User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.12

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| DCE Review Summary | |

| Founded | 1993 |

| Registered Country/Region | China |

| Regulation | Not regulated |

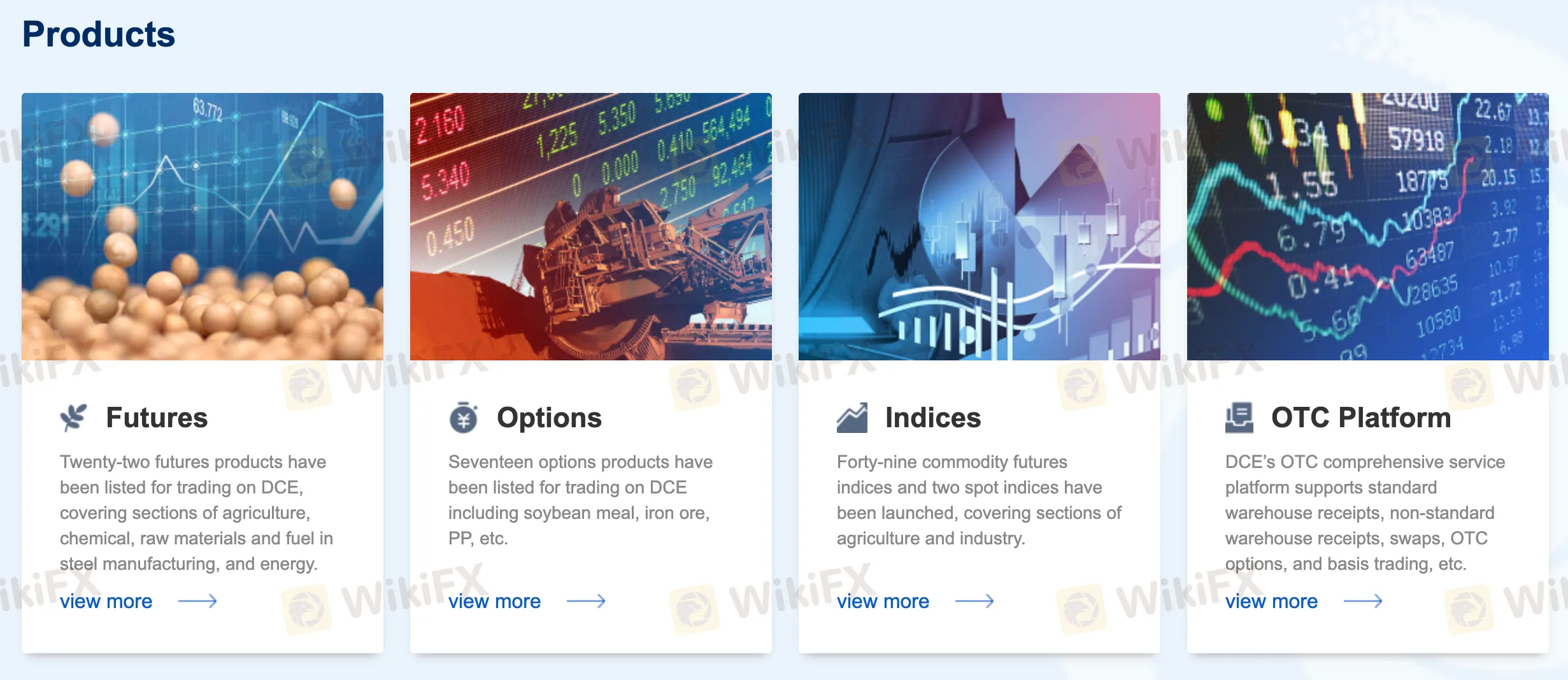

| Market Instruments | Commodities (Futures & Options), Indexes, OTC products |

| Demo Account | ❌ |

| Trading Platform | DCE Trading System, OTC Platform |

| Min Deposit | Not mentioned |

| Customer Support | Address: No.129 Huizhan Road, Dalian, China 116023 |

| Email: inquiries@dce.com.cn | |

| Tel: +86-411-84808185 / +86-411-84808226 | |

Primarily concentrating on agricultural, energy, and industrial materials, DCE is a Chinese commodity exchange providing futures, options, and index products. It backs basis trading and warehouse receipt among other OTC instruments. Although well run, it lacks international regulation and lacks services such retail investor apps or demo accounts.

| Pros | Cons |

| Provides several commodity-based derivatives | Not regulated |

| Supports fast, secure electronic deposit/withdrawal | No demo or Islamic account |

| Appropriate for institutional futures trading | Not suitable for retail |

DCE is not regulated as a financial broker or trading service provider in China, its country of registration. Additionally, DCE does not hold licenses from any internationally recognized regulatory authorities such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or NFA (US).

According to WHOIS records, the domain dce.com.cn was registered on May 29, 1997, and is currently active. It is set to expire on July 1, 2030. The domain has multiple protective statuses including clientDeleteProhibited, clientUpdateProhibited, and clientTransferProhibited, indicating that it is securely maintained and actively managed.

DCE provides a great range of trading tools oriented on commodity markets. Specifically, users can trade 22 futures products, 17 options products, and access 51 indices (including 49 commodity futures indices and 2 spot indices). In addition, DCE supports OTC (Over-the-Counter) trading through its dedicated platform, which includes swaps, warehouse receipt trading, and basis trading.

| Tradable Instruments | Supported |

| Forex | ❌ |

| Commodities | ✅ |

| Crypto | ❌ |

| CFD | ❌ |

| Indexes | ✅ |

| Stock | ❌ |

| ETF | ❌ |

Dalian Commodity Exchange (DCE) provides several types of live accounts specifically tailored for domestic and overseas institutional and individual traders. However, it does not mention the availability of demo accounts or Islamic (swap-free) accounts.

| Account Type | Target Group | Key Features |

| Domestic Individual/Entity | China-based traders | Standard account via futures company; requires identity and trading authority verification |

| Overseas Individual/Entity | International traders | Requires documentation via direct application or sub-delegation through a broker; must pass suitability review |

| Specified Product Access Account | Qualified clients (domestic/overseas) | Must meet financial, knowledge, and experience criteria for certain futures like iron ore |

DCE platforms are designed for institutional and regulated futures participants, not for individual retail trading via conventional apps like MT4 or cTrader.

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| DCE Trading System (Member Access) | ✔ | Desktop via broker terminals | Institutional/professional traders executing futures/options orders |

| OTC Comprehensive Platform | ✔ | Web-based via member login | Futures market clients using warehouse receipt, basis trading, etc. |

| MetaTrader / Retail Platforms | ❌ | – | Not supported |

| Mobile Trading App | ❌ | – | Not supported |

DCE uses an electronic payment system integrated with Chinas five major state-owned banks, offering real-time, low-cost, and secure fund transfers. The system completes the full transfer cycle in approximately 2 seconds.

| Method | Min. Amount | Fees | Processing Time |

| Electronic Payment System (via member or bank) | Not specified | Not disclosed (likely low) | About 2 seconds (real-time) |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment