User Reviews

More

User comment

25

CommentsWrite a review

2022-12-14 23:45

2022-12-14 23:45 2022-10-24 02:31

2022-10-24 02:31

Score

5-10 years

5-10 yearsRegulated in Mauritius

Retail Forex License

MT4 Full License

Global Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 18

Exposure

Score

Regulatory Index4.62

Business Index6.97

Risk Management Index0.00

Software Index9.85

License Index2.49

Single Core

1G

40G

Danger

More

Company Name

Dollar Markets Ltd

Company Abbreviation

Dollars Markets

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| Dollars MarketsReview Summary | |

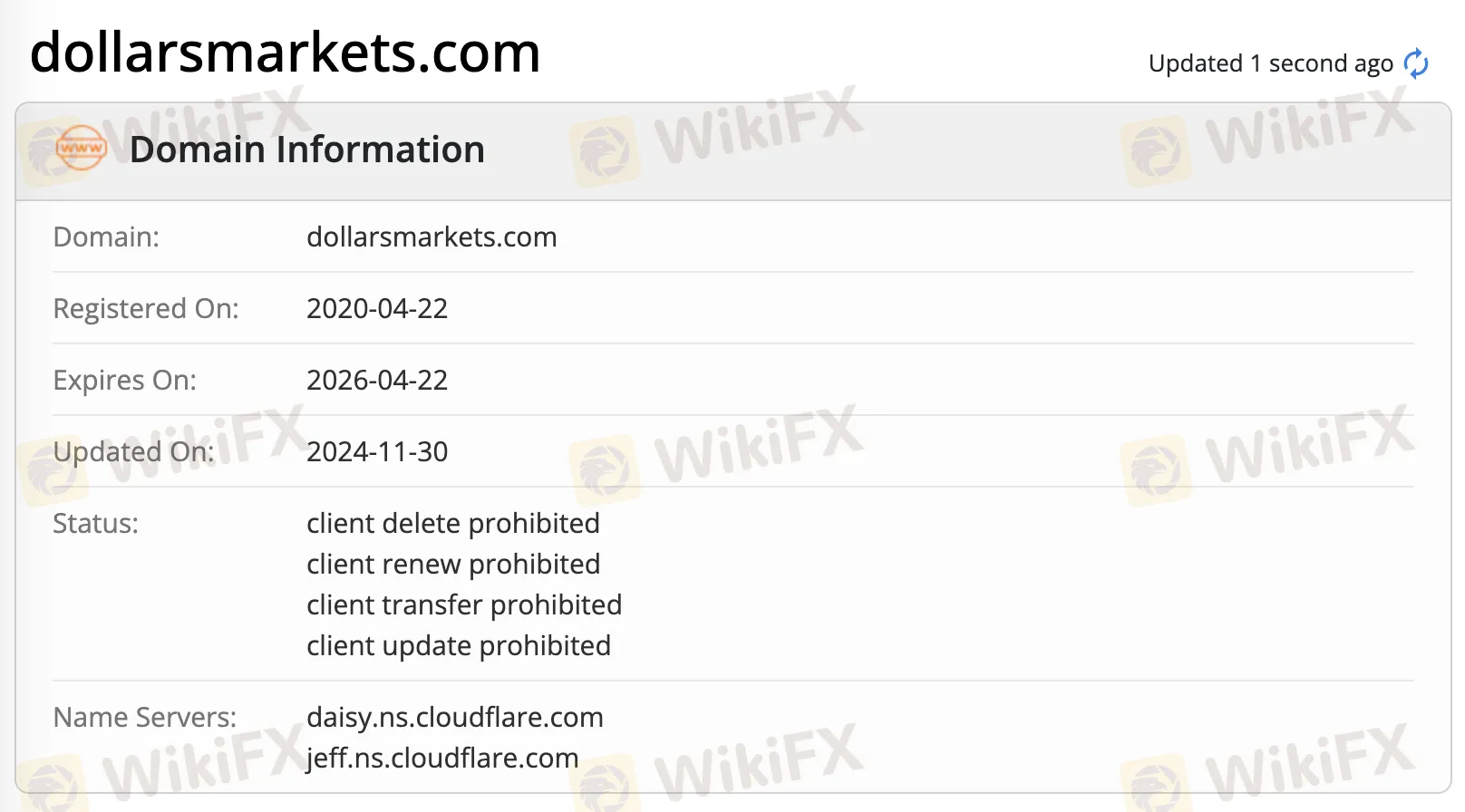

| Founded | 2020 |

| Registered Country/Region | Mauritius |

| Regulation | Offshore regulated |

| Market Instruments | Currency Pairs, Precious Metals , Indicies ,Cryptocurrencies, Shares, Energy, ETFs |

| Demo Account | ❌ |

| Leverage | Up to 1:3000 |

| Spread | From 0.02 pips |

| Trading Platform | MT4/MT5 |

| Min Deposit | $10 |

| Customer Support | Instagram, facebook, X, Tiktok, Youtube, Bloomberg |

| 24/5 customer support | |

| Contact form | |

| Regional Restrictions | US, Afghanistan, Bosnia and Herzegovina, Democratic People's Republic of Korea (DPRK), Guyana, Iran, Iraq, Lao People's Democratic Republic, Myanmar, Papua New Guinea, Syria, Uganda, Vanuatu, Yemen, Malaysia and Indonesia clients are not allowed |

Dollars Markets is an offshore regulated broker, offering trading on currency pairs, precious metals, indicies, cryptocurrencies, shares, energy and ETFs with leverage up to 1:3000 and spread from 0.02 pips on MT4/MT5 trading platform. The minimum deposit requirement is $10.

| Pros | Cons |

| Tight spreads | No contact Tel or email |

| Various trading products | Offshore regulation |

| MT4/MT5 platform | No demo accounts |

| Low minimum deposit requirement |

It is registered in Mauritius. It has offshore regulations currently.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| The Financial Services Commission | Offshore regulated | DOLLARS MARKETS LTD | Retail Forex License | GB21026297 |

| Tradable Instruments | Supported |

| Currency Pairs | ✔ |

| Precious Metals | ✔ |

| Indicies | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ✔ |

| Energy | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

Here are three account types Dollars Markets offers:

| Account Type | Min Deposit |

| Standard | $10 |

| Pro | $10 |

| Ultra | $50 |

The broker offers max leverage at 1:3000. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. Since leverage, can amplify both profits as well as losses, choosing the right amount is a key risk determination for traders.

Trading Fees

| Account Type | Commission | Swaps |

| Standard | 0 | 0 |

| Pro | 0 | 0 |

| Ultra | 4% On FX & Metals | 0 |

Dollars Markets Spreads

Dollars Markets offers spreads from 0.02 pips.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | / | Beginners |

| MT5 | ✔ | / | Experienced trader |

The broker accepts payments via bank wire, cryptocurrency, Mastercard and Visa.

Deposit Options

| Deposit Options | Min. Deposit | Fixed Rate | Processing Time |

| Instant Bank Transfers | $15.00 | Available | 1-5 Minutes |

| Cryptocurrency | $100.00 | Available | 10-45 Minutes |

| Mastercard | $5.00 | No | 5-10 Minutes |

| Visa | $5.00 | No | 5-10 Minutes |

Withdrawal Options

| Withdrawal Options | Min. Withdrawal | Fixed Rate | Processing Time |

| Instant Bank Transfers | $15.00 | Available | 1-3 Business Day |

26/9/2024 – Dollars Markets is proud to announce that we have been awarded the coveted “Best Trade Execution – Global” accolade at the Global Forex Awards 2024 in the Retail category. This prestigious

WikiFX

WikiFX

Dollars Markets rebrands with a new logo and enhanced identity, emphasizing innovation, transparency, and exceptional trading experiences for all clients.

WikiFX

WikiFX

Dollars Markets Announces Rebranding with New Logo and Enhanced Brand IdentityDollars Markets, a leader in the forex trading industry, is excited to announce its rebranding initiative. This transforma

WikiFX

WikiFX

The quarterly meeting of the Financial Policy Committee (FPC) of the Bank of England (BoE) took place on Tuesday, with a focus on highlighting the strength of Britain's economy despite challenging risks and limited growth expectations in the near term. Despite some members of the committee advocating for an increase in the counter-cyclical capital buffer (CCyB) from 2% to enhance banks' ability to withstand low loan losses, the decision was made to maintain the CCyB at its current level. However, the committee remains flexible and ready to modify the rate depending on future economic and financial fluctuations.

WikiFX

WikiFX

The quarterly meeting of the Financial Policy Committee (FPC) of the Bank of England (BoE) took place on Tuesday, with a focus on highlighting the strength of Britain's economy despite challenging risks and limited growth expectations in the near term.

WikiFX

WikiFX

In this article, we'll examine Dollars Markets' key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

WikiFX

WikiFX

In today's comprehensive review, WikiFX will delve into the details of Dollars Markets, examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service to help you decide whether to use this platform. Keep reading to find out more!

WikiFX

WikiFX

On Monday, a global securities watchdog highlighted the necessity for imposing limitations on the utilization of four dollar-denominated alternatives to the recently abolished Libor interest rate. The objective behind these restrictions is to safeguard financial stability rather than introducing a potential menace to the global financial landscape.

WikiFX

WikiFX

More

User comment

25

CommentsWrite a review

2022-12-14 23:45

2022-12-14 23:45 2022-10-24 02:31

2022-10-24 02:31