User Reviews

More

User comment

15

CommentsWrite a review

2023-02-14 10:11

2023-02-14 10:11

2025-01-04 15:38

2025-01-04 15:38

Score

10-15 years

10-15 yearsRegulated in United Kingdom

Market Maker (MM)

MT4 Full License

Global Business

High potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 19

Exposure

Score

Regulatory Index8.65

Business Index8.43

Risk Management Index0.00

Software Index9.66

License Index8.43

Single Core

1G

40G

More

Danger

Danger

Danger

More

Company Name

Admiral Markets AS Jordan Ltd

Company Abbreviation

Admiral Markets

Platform registered country and region

Jordan

Company website

X

YouTube

+44 74 9509 7435

+54 911 7033 1313

Company summary

Pyramid scheme complaint

Expose

Capital

$(USD)

| Founded in | 2001 |

| Headquarters | Seychelles |

| Regulated by | ASIC, FCA, CySEC, FSA (Offshore) |

| Trading instruments | 2,500+, forex, indices, commodities, ETFs, stocks, cryptocurrencies |

| Demo Account | ✅ (30 days) |

| Islamic Account | ✅ |

| Account Type | Trade.MT4, Zero.MT4, Trade.MT5, Invest.MT5, Zero.MT5 |

| Min Deposit | $25 |

| Leverage | 1:3-1:1000 |

| EUR/USD Spread | Floating around 0.1 pips |

| Trading platform | MT4/5, Trading App, Admirals Platform, StereoTrader |

| Payment Methods | Visa, MasterCard, Skrill, Neteller, Crypto payments, Bank Wire |

| Deposit Fee | ❌ |

| Withdrawal Fee | One free withdrawal request every month, 5 EUR/USD thereafter |

| Inactivity Fee | 10 EUR per month (only charged if the account balance is greater than zero) |

| Customer Support | Live chat, contact form |

| Tel: +2484671940, +3726309306 | |

| Email: global@admiralmarkets.com | |

| Regional Restriction | Belgium |

Admiral Markets is a global online trading provider offering trading services in 2,500+ financial instruments, including forex, indices, commodities, ETFs, stocks, and cryptocurrencies. The company was founded in 2001 and is headquartered in Seychelles, with offices in various countries around the world.

Admiral Markets is regulated by several financial authorities, including the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). The company offers a range of trading platforms, account types, and educational resources to its clients.

Admiral Markets is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, Admiral Markets acts as an intermediary and takes the opposite position to its clients.

Admiral Markets is regulated by several respected financial authorities globally.

In Australia, it is regulated by Australia Securities & Investment Commission (ASIC) under the Market Making (MM) model.

In the United Kingdom and Cyprus, the firm is overseen by the Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC) respectively, both also under the Market Making model.

Additionally, it holds a Retail Forex License in Seychelles, further extending its regulatory framework to offshore jurisdictions.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License Number |

| ASIC | Regulated | ADMIRALS AU PTY LTD | Market Making (MM) | 000410681 |

| FCA | Regulated | Admiral Markets UK Ltd | Market Making (MM) | 595450 |

| CySEC | Regulated | Admirals Europe Ltd (ex Admiral Markets Cyprus Ltd) | Market Making (MM) | 201/13 |

| FSA | Offshore Regulated | Admirals SC Ltd | Retail Forex License | SD073 |

Advantages:

Disadvantages:

Admiral Markets offers a diverse range of trading products, encompassing over 2,500 instruments across various asset classes to cater to different investment preferences.

| Asset Class | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| ETFs | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Ooptions | ❌ |

Admiral Markets offers five account types: Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.

The Invest.MT5 account has the lowest minimum deposit requirement, starting at just $1 USD/EUR, and offers the widest range of trading instruments including over 4500 stocks and more than 400 ETFs; however, it does not support leverage trading.

Only the Trade.MT5 account offers the option for an Islamic account.

For more detailed differences among the account types offered by Admiral Markets, please refer to the table below:

| Account Type | Trade.MT4 | Zero.MT4 | Trade.MT5 | Zero.MT5 | Invest.MT5 |

| Min Deposit | 25 USD/EUR, 100 BRL, 500 MXN, 20 000 CLP, 50 SGD, 1000 THB, 500 000 VND, 25 AUD | 1 USD/EUR | |||

| Trading Instruments | 37 currency pairs, 5 cryptocurrency CFDs, 2 metal CFDs, 3 energy CFDs, 12 cash index CFDs, 200+ stock CFDs | 80 currency pairs, 3 metal CFDs, 8 cash index CFDs, 3 energy CFDs | 80 currency pairs, 18 cryptocurrency CFDs, 2 metal CFDs, 3 energy CFDs, 12 cash Index CFDs, 2,300+ stock CFDs, 350+ ETF CFDs | 80 currency pairs, 3 metal CFDs, 8 cash index CFDs, 3 energy CFDs | 4,500+ stocks, 400+ ETFs |

| Leverage (Forex) | 1:3-1:1000 | ❌ | |||

| Leverage (Indices) | 1:10-1:500 | ❌ | |||

| Spread | From 1.2 pips | From 0 pips | From 0.6 pips | From 0 pips | |

| Commission | Single Share & ETF CFDs - from 0.02 USD per share | Forex & Metals - from 1.8 to 3.0 USD per 1.0 lots | Single Share & ETF CFDs - from 0.02 USD per share | Forex & Metals - from 1.8 to 3.0 USD per 1.0 lots | Stocks & ETFs - from 0.02 USD per share |

| Other instruments - no commissions | Cash Indices - from 0.15 to 3.0 USD per 1.0 lots | Other instruments - no commissions | Cash Indices - from 0.15 to 3.0 USD per 1.0 lots | ||

| Energies - 1 USD per 1.0 lots | Energies - 1 USD per 1.0 lots | ||||

| Islamic Account | ❌ | ❌ | ✔ | ❌ | ❌ |

Admiral Markets offers a range of leverage options from 1:10 to 1:1000, allowing traders to select the level that aligns with their strategy and risk tolerance. While higher leverage can amplify profits from smaller investments, it also increases the potential for significant losses.

Admiral Markets offers a comprehensive suite of trading platforms to cater to various trading needs:

Admiral Markets accepts deposits and withdrawals via Visa, MasterCard, Skrill, Neteller, Crypto payments, and Bank Wire.

All deposits are free of charge, while only one free withdrawal request every month, and 5 EUR/USD thereafter.

In addition to commissions and withdrawal fees that we have mentioned before, some other fees may be charged, as follows:

Internal transfer

| Between a client's separate trading accounts | |

| Accounts with the same base currency | ❌ |

| Accounts with different base currencies | 1% of the amount |

| Between a client's separate wallets, wallet and trading account | |

| Wallets, wallet and account with the same base currency | ❌ |

| Wallets, wallet and account with different base currencies | 5 free transfers, 1% of the amount thereafter (min 1 EUR) |

Additional fees

| Opening a live or demo trading account | ❌ |

| Inactivity fee | 10 EUR per month |

| Currency conversion fee | 0.3% |

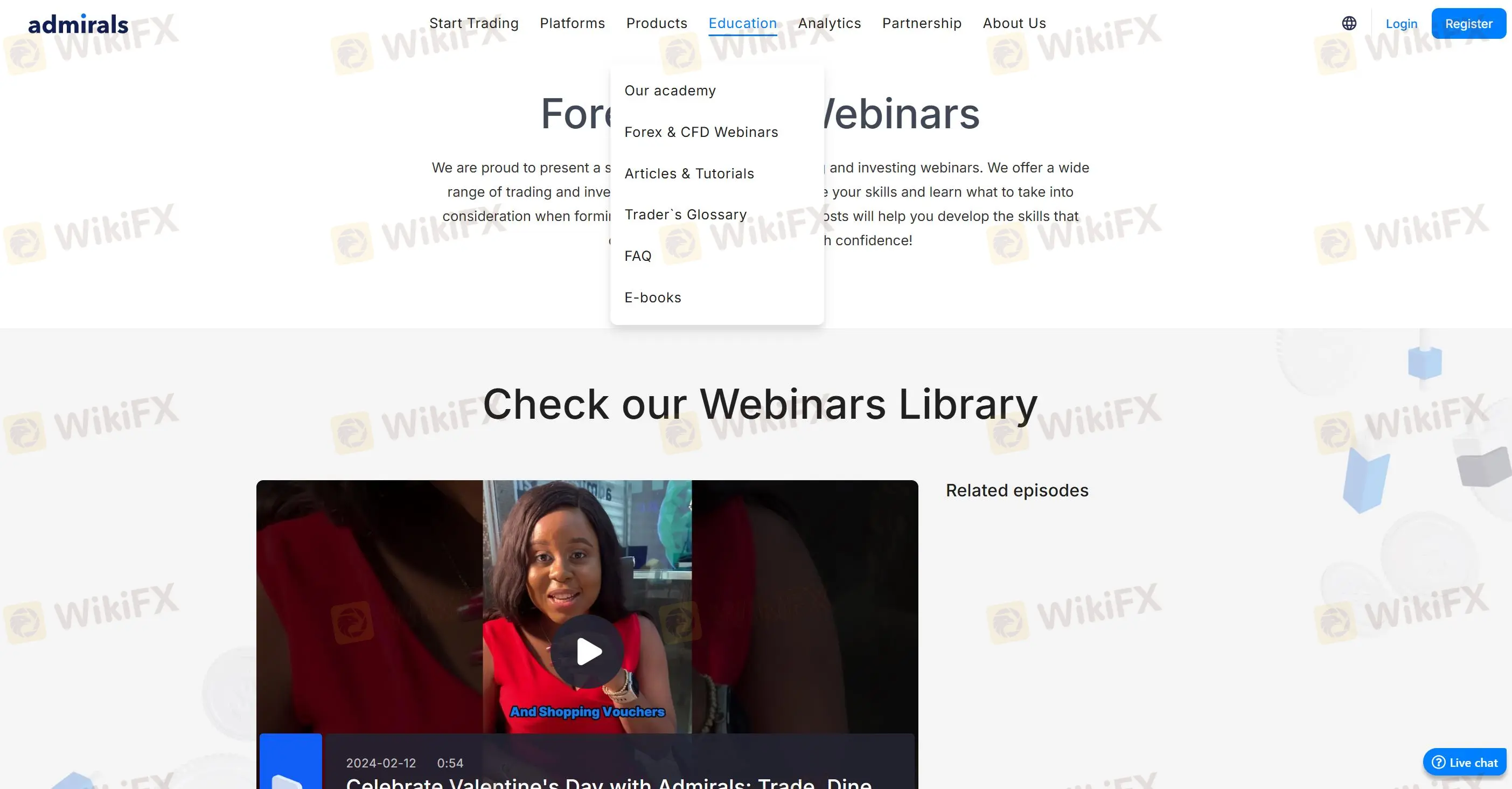

Admiral Markets offers a robust suite of educational resources suitable for traders of all experience levels. These resources encompass an economic calendar to monitor significant market events, comprehensive market reports, and real-time charts that provide up-to-date market conditions.

Additionally, traders can benefit from a variety of learning formats including video tutorials for practical guidance on trading platforms, interactive webinars and seminars for insights from market experts, as well as eBooks that delve into trading strategies and concepts.

A glossary is also available to help traders familiarize themselves with trading terminology, enhancing their understanding of the financial markets.

Admiral Markets is a well-established online trading broker with over 20 years of industry experience, offering a diverse range of financial instruments, platforms, and account types to traders globally. The broker provides robust tools and educational resources to support informed trading decisions, along with flexible leverage and multiple payment options.

While Admiral Markets stands out for its tailored services across different regions, various fees can't be overlooked.

What regulatory bodies oversee Admiral Markets?

Admiral Markets is regulated by ASIC, FCA, CYSEC, and holds an offshore Retail Forex License from the FSA in Seychelles.

What can I trade on Admiral Markets?

The platform offers 2,500+ tradable instruments, including forex, indices, commodities, stocks, bonds, cryptocurrencies, and ETFs.

Which trading platforms does Admiral Markets support?

Admiral Markets supports MT4/5, Trading App, Admirals Platform, and StereoTrader.

Does Admiral Markets provide educational resources?

Yes, it offers webinars, seminars, eBooks, and market analysis.

What account types does Admiral Markets offer?

Available accounts include Trade.MT4, Zero.MT4, Trade.MT5, Zero.MT5, and Invest.MT5.

Are there fees or commissions at Admiral Markets?

Yes. Both withdrawal fee and inactivity fee are charged, as well as some other fees. You can find detailed info above.

How can I manage funds in my Admiral Markets account?

Funds can be deposited or withdrawn via Visa, MasterCard, Skrill, Neteller, Crypto payments, and Bank Wire.

Admirals restarts EU client onboarding after a 2024 pause, enhancing compliance with CySEC regulations while aiming to boost its forex and CFD market presence.

WikiFX

WikiFX

URGENT WARNING FROM FCA! UK’s watchdog Financial Conduct Authority (FCA) issued a warning against Clone of FCA-authorised firm , Admiral Markets. The authority shared the clone firm and authorised firm details with the consumers to make them aware.

WikiFX

WikiFX

Admirals enhances MT5 with visible currency conversion fees, improving transparency. Traders can now clearly see and manage these fees directly on the platform.

WikiFX

WikiFX

Admirals enhances MetaTrader 4 and 5 with an AI-powered Analytical Research Terminal, merging news and data for informed trading decisions.

WikiFX

WikiFX

How do you choose a broker? Based on its regulatory status, valid license, good rating, customer feedback, and so on. Right?

WikiFX

WikiFX

Reserve Bank of India (RBI) highlights risks, lists unregulated brokers, and offers safety tips for Indian investors. Stay informed!

WikiFX

WikiFX

Admiral Markets AS concludes successful bond buyback offer, showcasing commitment to investors and corporate restructuring plans. Learn more about their achievements and future goals.

WikiFX

WikiFX

Foreign exchange brokerage Admirals is merging its Estonian unit, Admirals Markets AS, with its parent group, and plans to relinquish its Estonian investment company license by August 2023. Admirals aims to broaden its global presence while retaining Estonia as a strategic hub. Residual bond-related duties will be transitioned to Admirals Group.

WikiFX

WikiFX

More

User comment

15

CommentsWrite a review

2023-02-14 10:11

2023-02-14 10:11

2025-01-04 15:38

2025-01-04 15:38