User Reviews

More

User comment

17

CommentsWrite a review

2025-04-28 20:28

2025-04-28 20:28

2025-04-20 23:11

2025-04-20 23:11

Score

Within 1 year

Within 1 yearRegulated in Seychelles

Retail Forex License

Suspicious Scope of Business

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index3.92

Business Index2.83

Risk Management Index8.22

Software Index4.00

License Index3.92

Single Core

1G

40G

More

Company Name

Tradeco Limited

Company Abbreviation

Xlence

Platform registered country and region

Seychelles

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| Xlence Review Summary | |

| Founded | 2003 |

| Registered Country/Region | Seychelles |

| Regulation | Regulated by FSA |

| Market Instruments | Forex, metals, indices, commodities, futures, and shares |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.18 pips |

| Trading Platform | MT4 and MT5 |

| Minimum Deposit | 0 |

| Customer Support | 24/5 support |

| Contact form | |

| Facebook, LinkedIn, TikTok, Twitter, YouTube, Instagram | |

| Regional Restrictions | The USA, Iran, Cuba, Sudan, Syria and North Korea |

Xlence is a brokerage firm founded in 2003 and registered in Seychelles, regulated by the FSA. It offers over 300 trading instruments across 6 asset classes, with a maximum leverage of 1:1000 through MT4 and MT5 trading platforms. However, it does not support their physical address and there are many residents who have no access to trade with them.

| Pros | Cons |

| Regulated by FSA | Regional restrictions |

| MT4 and MT5 offered | No physical address |

| Many kinds of account types | No flexible payment methods |

| Social media presence | |

| No minimum deposit requirement |

Xlence is offshore regulated by the Seychelles Financial Services Authority(FSA), holding Retail Forex License, with No. SD029. Besides, they provide negative balance protection.

| The Seychelles Financial Services Authority (FSA) | |

| Regulatory Status | Offshore regulated |

| Regulated by | Seychelles |

| Licensed Institution | Tradeco Limited |

| Licensed Type | Retail Forex License |

| Licensed Number | SD029 |

Xlence offers over 300 trading instruments across 6 asset classes including forex, metals, indices, commodities, futures, and shares.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Shares | ✔ |

| Futures | ✔ |

| Metals | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

Xlence offers found kinds of accounts, including the Xlence Essential, Xlence Prime, Xlence Deluxe, and Xlence Uitlimate accounts. Besides, they also offer the Islamic accounts without a minimum deposit.

| Account Type | Xlence Essential | Xlence Prime | Xlence Deluxe | Xlence Ultimate |

| Bonus | ✔ | ✔ | ✔ | ✔ |

| Minimum Lot Size | 0.01 | |||

| Lot increment | ||||

| Stop out | 20% | |||

| Swap free/Islamic account | ✔ | |||

| Dedicated Manager | ❌ | ✔ | ✔ | ✔ |

To open an account of Xlence, it is easy and simple. You can enter your personal information to finish the opening procedures.

Xlence offers the maximum leverage of 1:1000 to their accounts. It should be noted that high leverage such as 1:1000 can lead to significant profits, but it also comes with extremely high risks.

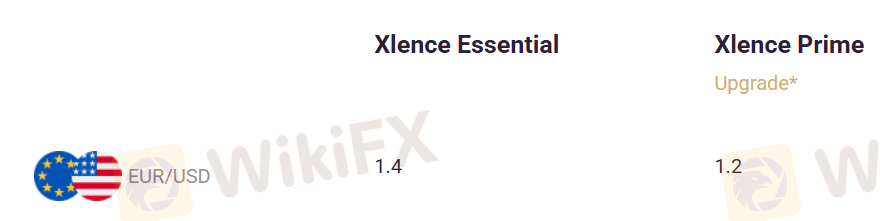

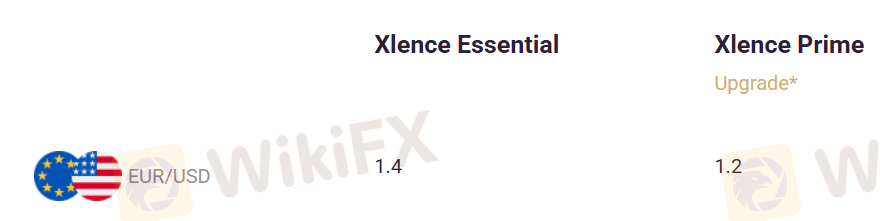

Xlence offers different spread across different accounts, products, and currency. Therefore, to learn specific spread, you should look through and learn form their spreads set carefully. Besides, they do not charge the commission.

| Account Type | Xlence Essential | Xlence Prime | Xlence Deluxe | Xlence Ultimate |

| EUR/USD Spread (Minimum/Average) | 1.1/1.4 | 0.9/1.2 | 0.6/0.9 | 0.4/0.7 |

| XAU/USD Spread(Minimum/Average) | 0.23/0.25 | 0.18/0.20 | 0.18/0.20 | 0.18/0.20 |

| Commission | ❌ | ❌ | ❌ | ❌ |

Xlence supports MT4 and MT5 to trade their instruments. Both MT4 and MT5 offer access to expert advisors for algorithmic trading and trading signals. You can explore the markets via desktop, mobile, or web browser at your convenience.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Web/ Phone/ Desktop | Beginners |

| MT5 | ✔ | Web/ Phone/ Desktop | Experienced traders |

To carry out a deposit or withdrawal, simply log into your account and access the client portal. The main currencies supported for these transactions are AUD, CHF, PLN, RUB, HUF, EUR, GBP, and USD. Deposits are free of charge on our end. However, it's important to note that your bank or payment service provider might impose extra fees.

More

User comment

17

CommentsWrite a review

2025-04-28 20:28

2025-04-28 20:28

2025-04-20 23:11

2025-04-20 23:11