US |

Accumarkets was registered in 2022 in South Africa, which focuses on forex, indices, and metals trading. It provides three types of accounts, with a minimum deposit of R50 and the leverage can be up to 1:1000. Accumarkets was regulated by FSCA, but its license was exceeded. Apart from that, it does not provide services to US residents.

| Pros | Cons |

| Low minimum deposit | High leverage ratio |

| MT5 supported | No demo accounts |

| Multiple channels for customer support | Exceeded FSCA license |

| Limited types of assets | |

| Regional restrictions | |

| No popular payment options |

No, it was regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, but its license was exceeded, and the effective date is 14 October 2022.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Sector Conduct Authority (FSCA) | Exceeded | Elite Financial Services (Pty) Ltd | South Africa | Financial Service Corporate | 52677 |

Accumarkets offers three types of assets, including forex, indices, and metals.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Accumarkets provides three types of accounts: Standard Account, 100% Bonus Account, and Cent Account. However, it does not mention whether a demo account is available or not.

| Account Type | Minimum Deposit | Spread |

| Standard Account | R50 | From 1 pip |

| 100% Bonus Account | R50 | From 1 pip |

| Cent Account | R50 | From 1 pip |

Accumarkets does not specify the leverage ratio of different account types, and it only prensents a “comming soon 1 k leverage” plan, which shows the leverage can be 1:1000. Traders need to consider carefully before investing, since high leverage is likely to bring high potential risks.

Accumarkets uses MT5 as its trading platform, which is a commonly used platform and is suitable for experienced traders.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | PC, web, mobile, mac | Experienced traders |

| MT4 | ❌ | / | Beginners |

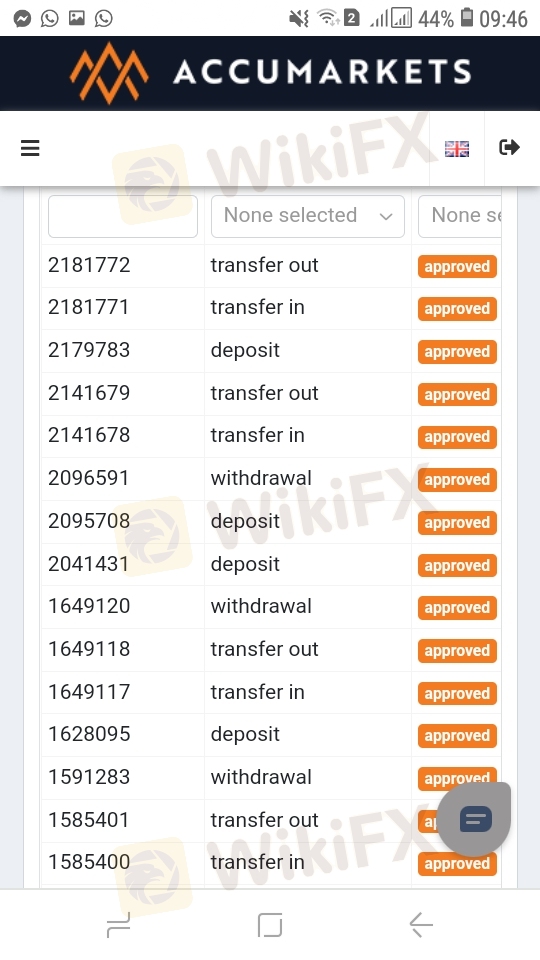

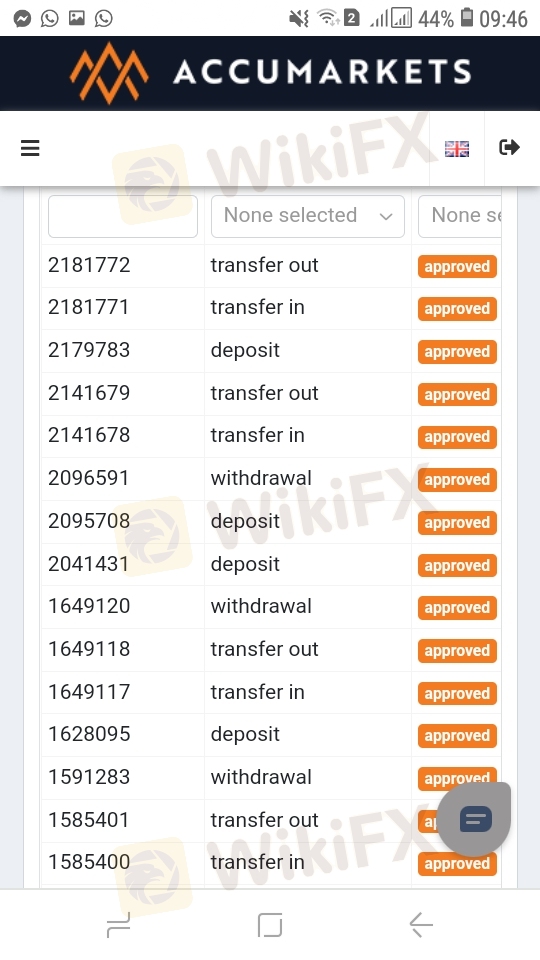

Accumarkets accepts several types of payment methods: Ozow, Virtual pay, Paystack, DusuPay, and Match2Pay. Depositing is instant, and the processing time for withdrawal is generally within 24 hours. However, other details such as the accepted currencies and commission fees are not clear.

More

User comment

3

CommentsWrite a review

2025-02-19 15:49

2025-02-19 15:49

2023-07-09 10:50

2023-07-09 10:50