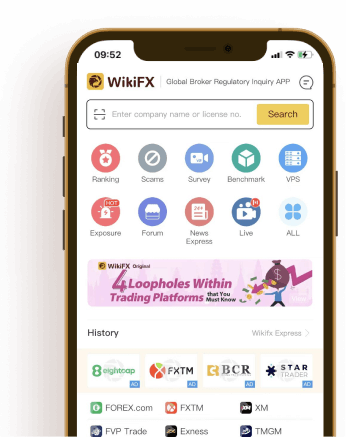

Global Forex Broker Regulatory Inquiry APP!

History

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

A South Korean trader experienced immediate loss after following a broker’s advice on certain investments. The broker further refuses to compensate for losses and keeps demanding additional investment deposits. The event spotlights issues about brokers employing deceptive methods to exploit traders and their funds.

WikiFX Launches “Elite’s View on the Challenge: Dialogue with Global Investment Influencers”

To further unite the strength of elite professionals in the forex industry and promote the healthy development of forex trading ecosystems, WikiFX, in collaboration with its "WikiFX Elites Club," officially launched the “Elite’s View on the Challenge: Dialogue with Global Investment Influencers” on April 23, 2025.

AvaTrade

FXCM

Neex

EC Markets

IC Markets Global

XM

Trive

GO MARKETS

Trade Nation

MultiBank Group

ATFX

FP Markets

MACRO MARKETS

FBS

FXTRADING.com

Vantage

Latest

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

The main trading dashboard account of a trader for LQH Markets was completely deleted by a broker. The trader is not being offered any access to their funds or profits. This incident shows the risks of trading markets and brokers and the importance of protecting your funds without relying on any broker.

Unable to Withdraw

Unable to Withdraw Not able to Withdraw deposit.

NVenus pro don’t reply to mail regarding my wish to Withdraw my deposit. I only want to Withdraw the amount I deposited. They were called Venus finance invest when I started investing. I got a new email address in 2022 and tried repeatedly to get in touch with Them At that time they were called Venus Market finance. I never got a response. Quite by chance I got a tip that they were now called NVenus Pro. I got in touch. And they found my address and I was back but they tell me if I can’t pay for more signals I can’t Withdraw. If that is correct I want to withdraw my deposit. I was informed that I could not withdraw money from the Account balance to pay for signals. I am not getting any response from NVenus pro on my email. I need to withdraw my deposit as due to personal circumstances I cannot pay more for signals. I lost contact with them in 2022. Now my Only wish is to Withdraw my deposit.

FX3667799340

FX3667799340

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

A South Korean trader experienced immediate loss after following a broker’s advice on certain investments. The broker further refuses to compensate for losses and keeps demanding additional investment deposits. The event spotlights issues about brokers employing deceptive methods to exploit traders and their funds.

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

What if everything you’re investing in now echoes the deadly mistakes of the dot-com era? Learn why traders who ignore history are setting themselves up for catastrophic losses.

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

Kraken Partners with Alpaca to Offer U.S. Stocks and Crypto

Kraken users can now access U.S. stocks, ETFs, and crypto on one platform through a new partnership with Alpaca, expanding into traditional finance markets.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Bitget Targets 8 Accounts Over $20M VOXEL Market Manipulation

Bitget announces legal action against 8 accounts behind the $20M market manipulation of VOXEL token, after unusual trading activity on April 20, 2025.

Broker Comparsion: FXTM vs AvaTrade

FXTM and AvaTrade are two well-established online brokers offering forex and CFD trading across global markets. Both enjoy strong reputations and high ratings on WikiFX—FXTM holds an AAA overall rating, while AvaTrade scores 9.49/10, indicating they’re regarded as reliable choices by the community. However, since brokers have great reputation in the industry, how do we know which one is more suitable for individuals to invest in? Today's article is about the comparison between FXTM and AvaTrade.

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Coinbase's new Bitcoin Yield Fund targets institutional investors, aiming for 4%-8% returns using a cash-and-carry strategy. Launching May 1, 2025.

Pi Network: Scam Allegations Spark Heated Debate

A whistleblower report has surfaced, casting doubt on the legitimacy of Pi Network, alleging psychological manipulation, opaque operations, and potential financial exploitation. What is your take on this?

Rights Protection Center

Grid Fx

Grid Fx

grid fx

grid fx is fake broker, withdrwal not given by this broker

CXM

CXM

profits with be turned negative with great loses

last night i opened 3 trades with running profits and set my be immediately , however this morning i woke up all my trades went negatives with great loses !

JustMarkets

JustMarkets

deposit delay not refunded cancellation of my ord

I have made deposit of 50 USD since 16th April 2025 but up to now I have not received any amount in my wallet I have sent email to the financial department no action taken lastly they have cancelled my order not refunded my money.

Paramount

Paramount

non-paying company

Hello, my name is Metin Cengiz. The company Paramount, which I have an account with, has not paid our 17,342 dollars since December 17. The IB we work with is constantly stalling us by saying the company will pay but does not have the money. The fact that the company has not paid a single dollar for months cannot be considered good faith. Stay away from this company, especially Dubai investors.

Succedo Markets

Succedo Markets

Totally Scam

You can't withdraw your money. As I have more than 397000 USD I can't withdraw

AssetsFX

AssetsFX

Scammers, Be ware of this broker

As a country manager, I worked with this broker. they are always demanding loosing money and stop withdrawal of my clients and my salary without any notice.

Upbitfxpro

Upbitfxpro

scammer

This site is not reliable, it's a scam, it's cheated people around me out of countless amounts of money , I wish I could get the police to arrest the people on this site, they're all scams, they've cheated me out of 2 houses and over a million dollars!

ActivTrades

ActivTrades

thief broker, scam broker

Cheater broker, scam broker, froude broker, thief broker. I had 1543 dollars in my account, I waited 2 weeks with a withdrawal of 500 dollars, but the withdrawal was not granted and my trading account was closed. After 2/3 days they took all the dollars from my account. I spoke to customer service about this and he told me that he gave me all the dollars but gave me nothing and he told me a complete lie.I sent an email to the official email of Active Trade regarding this matter but they did not reply me at all.

MTrading

MTrading

market manipulation

not recommend to use this broker, scam highly suspect just market manipulatr the market

JustMarkets

JustMarkets

withdrawal delay and pending

it’s a raise concern that I made a withdrawal but it show pending for long time and I’m not receiving it. I canceled it and did new withdrawal out same issue pending.

BDSWISS

BDSWISS

VERY DANGEROUS BROKER!!!! is a fact...

1 days after making a deposit I tried to make a withdrawal and it was true as other people's reviews said that we can make a deposit but cannot make a withdrawal...stay away because they are just wasting time and they say there is an internal problem and we are told to wait for a very long time...stay away!!!!!

TIO Markets

TIO Markets

Tio scammed me

I am writing to share my review of the services provided by Tio Markets, which I believe to be a fraudulent broker.im Saba Sarwar , and I opened an account with Tio Markets with the MT5 Account No.1043180. I would like to bring to your attention an incident that has occurred with my account, leading me to conclude that Tio Markets Broker is engaging in unethical practices. On 22th April 2025, I deposited $340 into my account and opened a buy trade of 28 shares of US stock Tsla and I made a profit of $326. However, when I requested to withdraw my profits,so Tio Markets canceled all my profits and even my initial deposit Also and block my mt5 account and my client portal too.and They emailed me, accusing me of brijing of negative balance rules trading.

DBG Markets

DBG Markets

DBG is a scammer, unable to withdraw. be vigilance

DBG is a scammer, customer service have been closed, can't contact at all. When I make a withdrawal, their straight forward to close the details

JustMarkets

JustMarkets

Deposit delay not refunded

I have made a deposit since the 4th but until now my money has not been credited. I have sent an email to the finance department but there is no response, they have responded but no action taken

Vorbex

Vorbex

This company is one way investment

Vorbex is a most dangerous company in the world I have invest 2700 $ my advisor name is musthafa Only two staffs in this company I want to withdraw money he say again invest in 300 $ for upgrade Only one number was active this whole company I want to withdraw my money of 2700$ My account balance show 7576 $ Not give with drawal pls help me

NVenus Pro

NVenus Pro

Not able to Withdraw deposit.

NVenus pro don’t reply to mail regarding my wish to Withdraw my deposit. I only want to Withdraw the amount I deposited. They were called Venus finance invest when I started investing. I got a new email address in 2022 and tried repeatedly to get in touch with Them At that time they were called Venus Market finance. I never got a response. Quite by chance I got a tip that they were now called NVenus Pro. I got in touch. And they found my address and I was back but they tell me if I can’t pay for more signals I can’t Withdraw. If that is correct I want to withdraw my deposit. I was informed that I could not withdraw money from the Account balance to pay for signals. I am not getting any response from NVenus pro on my email. I need to withdraw my deposit as due to personal circumstances I cannot pay more for signals. I lost contact with them in 2022. Now my Only wish is to Withdraw my deposit.

EA

Shock PinStrike(MT5)

Income in last year +286.08%

This strategy uses PinBar patterns for trading. It sells when PinBar appears at high levels and buys when PinBar appears at low levels.

USD 0.99 USD 280.00PurchaseTools NewsTrading(MT5)

This strategy is primarily designed for trading during news events by placing pending orders in advance.

USD 0.99 USD 280.00PurchaseTrend type TrendMaster

Income in last year +607.10%

This strategy uses the Golden Cross and Death Cross of the Adaptive Moving Average (AdaptiveMA) indicator for trading. The Adaptive Moving Average indicator has higher sensitivity than the standard moving average.

USD 0.99 USD 280.00PurchaseMartin Fortress

Income in last year +342.21%

This strategy is primarily designed for markets like the Nasdaq index, which exhibit a single upward trend, and uses a Martingale strategy to add positions during pullbacks.

USD 0.99 USD 280.00Purchase

Forum

drderib

2025-04-30 02:17

SHAP Values

#CurrencyPairPrediction SHAP Values (Local) Prediction: Sell EUR/USD at 1.1025 Feature Contributions: + Volatility Up Spike (+0.15) + Bearish MACD Signal (+0.10) - Oversold RSI (-0.05) - Tightening Spreads (-0.02) Model believes the trend is bearish but slightly softened by RSI oversold conditions.

bysas

2025-04-30 02:15

Model interpretability

#CurrencyPairPrediction Model interpretability transforms AI from a mysterious black box into a transparent advisor. In Forex AI: • It ensures trust. • Helps debug bad decisions. • Improves model performance. • Prepares your model for real-money deployment and compliance. A good Forex AI system is not just accurate — it’s explainable.

seeta

2025-04-30 02:14

Challenges in Model Interpretability

#CurrencyPairPrediction Challenges in Model Interpretability Challenge Solution Too many features Use feature selection or PCA before interpretation. Deep neural networks are opaque Use attention, layer-wise relevance propagation (LRP), or SHAP. Time-sensitive data Interpret across different time windows. Market behavior is non-stationary. Interpretability vs Performance Sometimes simpler models are preferable if trust is critical.

hitawa

2025-04-30 02:12

Workflow for Making Forex AI Models Interpretable

#CurrencyPairPrediction Workflow for Making Forex AI Models Interpretable 1. Train your AI model normally. 2. Collect validation or backtest predictions. 3. Apply SHAP or LIME to explain outputs. 4. Visualize feature contributions across many predictions. 5. Investigate individual trades (especially bad trades!). 6. Summarize findings to refine the model or strategy.

oprah

2025-04-30 02:10

Saliency Maps

#CurrencyPairPrediction Saliency Maps (for CNNs on Candlestick Images) If you use convolutional neural networks (CNNs) on Forex price chart images: • Saliency maps highlight which parts of the image influenced a decision. Forex Use: • Which candlesticks, patterns, or levels led to a BUY signal?

terra

2025-04-30 01:42

Attention Mechanisms

#CurrencyPairPrediction Attention Mechanisms (for Deep Learning) If you use LSTM, Transformer, or other sequence models: • Attention shows which past time steps the model focuses on. In Forex Example: • Before making a prediction, the model mostly “looked” at price action during London open 30 minutes ago. Attention weights are a natural way to understand what sequence models are focusing on.

Ranking List

- Total Margin

- Active Trading Ranking

- Total lots

- Stop Out

- Profit Order

- Brokers' Profitability

- New User

- Spread Cost

- Rollover Cost

- Net Deposit Ranking

- Net Withdrawal Ranking

- Active Funds Ranking

Total Margin

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Asset%

- Ranking

- 1

XM

XM- 21.66

- --

- 2

Exness

Exness- 15.89

- --

- 3

Vantage

Vantage- 11.11

- 2

- 4

FBS

FBS- 8.66

- 1

- 5

GMI

GMI- 8.50

- 1

- 6

Doo Prime

Doo Prime- 8.27

- 2

- 7

VT Markets

VT Markets- 5.43

- --

- 8

IC Markets Global

IC Markets Global- 4.41

- --

- 9

STARTRADER

STARTRADER- 3.50

- --

- 10

TMGM

TMGM- 2.51

- --

Active Trading Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

Exness

Exness- 17.00

- 1

- 2

IC Markets Global

IC Markets Global- 7.13

- 1

- 3

Vantage

Vantage- 6.49

- 5

- 4

Doo Prime

Doo Prime- 5.96

- --

- 5

GMI

GMI- 5.90

- 3

- 6

TMGM

TMGM- 5.61

- 1

- 7

FBS

FBS- 5.20

- 1

- 8

VT Markets

VT Markets- 4.38

- 3

- 9

ZFX

ZFX- 1.99

- --

- 10

STARTRADER

STARTRADER- 1.81

- --

Total lots

- 30 days

- 90 days

- 6 months

- Brokerage

- Trading Volume%

- Ranking

- 1

IC Markets Global

IC Markets Global- 5.23

- 1

- 2

Exness

Exness- 5.00

- --

- 3

CPT Markets

CPT Markets- 4.99

- 4

- 4

XM

XM- 4.71

- 3

- 5

ZFX

ZFX- 4.68

- 2

- 6

FXTM

FXTM- 3.49

- 2

- 7

Tickmill

Tickmill- 2.99

- 1

- 8

GMI

GMI- 2.30

- 9

- 9

TMGM

TMGM- 2.02

- 4

- 10

Vantage

Vantage- 1.22

- 2

Stop Out

- 30 days

- 90 days

- 6 months

- Brokerage

- Stop Out%

- Ranking

- 1

FXCM

FXCM- 6.02

- 1

- 2

FXTRADING.com

FXTRADING.com- 3.80

- 26

- 3

ATFX

ATFX- 3.45

- 30

- 4

FOREX.com

FOREX.com- 2.93

- 32

- 5

IC Markets Global

IC Markets Global- 2.47

- 3

- 6

Axitrader

Axitrader- 2.36

- 31

- 7

FXTM

FXTM- 2.34

- 4

- 8

CWG Markets

CWG Markets- 2.01

- 13

- 9

Eightcap

Eightcap- 2.01

- 22

- 10

ZFX

ZFX- 1.79

- 4

Profit Order

- 30 days

- 90 days

- 6 months

- Brokerage

- Win rate%

- Ranking

- 1

XM

XM- 25.39

- 2

- 2

TMGM

TMGM- 6.76

- 34

- 3

FBS

FBS- 3.77

- 2

- 4

ZFX

ZFX- 1.62

- 2

- 5

Tickmill

Tickmill- 1.30

- 1

- 6

RockGlobal

RockGlobal- 0.79

- 4

- 7

CPT Markets

CPT Markets- 0.63

- --

- 8

KVB PRIME

KVB PRIME- 0.54

- 4

- 9

FOREX.com

FOREX.com- 0.52

- 17

- 10

Valutrades

Valutrades- 0.37

- 2

Brokers' Profitability

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Profit%

- Ranking

- 1

GMI

GMI- 17.39

- 2

- 2

Doo Prime

Doo Prime- 12.47

- --

- 3

STARTRADER

STARTRADER- 8.13

- 2

- 4

VT Markets

VT Markets- 5.56

- --

- 5

CXM Trading

CXM Trading- 4.25

- 5

- 6

FISG

FISG- 1.31

- --

- 7

Vantage

Vantage- 1.26

- 2

- 8

Anzo Capital

Anzo Capital- 0.32

- 27

- 9

CWG Markets

CWG Markets- 0.11

- 18

- 10

FXTM

FXTM- 0.06

- 24

New User

- 30 days

- 90 days

- 6 months

- Brokerage

- Growth value%

- Ranking

- 1

Exness

Exness- 21.97

- 1

- 2

XM

XM- 13.65

- 1

- 3

IC Markets Global

IC Markets Global- 4.81

- --

- 4

Doo Prime

Doo Prime- 2.89

- 3

- 5

Vantage

Vantage- 2.59

- 1

- 6

GMI

GMI- 2.52

- 2

- 7

FBS

FBS- 2.48

- 2

- 8

TMGM

TMGM- 2.07

- --

- 9

VT Markets

VT Markets- 1.52

- --

- 10

FXTM

FXTM- 1.13

- --

Spread Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average Spread

- Ranking

- 1

Exness

Exness- 25.15

- 9

- 2

XM

XM- 15.65

- 1

- 3

IC Markets Global

IC Markets Global- 3.08

- 1

- 4

Doo Prime

Doo Prime- 2.74

- 2

- 5

GMI

GMI- 2.51

- 2

- 6

Vantage

Vantage- 2.37

- 1

- 7

FBS

FBS- 2.15

- 3

- 8

TMGM

TMGM- 1.96

- 3

- 9

VT Markets

VT Markets- 1.49

- 1

- 10

STARTRADER

STARTRADER- 1.22

- 1

Rollover Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average rollover

- Ranking

- 1

ATFX

ATFX- 17.30

- 31

- 2

ThinkMarkets

ThinkMarkets- 15.01

- 25

- 3

FOREX.com

FOREX.com- 10.08

- 16

- 4

ZFX

ZFX- 3.48

- 2

- 5

Pepperstone

Pepperstone- 2.93

- 27

- 6

Exness

Exness- 2.85

- --

- 7

TMGM

TMGM- 2.32

- 2

- 8

CXM Trading

CXM Trading- 2.25

- 21

- 9

IC Markets Global

IC Markets Global- 2.13

- 9

- 10

INFINOX

INFINOX- 1.86

- 23

Net Deposit Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Deposit%

- Ranking

- 1

GO MARKETS

GO MARKETS- 81.96

- 3

- 2

FxPro

FxPro- 80.17

- 21

- 3

CWG Markets

CWG Markets- 77.36

- 2

- 4

FXTM

FXTM- 73.33

- 9

- 5

MultiBank Group

MultiBank Group- 71.99

- 35

- 6

WeTrade

WeTrade- 71.02

- --

- 7

FXTRADING.com

FXTRADING.com- 70.00

- 24

- 8

CPT Markets

CPT Markets- 69.37

- 20

- 9

Eightcap

Eightcap- 69.06

- --

- 10

GMI

GMI- 66.67

- 2

Net Withdrawal Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Withdraw%

- Ranking

- 1

Axitrader

Axitrader- 8.00

- 13

- 2

Exness

Exness- 9.00

- 1

- 3

Valutrades

Valutrades- 9.00

- 3

- 4

FxPro

FxPro- 10.00

- 1

- 5

AvaTrade

AvaTrade- 10.00

- 3

- 6

IC Markets Global

IC Markets Global- 10.00

- 1

- 7

Doo Prime

Doo Prime- 11.00

- 3

- 8

Pepperstone

Pepperstone- 11.00

- 21

- 9

FXTM

FXTM- 11.00

- 5

- 10

AUS GLOBAL

AUS GLOBAL- 11.00

- 1

Active Funds Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

FXCM

FXCM- -0.10

- 7

- 2

FOREX.com

FOREX.com- -0.30

- 8

- 3

Alpari

Alpari- -0.50

- 3

- 4

AUS GLOBAL

AUS GLOBAL- -0.86

- 2

- 5

GMI

GMI- -0.96

- 2

- 6

INFINOX

INFINOX- -1.00

- 19

- 7

Doo Prime

Doo Prime- -1.85

- --

- 8

HYCM

HYCM- -1.90

- 3

- 9

AvaTrade

AvaTrade- -2.73

- --

- 10

ZFX

ZFX- -4.72

- 2

Real-time spread comparison EURUSD

- Brokers

- Accounts

- Buy

- Sell

- Spread

- Average spread/day

- Long Position Swap USD/Lot

- Short Position Swap USD/Lot

To view more

Please download WikiFX APP

Know More and Enjoy more